Reprint from August 19 last year.

Let's go back and picture a man from the 1929 era. He would have been born about 1890 and been about 40 at the time. His world had gone from horse and buggy to the automobile. Between 1908 and 1927 Ford had produced 15,000,000 model T's. In 1904 there were three million telephones, by 1915 you could call coast to coast (the cost was prohibitive). By 1906, the electric light bulb was commercially feasible to produce. Radio came into its own in the 1920's. By 1924 there were 3 million radios in use in the US. The airplane had come on line. It was used to speed up mail delivery; commercial aviation was still a few years away. Technology had turned his life into something new and different.

The banks were loaning money out, 100% financing, interest only, 5 year loans that had to be refinanced at the end of the term. Also, you could borrow any amount you desired from your stock broker just pay the interest. Buying stocks on margin (10% down) was the name of the game.

Another thing to come of age, was installment buying. GMAC was created in 1919 to help sell more cars, and it did just that. There had been a stigma attached to not paying cash and through advertising, it became more acceptable. By the eve of the great depression, it had become a way to acquire the American Dream. You didn't have to wait and save up for what you wanted, you could have it now.

From 1915 to 1930 we had been transitioning from an agrarian economy to a more industrialized economy. Technology had changed our way of life without any perceived realization of it by the general population. A farmer was 10 times more productive with modern machinery. Agricultural prices were dropping because of this over supply. The speculation that had been going on in farm land was unsustainable. A bigger farm did not increase your return on investment, just the opposite.

Things started to go bad in 1926 with the Florida Hurricane, land speculation lost its appeal (severe understatement). Then in June of 1928 there was a mini stock market crash, a precursor to the big one. In October of 1929 the big crash came and "rearranged" the financial markets. In 1930 Congress passed The Smoot-Hawley Tariff Act, which some claim was responsible for the unemployment rate climbing to 25% (over the next two years). Bank failures started to be a problem in 1929 only to get worse in 1930, 1,352 banks failed. In 1931, 2,294 banks bit the dust.

So what happened to our gentleman? If he had a 5 year I/O loan that was due for renewal, it wasn't renewed; the bank wanted and needed the cash. Result, the bank got the house. He stood a 1 in 4 chance of being unemployed. If his bank had failed, he might have no savings left. Anything bought on installment might have to be returned or a payment made on it.

He probably survived with memories of the rough times he had. People from that generation were seasoned with these memories. They acted differently as so to avoid making the same mistakes over again.

Today, in the world of 2007, the "group memory" of these people is no longer with us. Are we destined to make the same mistakes as they did so long ago?

The evolution of the Internet is comparable to Radio of that time. And Google stock isn't quite as high as RCA's stock got to, before the crash. Then, there was the installment buying and interest only loans of the 1920's, verses the credit card of today and the same old loan formula (use their money not mine).

Almost sounds like an eerie episode of The Twilight Zone, doesn't it?

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Friday, August 31, 2007

Sunday, August 26, 2007

Liquidity, "A Well Run Dry"

There is a massive call to redeem mortgage CDO’s and there are few buyers. Let’s face it; almost everything is suspect that was written up to the third week in June when Bear Stearns “Roman Candled” into the ground. So if there is some good stuff out there, most investors wouldn’t know how to even recognize it. Even if it was a good deal, liquidity for a security means willing buyers. Finding any buyers seems to be a problem now.

Notice the issue here is not the mortgage itself; you just can’t lay your hands on the individual notes written on each home. The mortgages have been grouped and abstracted into an asset that can’t be broken down, its all or nothing. This new security is full of covenants and restrictions. How do you get clear title to a foreclosure when you’re not sure who really owns it? Purchasing a CDO is kind of like buying a dozen eggs and you notice that 6 are broken. The store owner won’t let you switch the broken ones with some from another container.

Over at Country Wide, the problem is a little different. It’s a catch 22 situation. They can write the paper, but in order to write more loans, they have to sell the loan for cash to some investor in order to have cash to write another loan. In the past, these loans went out the door and were packaged and sliced up for consumption, no questions asked. Now the real estate paper is a hot potato. This stuff is the new Monopoly money. You bought it, keep it and good luck!

