A pension plan is a form of savings that allows one to retire with a predetermined monthly income. It’s a little like putting money in a savings bank until you retire. A pension fund is a little more sophisticated they employ all sorts of advisors to figure out what your monthly payment from them will be when you choose to retire. In order to come up with these projections, they have to know beforehand your monthly contribution, the average life expectancy and a projection of future interest rates. From there it is a pretty cut and dry calculation.

Let’s examine it in a more simplified form. Assume that we have a person ready to retire with one million dollars in cash in the bank. That’s his total retirement. If we compute the interest rate on that at 12%, it comes out to about $120,000 a year. At 8% we get $80,000, at 4% we get $40,000, at 2% we get $20,000 and at 1% figure a whopping $10,000. Just examining the return rates here, it is easy to realize that a mistaken assumption of where interest rates will be, changes your spending habits and could force you to tap into the principle as well.

Examine the rule of 72. Divide the interest rate into 72 and you have a pretty good idea how many years it takes for your savings to double. It also works quite well for inflation. Divide the inflation rate into 72; only in this case we are not doubling, we are halving. Figure that the banks are paying 2% interest. That is about 36 years to double your money. Inflation is around 6% so figure 12 years down the road, you’ll still have a million dollars, but only half the buying power.

The difference between say CalPERS (California Public Employees' Retirement System) and an individual savings account used for retirement is that the left over funds in a savings account goes to your heirs. Pension funds don’t need a big cushion. They know that everyone as a group will drop dead at age 78 by using actuary tables.

Every year in the past CalPERS was asked, "Is there enough money in the plan to carry everyone to the drop dead age?" At 7.75% interest with no loss of principle, the answer was "Yes." Well, CalPERS lost 56 billion and the interest rate is now about 1.5%. Rates can’t stay this low for 20 years, like Japan, now can they? So this is only temporary. Now that you’ve bought the bridge, can we interest you in a toll booth to go with it?

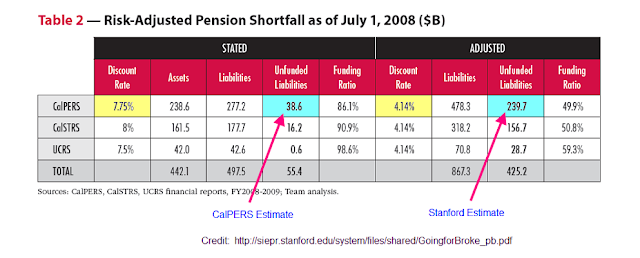

The picture below is an excerpt from a Stanford study requested by the Governator's office, published in April of 2010. Here's a Link to it. Notice that CalPERS is using a 7.75% interest rate for their calculations and Stanford at the time chose 4.14%.

Double click for a larger view

The present attainable interest rates are in a range of 2 to 4 percent. CalPERS whole financial structure was built on 8%. This low interest rate was not anticipated. If we were to take their present asset base and double it, that doubling would generate the interest income needed, to keep the fund solvent.

As usual, I could be shot for this over simplification. It seems certain that things are going to get worse before they get better. This Stanford projection of future pension costs appears quite reasonable. The three retirement funds cited in the report could have a half trillion dollar short fall. The size of the shortfall amount appears absurdly large, the possible reality of it, is rather unsettling.

Governor Schwarzenegger has stated that the California pension plan program is unsustainable. At the same time CalPERS wants 600 million more of State funds for just this year. Who do you listen to? One thing to consider, our next governor won't work for $1 a year.

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Saturday, May 22, 2010

Sunday, May 16, 2010

The Kalifornia Solution

A lot of states are coming to a fork in the road; how to live within their budget. Here in California, teachers, firemen and police have already gotten their budgets trimmed. Now it is time for deeper budget cuts or entertain the idea of raising taxes.

Here is a breakdown of present expenditures:

The Republicans are dead set against tax increases and more or less figure if you pay no taxes in, you’re first in line to lose benefits. In essence, it's the free stuff that the poor qualify for.

The Democrats on the other hand, want to raise taxes on the rich and big business and leave entitlements alone. Needless to say, the Democrats are not after the Big business vote. By God, make those fat corporations pay their fair share, rah rah rah! (I might sound a bit biased here, but show me a business that pays taxes, it's passed on to the customer)

We have two political philosophies that differ immensely. California’s problem is a financial one created by an economy that has gone sour. If the economy was in good shape, this problem would not exist.

