Here is pretty much how it works. The Treasury figures out how much they want to sell that day. They add up the Noncompetitive bids and subtract them from the total desired. Then they examine the Competitive bids. They accept the lowest interest rates offered by the Competitive bids until they reach the desired total.

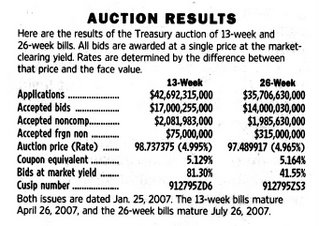

Lets look at the auction results for 13 week T-bill for last Monday’s auction.

The thing to really notice is the total applications. In this case, over 42 billion was offered and only 17 billion was accepted. There is a lot of money out there looking for a home. There is also “Accepted foreign noncompetitive.” The 26 week had a healthy chunk of foreign interest 300 million vs. the 75 million for the 13 week. As long as total bids is larger than the amount needed, the Treasury is somewhat secure. If some of the Competitive bid players were to leave the market, the interest rates accepted would probably shift higher.

The quality of Treasury’s is not in question. But, examine the plethora of housing loans that seem to be written at about 6.25% interest, something is quite disturbing. The added risk factor is not reflected in the rates being charged. Investors are willing to accept higher risk for less premium. It looks as if the inexperience Mutual Fund money manager has gotten “experience.” The only problem, there hasn’t been a real melt down to show these “seasoned” investors what the real world can be like.

Think about it from a money manager’s view, they have been doing this for 15 years. So they ought to know what they are doing, don’t you think?

What it really boils down to, is there is no perceived risk in the market. Here is a historical graph of Fannie Mae rates along side of the CMT (monthly average of the Constant Maturity Treasury’s Index)

Lifted from:http://mortgage-x.com/general/indexes/rny.asp

From the spread between the two we can deduce two things. One, the 13 week T Bill interest rate is determined by competitive bidding. And two, something is out of whack with the home loan interest rate.

Does it really make sense that a 13 week T-Bill and a 30 year mortgage only have one percent of risk between them.

Didn't Greenspan call this a Conundrum?

What is plain, is that the dynamics that got us to this point in time, are not going to stay in place forever, something is going to snap.

3 comments:

Hey Jim,

Just found your blog and find it quite interesting. Thank you for your efforts and helping me to think.

T

Thank you for taking the time to comment.

It takes about two or three hours to write each article (I'm slow).

I not writing these articles to foster my opinions, but to (as you said) make you think. We can all be right, but we all can't be right at the same time.

I use to comment on other blogs, but I found that my comments were lost in the hundreds of other comments of some of these well read blogs.

On this blog if you post a comment, you have the luxury of being read and not glanced over.

Thank you again

One factor for this that I just heard about is that there is a tremendous appetite for U.S. bonds (not just Treasurys) in the Asian markets, particularly China. This means a lot of money is being made available cheaply for mortgages. That means a cheaper cost of borrowing.

It's interesting that I heard about the curious incident of low mortgage rates in this different context at the same time. It means other people are also noticing this phenomenon.

Post a Comment