Then we have the Yen carry trade that has been going on for years. The Japanese stock market crashed in 1990 and the banks literally went under. To save the banks, they dropped the interest rate to zero and invested in U.S. Treasury bills, which over the last 17 years, have made them whole again. Lately there have been rumors that their banks have been investing in hedge funds of all things (more bang for the buck). There are indications that the carry trade has dried up even though the interest rate spread between BOJ and the U.S. is about 5%. I guess that the futures trading for the Yen to Dollar now has the meanness of a rabid dog. You could say there is a Yen to go home.

Bloomberg on Friday mentioned that worldwide, governments have added 400 billion dollars of liquidity to the markets. If money is water, then this financial crisis is a pretty thirsty critter! Our current situation revolves around the fact that real estate instruments are no longer highly fungible. A majority of financial issues trade on faith. If it can’t be exchanged freely between everyone, then there is a problem. Some of the holders of these CDO’s have no real cash for the next hand of poker. That’s no problem, the discount window is open. Bernanke is catering the event, and you thought there was no Free Lunch!

Notice the issue here is not the mortgage itself; you just can’t lay your hands on the individual notes written on each home. The mortgages have been grouped and abstracted into an asset that can’t be broken down, its all or nothing. This new security is full of covenants and restrictions. How do you get clear title to a foreclosure when you’re not sure who really owns it? Purchasing a CDO is kind of like buying a dozen eggs and you notice that 6 are broken. The store owner won’t let you switch the broken ones with some from another container.

Over at Country Wide, the problem is a little different. It’s a catch 22 situation. They can write the paper, but in order to write more loans, they have to sell the loan for cash to some investor in order to have cash to write another loan. In the past, these loans went out the door and were packaged and sliced up for consumption, no questions asked. Now the real estate paper is a hot potato. This stuff is the new Monopoly money. You bought it, keep it and good luck!

Then we have the Yen carry trade that has been going on for years. The Japanese stock market crashed in 1990 and the banks literally went under. To save the banks, they dropped the interest rate to zero and invested in U.S. Treasury bills, which over the last 17 years, have made them whole again. Lately there have been rumors that their banks have been investing in hedge funds of all things (more bang for the buck). There are indications that the carry trade has dried up even though the interest rate spread between BOJ and the U.S. is about 5%. I guess that the futures trading for the Yen to Dollar now has the meanness of a rabid dog. You could say there is a Yen to go home.

Bloomberg on Friday mentioned that worldwide, governments have added 400 billion dollars of liquidity to the markets. If money is water, then this financial crisis is a pretty thirsty critter! Our current situation revolves around the fact that real estate instruments are no longer highly fungible. A majority of financial issues trade on faith. If it can’t be exchanged freely between everyone, then there is a problem. Some of the holders of these CDO’s have no real cash for the next hand of poker. That’s no problem, the discount window is open. Bernanke is catering the event, and you thought there was no Free Lunch!

Friday, August 24, 2007

DJIA Stock Market Math

The DJIA just went up 143 points or did it? Here is an abbreviated re edit of a previous post The Stock Market Game from April 25th. The market at that time was at 13,000 and I am going to use the figures for that date. If you held one share of each stock in the Dow Jones average, you would have had an increase in equity of less than 18 dollars with today’s surge.

The "Dow Jones Industrial Average" sounds impressive. Right now it’s at 13,000. Add up the value of all thirty stocks in the DOW and you get 1,600. Hmmm where does the 13,000 come from?

There is the Dow divisor index which is currently at 0.1248. This is a peculiar animal.