The question arises, will either political view, result in a solution? Sadly, probably not. From looking back at history, raising taxes in hard times (the Democrats plan) brings in less revenue and stifles the creation of new businesses. Of course if you are poor and your entitlements get cut (The Republicans plan), you will vote for the Democrats to get them back. Both perspectives appear doomed to failure.

Where else can the state governments cut? There are limits here; people expect and demand services for their tax dollars. The part of the budget that might end up being cut could be welfare and health care.

Governator Schwarzenegger is suggesting elimination of some welfare programs. However it seems more likely that California residents might see an across the board cut in welfare benefits of say 25% this year and another 25% the following year. This would put our state in line with the benefits other states pay. We could also see major cuts in health care. Health care for kids could flat out disappear.

And as if it couldn't get any worse, new laws will prevent four million Arizona "tourists" from their annual trek to the San Joaquin Valley in California to harvest vegetables this year (a definite crimp on "tourism"). This should have no adverse effect on this years bumper pot crop.

It kind of looks as if those that don't help row and bail water out of the boat, get to swim along side.

Here is a breakdown of present expenditures:

The Republicans are dead set against tax increases and more or less figure if you pay no taxes in, you’re first in line to lose benefits. In essence, it's the free stuff that the poor qualify for.

The Democrats on the other hand, want to raise taxes on the rich and big business and leave entitlements alone. Needless to say, the Democrats are not after the Big business vote. By God, make those fat corporations pay their fair share, rah rah rah! (I might sound a bit biased here, but show me a business that pays taxes, it's passed on to the customer)

We have two political philosophies that differ immensely. California’s problem is a financial one created by an economy that has gone sour. If the economy was in good shape, this problem would not exist.

The question arises, will either political view, result in a solution? Sadly, probably not. From looking back at history, raising taxes in hard times (the Democrats plan) brings in less revenue and stifles the creation of new businesses. Of course if you are poor and your entitlements get cut (The Republicans plan), you will vote for the Democrats to get them back. Both perspectives appear doomed to failure.

Where else can the state governments cut? There are limits here; people expect and demand services for their tax dollars. The part of the budget that might end up being cut could be welfare and health care.

Governator Schwarzenegger is suggesting elimination of some welfare programs. However it seems more likely that California residents might see an across the board cut in welfare benefits of say 25% this year and another 25% the following year. This would put our state in line with the benefits other states pay. We could also see major cuts in health care. Health care for kids could flat out disappear.

And as if it couldn't get any worse, new laws will prevent four million Arizona "tourists" from their annual trek to the San Joaquin Valley in California to harvest vegetables this year (a definite crimp on "tourism"). This should have no adverse effect on this years bumper pot crop.

It kind of looks as if those that don't help row and bail water out of the boat, get to swim along side.

Wednesday, May 12, 2010

The Last Hurrah

Interest rates right now are a joke; Banks are paying ½ to 2%. My wife and I stopped buying T-bills that were paying a ¼ percent. Interest rates usually measured risk, the lesser the risk, the lower the rate.

Look at bonds as a long term investment. The investor might be willing to take more risk to increase his rate of return. If there is no risk (because of government guarantees), the interest paid will approach zero. With inflation running in a range of around 6 to 15 percent (pick a value) bonds look like a real dumb investment.

Consider that the bond market is 5 times larger than the stock market, where is money going to go? The stock market appears to be the only option left.

The real question is, what level do interest rates need to rise to keep money in the bond market? A 10 percent rate would ruin the housing market, and a 20 percent rate would spell financial disaster for the country. Now we have the European Union printing up one trillion Euros to save the Euro. This frees up the money from bad loans (unredeemable) made to Greece. Where are investors going to put this money, in other markets? What’s a trillion Euros trying to find a home? Answer: Inflation.

Notice, governments never question markets that reach to the sky. But have one that takes an ugly dip like the real estate market or the stock market and they hold an inquisition.

Where to from here? Dow 30,000, Gold $3,000? So as the Dow Jones average rips through 40,000 next week, look for Obama to declare the recession over. Even though I am joking around here, this is the last party in town and they just refilled the punch bowl.

Look at bonds as a long term investment. The investor might be willing to take more risk to increase his rate of return. If there is no risk (because of government guarantees), the interest paid will approach zero. With inflation running in a range of around 6 to 15 percent (pick a value) bonds look like a real dumb investment.

