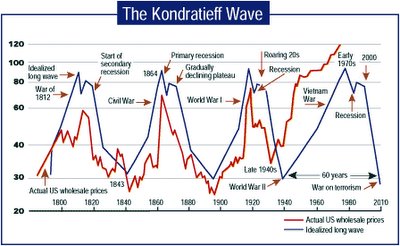

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

As an addition to the original post, here is a little bit of video from You-Tube that everyone is carrying.

10 comments:

Everybody is thinking major inflation but we are all going to be surprised. Yes there is the creeping inflation that has been moving through the decades but it is going to be overpowered by deflation. The Fed is failing to inflate or reflate or restimulate the economy. Hoisington makes a very good case for deflation. Very interesting charts and reasoning. Oh oh... This is going to change life in America. Investors holding cash may turn out to be the ones who are better off than those holding gold. Here is the link to the pdf. Definitely worth the read. Don't know how anyone can argue with the charts and the logic.

http://www.hoisingtonmgt.com/pdf/HIM2013Q1NP.pdf

Hi Anon 1:04

Thank you for the link.

I know that what ever I say is not going to change your view, but to the other readers, I have no fear of deflation.

The Treasury just announced the redesign of the 100 dollar bill. The only thought that ran through my mind was that it is now the equivalent of the 10 dollar bill of 40 years ago. We need a bigger bill just for normal transactions, like maybe the 1,000 dollar bill.

Think about it though, if the government did that, the lines to buy gold would be longer than the lines at the Post Office.

In an economy with a reasonable interest rate, there is absolutely no reason to hold gold. But if interest rates are extremely low, why hold cash, your not going to get a reasonable return.

The spread of time seems to ameliorate inflation. The thought that the present 100 dollar bill could have the future buying power of the 1 dollar bill of the 1960's escapes the argument.

I cannot see where deflation will appear in the economy. A lack of consumption may lower prices a bit, but that's what a depression is all about; unemployed people without money.

it's more like inflation, disinflation, stagflation, deflation all happening in phases (we're gonna have it all, in all sorts of sequences over and over again) as we muddle along in our crippled heavily indebted state guided by corrupt or brain dead leaders and we continue to suffer the consequences of kleptocracy, corporatocracy, fascism, warefareism, welfarism and all the other trappings of a diseased and dying country and financial system. right now with the lowest velocity of money rate in decades and the fed being unable to jumpstart the economy with all of its trillions and most households in trouble and unable to take on more debt or consume anymore and with governments and banks insolvent i agree we have a good case for deflationary pressures. japan's currency is going to crack, the euro is going to crack and the european union is going to unravel. in the beginning they'll be a capital flight to the us dollar but then the capital will turn against and leave the us for asia afterwards. just a matter of time for all of this to happen. the die have been cast.

I share anon's cheerful view: it'll be one damn thing after another.

The purpose of the Kontradieff Wave was to prove that capitalism always comes back from crashes.....a criticism of Russian communism.

Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.<<<<<<<<

And there were many who sold LU at 80 and at much higher prices than 2...making mega bucks.

Booms are great times to make a lot of money except for the greedy. Like the recent housing boom......subsequent crashes also present great times to make money pretty easily, as long as one isn't a "Chicken Little."

That said, just looking at FACTS (GOOG, FB, Twitter,Tesla, 3D printers, robotics, biotech, oil/gas boom), the wipe-out just cleared the way for the beginnings of likely the greatest economic boom ever.

China, Central banks, etc are now buying US assets (great dividend-paying stocks).

The global economy changed everything and made the US more powerful, economically, than ever.

You ain't seen nothin' yet!

Joeseph,

please add ILMN to your watch-list and let me know what you think. I like your balanced perspective and would appreciate your thoughts. It's a local company here in san diego.

Genetic is changing the health care industry as we know it, trust me, in 10 years surgery will be looked at as butchery.

Opp Fan

please add ILMN to your watch-list and let me know what you think<<<<<<

Since this isn't a stock site, it's inappropriate for me to comment.

But, generally, I am not a speculator (ILMN is a speculation since it pays no dividend).....I think of myself as a businessman and buy great companies (I'd like to own completely if I could) which have products or services which are always in demand and pay dividends and raise them each year and have a solid balance sheet....so I really don't care what the price does (buy when price drops and assume it will eventually be higher)....just watch the income rise each year.......all taxed favorably (including LT cap gains).....that's the secret...little guys can get the same or better deals as the big guys. The US is a capitalist nation so subsidizes stocks. (I like when the gov't is on my side.)

What is this Oppenheimer guy smoking?

good stuff bc he invested while everyone else was scared. Price of homes up nationally 10%, unemployment dropping, and economy growing stronger...time will tell all!

This is cool!

Post a Comment