Here is a cut and paste from Wikipedia:

Today with the DOW, you would take 1600/.1248=12,820

DOW 30 Stocks---------------Weight %-----Present Value

3M Co.--------------------------4.8746---------77.75

Alcoa Inc-----------------------2.15-------------34.37

Altria Group-------------------4.3605---------69.55

American Express------------3.8245---------61

American International ----4.3593---------69.53

AT&T Inc--------------------- 2.4997---------39.87

Boeing Co. --------------------5.8489---------93.29

Caterpillar Inc. --------------4.5028---------71.82

Citigroup Inc. ----------------3.3492---------53.42

Coca-Cola Co. ----------------3.2659---------52.09

DuPont------------------------ 3.0897---------49.28

Exxon Mobil Corp. ----------5.0007---------79.76

General Electric Co.---------2.2025---------35.13

General Motors Corp.-------1.9862---------31.68

Hewlett-Packard Co.--------2.5937----------41.37

Home Depot Inc.------------2.4583---------39.21

Honeywell-------------------- 3.2226---------51.4

Intel Corp.--------------------1.3894----------22.16

IBM----------------------------5.9298---------94.58

Johnson & Johnson---------4.0828---------65.12

JPMorgan Chase & Co.-----3.2941---------52.54

McDonald's Corp.-----------3.032-----------48.36

Merck & Co. Inc.-------------3.2282---------51.49

Microsoft Corp.--------------1.8194----------29.02

Pfizer Inc.---------------------1.6909---------26.97

Procter & Gamble-----------4-----------------63.8

United Technologies-------4.2307----------67.48

Verizon-----------------------2.3768----------37.91

Wal-Mart Stores Inc.------3.1198---------49.76

Walt Disney Co.------------2.2119---------35.28

Total-------------------------99.9998------1594.99

If you examine the Market Weighted %, this is the actual amount the Dow swings per dollar for each individual stock. Notice that a 5 dollar move in IBM translates into 30 points on the DOW (5 x 5.92). A 5 dollar move in Intel translates into 7 points on the DOW (5 x 1.38).

As boring as all of this is, its rather like doing 20 miles per hour in a car and the Manufacturer decides to add another zero to the speedometer and make it 200. In that scenario, you can go through a hospital zone at 200 mph and not suck the drapes out of the rooms.

DOW 13,000 sounds super, but when you add it up you begin to realize that the perspective is a little misleading. The DJIA 30 stocks are worth $1600. The real validity of the DOW hitting 13,000 has more to do with someone who bought into the market in about the year 1910.

So an $800 dollar drop in value of the 30 Dow stocks drops the Dow down six or seven thousand points.

The $1,600 hundred dollar value for the Dow is a concept I understand. When you start fiddling with graphs and divisors, things take on a look that can be quite misleading. Terms like P/E, Earnings, Book Value, Dividend mean nothing, afterall "It’s a high powered growth stock." It’s kind of like asking you daughter about her new boyfriend and what he does for a living and she says “It doesn’t matter Dad, he’s a STUD.” That's a good indication that Rug Rat “Welfare One” is probably on the way.

The "Dow Jones Industrial Average" sounds impressive. Right now it’s at 13,000. Add up the value of all thirty stocks in the DOW and you get 1,600. Hmmm where does the 13,000 come from?

There is the Dow divisor index which is currently at 0.1248. This is a peculiar animal.

Here is a cut and paste from Wikipedia:

Assume an index comprising on 2 stocks A and B.

A is priced at $100 and B is priced at $200.

Hence the index value in this case is (100+200)/2=150

(where N=2 which is index divisor). So the index value here is 150.

Now assume stock B undergoes 2:1 stock split so its value becomes $100.

Now the index value would become 100 instead of 150.

To correct his irregularity we need to do the index divisor calculation as

(100+100)/N=150 (Since Market Capitalization of the stock is unchanged).

Hence, upon calculation we get the value of N as 1.333.

This shows that a stock split caused the index divisor to be revised

from a value of 2 to 1.33.

Today with the DOW, you would take 1600/.1248=12,820

DOW 30 Stocks---------------Weight %-----Present Value

3M Co.--------------------------4.8746---------77.75

Alcoa Inc-----------------------2.15-------------34.37

Altria Group-------------------4.3605---------69.55

American Express------------3.8245---------61

American International ----4.3593---------69.53

AT&T Inc--------------------- 2.4997---------39.87

Boeing Co. --------------------5.8489---------93.29

Caterpillar Inc. --------------4.5028---------71.82

Citigroup Inc. ----------------3.3492---------53.42

Coca-Cola Co. ----------------3.2659---------52.09

DuPont------------------------ 3.0897---------49.28

Exxon Mobil Corp. ----------5.0007---------79.76

General Electric Co.---------2.2025---------35.13

General Motors Corp.-------1.9862---------31.68

Hewlett-Packard Co.--------2.5937----------41.37

Home Depot Inc.------------2.4583---------39.21

Honeywell-------------------- 3.2226---------51.4

Intel Corp.--------------------1.3894----------22.16

IBM----------------------------5.9298---------94.58

Johnson & Johnson---------4.0828---------65.12

JPMorgan Chase & Co.-----3.2941---------52.54

McDonald's Corp.-----------3.032-----------48.36

Merck & Co. Inc.-------------3.2282---------51.49

Microsoft Corp.--------------1.8194----------29.02

Pfizer Inc.---------------------1.6909---------26.97

Procter & Gamble-----------4-----------------63.8

United Technologies-------4.2307----------67.48

Verizon-----------------------2.3768----------37.91

Wal-Mart Stores Inc.------3.1198---------49.76

Walt Disney Co.------------2.2119---------35.28

Total-------------------------99.9998------1594.99

If you examine the Market Weighted %, this is the actual amount the Dow swings per dollar for each individual stock. Notice that a 5 dollar move in IBM translates into 30 points on the DOW (5 x 5.92). A 5 dollar move in Intel translates into 7 points on the DOW (5 x 1.38).

As boring as all of this is, its rather like doing 20 miles per hour in a car and the Manufacturer decides to add another zero to the speedometer and make it 200. In that scenario, you can go through a hospital zone at 200 mph and not suck the drapes out of the rooms.

DOW 13,000 sounds super, but when you add it up you begin to realize that the perspective is a little misleading. The DJIA 30 stocks are worth $1600. The real validity of the DOW hitting 13,000 has more to do with someone who bought into the market in about the year 1910.

So an $800 dollar drop in value of the 30 Dow stocks drops the Dow down six or seven thousand points.

The $1,600 hundred dollar value for the Dow is a concept I understand. When you start fiddling with graphs and divisors, things take on a look that can be quite misleading. Terms like P/E, Earnings, Book Value, Dividend mean nothing, afterall "It’s a high powered growth stock." It’s kind of like asking you daughter about her new boyfriend and what he does for a living and she says “It doesn’t matter Dad, he’s a STUD.” That's a good indication that Rug Rat “Welfare One” is probably on the way.

Saturday, August 18, 2007

The Wyle E. Coyote Acme Credit Loan

The Fed's over night discount rate cut of Friday has a lot of people wondering; "What is going on?" and "Why it was done?" I could be shot again for over simplification on this one. On the plus side, there are no complicated graphs, so read on.

Imagine a bunch of little stores that are about to open in the morning. Before they open, they go to the cash register and put in their transaction money for the day. This would be something like 5 20’s, 10 10’s, 20 5’s and 40 1’s and quarters, dimes nickels and pennies. This money is needed to open the store. The bigger the store, the more transaction money is needed.

Now let’s go one step further. Suppose the money is not there to open the store. Most businesses have an open credit line with their bank for such occasions. They can go down and borrow the money. What the heck, at the close of business, they can pay it back.

On to step three, the banks issue these lines of credit to businesses thinking that maybe only five to ten percent of their clients will call for such a loan at any one time. They were not counting on all of their clients lining up at the credit line window at the same time. The bank at this point has over contracted these lines of credit, and has to go to the Fed window for an overnight loan. Wasn’t it Countrywide that exercised their line of credit for 11.5 billion Thursday with 41 lenders?

So what is happening? New money is not flowing into the system. People are not borrowing, buying or what ever. The money supply is contracting. Lowering the discount rate, allows banks to make those loans to business so they can open with cash in the drawer ready for business. It’s no longer an over-nighter, hey pay us when you can. I think the Fed is stealing the same boiler plate previously used on home loans.

But why did the stock market go up? The increased access to liquidity allows the big traders to exercise their credit lines. After all buying and selling stocks is a business. You’ll notice that Bernanke picked an expiration Friday, (before the market opened) to drop the discount rate, which burned the short option players royally. Done like a true professional!

Halloween is early this year, the third Friday (Thursday if you're smart) in September, a Triple Witching Expiration. I guess I’ll mosey over for some cider and donuts at the 11.5 billion dollar bon(d)fire.

Imagine a bunch of little stores that are about to open in the morning. Before they open, they go to the cash register and put in their transaction money for the day. This would be something like 5 20’s, 10 10’s, 20 5’s and 40 1’s and quarters, dimes nickels and pennies. This money is needed to open the store. The bigger the store, the more transaction money is needed.

Now let’s go one step further. Suppose the money is not there to open the store. Most businesses have an open credit line with their bank for such occasions. They can go down and borrow the money. What the heck, at the close of business, they can pay it back.

On to step three, the banks issue these lines of credit to businesses thinking that maybe only five to ten percent of their clients will call for such a loan at any one time. They were not counting on all of their clients lining up at the credit line window at the same time. The bank at this point has over contracted these lines of credit, and has to go to the Fed window for an overnight loan. Wasn’t it Countrywide that exercised their line of credit for 11.5 billion Thursday with 41 lenders?

So what is happening? New money is not flowing into the system. People are not borrowing, buying or what ever. The money supply is contracting. Lowering the discount rate, allows banks to make those loans to business so they can open with cash in the drawer ready for business. It’s no longer an over-nighter, hey pay us when you can. I think the Fed is stealing the same boiler plate previously used on home loans.

But why did the stock market go up? The increased access to liquidity allows the big traders to exercise their credit lines. After all buying and selling stocks is a business. You’ll notice that Bernanke picked an expiration Friday, (before the market opened) to drop the discount rate, which burned the short option players royally. Done like a true professional!

Halloween is early this year, the third Friday (Thursday if you're smart) in September, a Triple Witching Expiration. I guess I’ll mosey over for some cider and donuts at the 11.5 billion dollar bon(d)fire.

Thursday, August 16, 2007

Possible Explosion on Wall Street???

Then:

The Dow Jones hit a high of 381 September 3, 1929. By Wednesday October 23 it had dropped to 305. On Black Thursday October 24th 1929, the stock market was in a free fall. The market had fallen to 274. Then at 1:30 Richard Whitney Vice President of the Stock exchange walked to trading post number two, US Steel and announced a bid of 205 for 10,000 Steel. This was 40 points above the market price. He then went on to several other posts and placed bids for stock above the market price. The stock market came back to close at 299 (The money for his bids was fronted by JP Morgan et al). The following Monday the market dropped to 260 and then on Black Tuesday the market dropped to 230.

And Now:

The Dow Jones hit a high of 14,000 July 19, 2007. By Wednesday August 16, 2007 it had dropped to 12,861. On Thursday the market started dropping down about 350 points and came back to close at 12,845.

It looks like Bernanke is the replacement for the historical JP Morgan banker’s consortium of 1929. It kind of makes you wonder if the rest of what is about to happen, hasn’t already been written. It's probably just my imagination running amok again.

BTW can somebody go over to Bear Sterns and turn out the lights? I guess we won’t read the obit until they pull the plug. Plus, I hear that Country Wide is in an adjoining bed.

The Dow Jones hit a high of 381 September 3, 1929. By Wednesday October 23 it had dropped to 305. On Black Thursday October 24th 1929, the stock market was in a free fall. The market had fallen to 274. Then at 1:30 Richard Whitney Vice President of the Stock exchange walked to trading post number two, US Steel and announced a bid of 205 for 10,000 Steel. This was 40 points above the market price. He then went on to several other posts and placed bids for stock above the market price. The stock market came back to close at 299 (The money for his bids was fronted by JP Morgan et al). The following Monday the market dropped to 260 and then on Black Tuesday the market dropped to 230.

And Now:

The Dow Jones hit a high of 14,000 July 19, 2007. By Wednesday August 16, 2007 it had dropped to 12,861. On Thursday the market started dropping down about 350 points and came back to close at 12,845.

It looks like Bernanke is the replacement for the historical JP Morgan banker’s consortium of 1929. It kind of makes you wonder if the rest of what is about to happen, hasn’t already been written. It's probably just my imagination running amok again.

BTW can somebody go over to Bear Sterns and turn out the lights? I guess we won’t read the obit until they pull the plug. Plus, I hear that Country Wide is in an adjoining bed.

Tuesday, August 14, 2007

Famous Quotes From the Past revisited

This is a reprint of my 9/03/06 post it seems appropriate for today, you might have missed it.

Here is something that I ran across that seems like a parallel to todays mindset.

This is a link to the site: http://www.gold-eagle.com/editorials_01/seymour062001.html

Quotes #5 and #8 are very famous remarks by Irving Fisher, who at the time was managing the Yale endowment funds. It didn't go well from there.

These were very intelligent people back in their time. Their thoughts on what would happen next were way off the mark. What was said, sounded good and was reassuring.

It leaves a lot of doubt about what you can take for granted in todays newspapers

Note, quote 20 refers to the fact that it became illegal to own gold as an American citizen. The government was making sure no one was holding out on them. You had to trade your gold in for currency. This was FDR's way of keeping everyone honest--government excluded.

Here is something that I ran across that seems like a parallel to todays mindset.

This is a link to the site: http://www.gold-eagle.com/editorials_01/seymour062001.html

1927-1933 Chart of Pompous Prognosticators

1. "We will not have any more crashes in our time."

- John Maynard Keynes in 1927

2. "I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

- E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"There will be no interruption of our permanent prosperity."

- Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12, 1928

3. "No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment...and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding."

- Calvin Coolidge December 4, 1928

4. "There may be a recession in stock prices, but not anything in the nature of a crash."

- Irving Fisher, leading U.S. economist , New York Times, Sept. 5, 1929

5. "Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

- Irving Fisher, Ph.D. in economics, Oct. 17, 1929

"This crash is not going to have much effect on business."

- Arthur Reynolds, Chairman of Continental Illinois Bank of Chicago, October 24, 1929

"There will be no repetition of the break of yesterday... I have no fear of another comparable decline."

- Arthur W. Loasby (President of the Equitable Trust Company), quoted in NYT, Friday, October 25, 1929

"We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices."

- Goodbody and Company market-letter quoted in The New York Times, Friday, October 25, 1929

6. "This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

- R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

"Buying of sound, seasoned issues now will not be regretted"

- E. A. Pearce market letter quoted in the New York Herald Tribune, October 30, 1929

"Some pretty intelligent people are now buying stocks... Unless we are to have a panic -- which no one seriously believes, stocks have hit bottom."

- R. W. McNeal, financial analyst in October 1929

7. "The decline is in paper values, not in tangible goods and services...America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin."

- Stuart Chase (American economist and author), NY Herald Tribune, November 1, 1929

"Hysteria has now disappeared from Wall Street."

- The Times of London, November 2, 1929

"The Wall Street crash doesn't mean that there will be any general or serious business depression... For six years American business has been diverting a substantial part of its attention, its energies and its resources on the speculative game... Now that irrelevant, alien and hazardous adventure is over. Business has come home again, back to its job, providentially unscathed, sound in wind and limb, financially stronger than ever before."

- Business Week, November 2, 1929

"...despite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation..."

- Harvard Economic Society (HES), November 2, 1929

8. "... a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall."

- HES, November 10, 1929

"The end of the decline of the Stock Market will probably not be long, only a few more days at most."

- Irving Fisher, Professor of Economics at Yale University, November 14, 1929

"In most of the cities and towns of this country, this Wall Street panic will have no effect."

- Paul Block (President of the Block newspaper chain), editorial, November 15, 1929

"Financial storm definitely passed."

- Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

9. "I see nothing in the present situation that is either menacing or warrants pessimism... I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress."

- Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929

"I am convinced that through these measures we have reestablished confidence."

- Herbert Hoover, December 1929

"[1930 will be] a splendid employment year."

- U.S. Dept. of Labor, New Year's Forecast, December 1929

10. "For the immediate future, at least, the outlook (stocks) is bright."

- Irving Fisher, Ph.D. in Economics, in early 1930

11. "...there are indications that the severest phase of the recession is over..."

- Harvard Economic Society (HES) Jan 18, 1930

12. "There is nothing in the situation to be disturbed about."

- Secretary of the Treasury Andrew Mellon, Feb 1930

13. "The spring of 1930 marks the end of a period of grave concern...American business is steadily coming back to a normal level of prosperity."

- Julius Barnes, head of Hoover's National Business Survey Conference, Mar 16, 1930

"... the outlook continues favorable..."

- HES Mar 29, 1930

14 "... the outlook is favorable..."

- HES Apr 19, 1930

15. "While the crash only took place six months ago, I am convinced we have now passed through the worst -- and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us."

- Herbert Hoover, President of the United States, May 1, 1930

"...by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent..."

- HES May 17, 1930

"Gentleman, you have come sixty days too late. The depression is over."

- Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930

16. "... irregular and conflicting movements of business should soon give way to a sustained recovery..."

- HES June 28, 1930

17. "... the present depression has about spent its force..."

- HES, Aug 30, 1930

18. "We are now near the end of the declining phase of the depression."

- HES Nov 15, 1930

19. "Stabilization at [present] levels is clearly possible."

- HES Oct 31, 1931

20. "All safe deposit boxes in banks or financial institutions have been sealed... and may only be opened in the presence of an agent of the I.R.S."

- President F.D. Roosevelt, 1933

Quotes #5 and #8 are very famous remarks by Irving Fisher, who at the time was managing the Yale endowment funds. It didn't go well from there.

These were very intelligent people back in their time. Their thoughts on what would happen next were way off the mark. What was said, sounded good and was reassuring.

It leaves a lot of doubt about what you can take for granted in todays newspapers

Note, quote 20 refers to the fact that it became illegal to own gold as an American citizen. The government was making sure no one was holding out on them. You had to trade your gold in for currency. This was FDR's way of keeping everyone honest--government excluded.

Wednesday, August 08, 2007

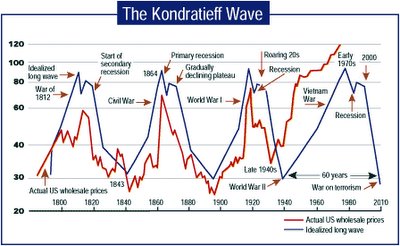

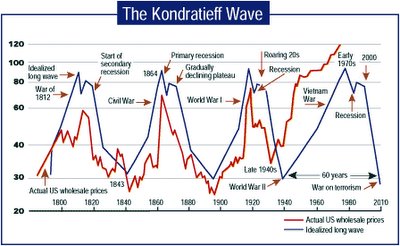

Surfing The Kondratieff Wave

Here is An Article I wrote 5/8/06, I thought it worth repeating.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

Saturday, August 04, 2007

The Jim Cramer Implosion

I watched the Jim Cramer of Mad Money melt down on CNBC Friday. Here is a Link to it. He wants Bernenke to lower the interest rates. It was kind of a toss up as to whether it was an act or not. You wouldn’t normally pull stuff like that with people you work with on a daily basis. I don’t think that Erin Burnett who was interviewing him was enjoying the loss of control. I am sure that she thought he deserved a kick in the nuts.

Today on Bloomberg Jim Rogers was interviewed and he referred to the auto industry, the housing industry and the finance industry as being in a recession. He had to correct himself when he tried to pronounce “recession” with a “d,” on two occasions. Just maybe it’s time to pass out the life jackets.

Jim Cramer seems to think that lowering the discount rate is going to save the market. In his way of thinking it will save the market. It will save the quid pro quo. I think we are tired of the salesmanship of, “If this erection lasts more than 4 hours. . . .” In reality we have a stock market that is out of control, we need a meltdown to restore reality. Google alone is pumped up on steroids.

On a good note, we have Wells Fargo raising the Jumbo rate to 8%. This for once seems like a realistic rate for long term home loans. It’s not that I wouldn’t like them lower; it’s the spread between short term and long term that has now gotten healthy. There is now a premium for investing long term that wasn’t present in the past. Things are starting to make sense now.

Bear Sterns is still in control of seating arrangements on the Titanic—I think they are going to move the band to the back of the boat, everyone loves music. It will surprise the people coming back from the life boat tour of the iceberg.

Today on Bloomberg Jim Rogers was interviewed and he referred to the auto industry, the housing industry and the finance industry as being in a recession. He had to correct himself when he tried to pronounce “recession” with a “d,” on two occasions. Just maybe it’s time to pass out the life jackets.

Jim Cramer seems to think that lowering the discount rate is going to save the market. In his way of thinking it will save the market. It will save the quid pro quo. I think we are tired of the salesmanship of, “If this erection lasts more than 4 hours. . . .” In reality we have a stock market that is out of control, we need a meltdown to restore reality. Google alone is pumped up on steroids.

On a good note, we have Wells Fargo raising the Jumbo rate to 8%. This for once seems like a realistic rate for long term home loans. It’s not that I wouldn’t like them lower; it’s the spread between short term and long term that has now gotten healthy. There is now a premium for investing long term that wasn’t present in the past. Things are starting to make sense now.

Bear Sterns is still in control of seating arrangements on the Titanic—I think they are going to move the band to the back of the boat, everyone loves music. It will surprise the people coming back from the life boat tour of the iceberg.

Doomed October Real Estate Figures

June 21, Bear Sterns hit a brick wall. In the last 6 weeks, the real estate finance markets have tightened up. No more easy loans. Home owners are looking at June Housing figures which are 30 days behind today’s date and the purchase date is 30 to 90 days behind that. These homes went into escrow 8 to 16 weeks ago and have been in the sold category for less than 4 weeks.

Notice one thing, the effect of the new lending standards has not even shown up in the real estate statistics. Even if we did a 30 day escrow, the June 21 contract signing would not show up in statistics until September 1. So in effect real numbers for the new lending criteria will not show their effect until October 1, or later (30 to 90 days from now).

If we examine this more minutely, you find that the home owner trying to sell is three months behind the curve. The newspaper figures for home values are a tad bit stale. The number of house sellers has increased, and the people that qualify as buyers have decreased considerably.

The October housing statistics should start to reflect the new lending standards. I would expect to see a very substantial drop in home purchases in San Diego. A lot of people won’t be able to qualify for a home loan. They don’t earn enough to afford the monthly payments; of course that fact didn’t seem to bother anyone a month ago.

Now as of last night, Wells Fargo has announced that its Jumbo rate has now jumped to 8%. So now you can buy a McMansion and they will super size your interest rate (what a deal!). This is a take out order; the current seller gets his lunch and a free ride to the poor house without lifting a finger. Notice that the words “free” and “lunch” were not next to each other.

Notice one thing, the effect of the new lending standards has not even shown up in the real estate statistics. Even if we did a 30 day escrow, the June 21 contract signing would not show up in statistics until September 1. So in effect real numbers for the new lending criteria will not show their effect until October 1, or later (30 to 90 days from now).

If we examine this more minutely, you find that the home owner trying to sell is three months behind the curve. The newspaper figures for home values are a tad bit stale. The number of house sellers has increased, and the people that qualify as buyers have decreased considerably.

The October housing statistics should start to reflect the new lending standards. I would expect to see a very substantial drop in home purchases in San Diego. A lot of people won’t be able to qualify for a home loan. They don’t earn enough to afford the monthly payments; of course that fact didn’t seem to bother anyone a month ago.

Now as of last night, Wells Fargo has announced that its Jumbo rate has now jumped to 8%. So now you can buy a McMansion and they will super size your interest rate (what a deal!). This is a take out order; the current seller gets his lunch and a free ride to the poor house without lifting a finger. Notice that the words “free” and “lunch” were not next to each other.

Subscribe to:

Posts (Atom)