Consider that the bond market is 5 times larger than the stock market, where is money going to go? The stock market appears to be the only option left.

The real question is, what level do interest rates need to rise to keep money in the bond market? A 10 percent rate would ruin the housing market, and a 20 percent rate would spell financial disaster for the country. Now we have the European Union printing up one trillion Euros to save the Euro. This frees up the money from bad loans (unredeemable) made to Greece. Where are investors going to put this money, in other markets? What’s a trillion Euros trying to find a home? Answer: Inflation.

Notice, governments never question markets that reach to the sky. But have one that takes an ugly dip like the real estate market or the stock market and they hold an inquisition.

Where to from here? Dow 30,000, Gold $3,000? So as the Dow Jones average rips through 40,000 next week, look for Obama to declare the recession over. Even though I am joking around here, this is the last party in town and they just refilled the punch bowl.

Wednesday, May 05, 2010

Greek Bailout

From the AP wire May 2, 2010:

IMF funding, hmmm! Sounds like some big bucks there, ever wonder whose money is being spent? Who’s in charge of this “One stop shop for loans with no collateral?” The United States of America pretty much runs the organization they have 17% of the vote and nothing happens unless they say so. Who’s in charge for our side?--- Tim Geithner and Ben Bernanke. At the last Senate hearing for the Federal Reserve, Bernanke got asked a question about the IMF and more or less stated he didn’t have enough information on the subject. Talk about a piece of lit dynamite and no one in the panel called Ben on it! Here's a graphical representation of how the United States fits into the IMF. It is our baby, we run it.

There is absolutely no reason to bail out Greece. They had a walapalosa party; does the rest of the world have to pick up the tab? Do we keep the game going one more year, or let the chips fall where they may? There is Spain and Portugal with Ireland waiting in the wings.

Germany may find 29 billion (over a time span of 3 years) for Greece, what happens when Spain comes knocking? At what point do these loans become grants of aid that have to be written off by the issuer? This wouldn’t be an issue to bring up when running for reelection in say Germany.

There are two different goals here “Save the Euro,” and/or “Save the PIIGS.” Everyone is for the idealistic Euro. Europe is not ready to save the Greeks. The bar of soap is on the shower floor, and no one has any intention, to bend over and pick it up. Refinancing Greece’s debt, in a world economy that is plunging into the abyss, has very little chance of success. You are only adding more debt to the system. It could be time to cut and run. Sometimes doing nothing is the solution, the problem solves itself.

My advice, go to the concession stand and get a box of popcorn and a drink and find a seat, the show is about to begin. In this episode, Ben is going to save the Euro with American Dollars from the IMF. Aw gee, I guess I spoiled the ending—sorry.

Of the 110 billion euros in total commitments endorsed Sunday, the euro zone will contribute 80 billion euros to the package, with 30 billion of that to be made available this year. The rest of the money would come from the Washington-based IMFGreece gets 30 billion this year from everyone. But reexamine the statement. The total amount raised is 110 billion euros. The Eurozone will contribute 80 billion (sometime in the future) with 30 billion of that available to Greece this year. 110 minus 80 comes out to 30 billion not covered---“The rest of the money would come from the Washington-based IMF.” Here is a Link that goes into more detail

IMF funding, hmmm! Sounds like some big bucks there, ever wonder whose money is being spent? Who’s in charge of this “One stop shop for loans with no collateral?” The United States of America pretty much runs the organization they have 17% of the vote and nothing happens unless they say so. Who’s in charge for our side?--- Tim Geithner and Ben Bernanke. At the last Senate hearing for the Federal Reserve, Bernanke got asked a question about the IMF and more or less stated he didn’t have enough information on the subject. Talk about a piece of lit dynamite and no one in the panel called Ben on it! Here's a graphical representation of how the United States fits into the IMF. It is our baby, we run it.

There is absolutely no reason to bail out Greece. They had a walapalosa party; does the rest of the world have to pick up the tab? Do we keep the game going one more year, or let the chips fall where they may? There is Spain and Portugal with Ireland waiting in the wings.

Germany may find 29 billion (over a time span of 3 years) for Greece, what happens when Spain comes knocking? At what point do these loans become grants of aid that have to be written off by the issuer? This wouldn’t be an issue to bring up when running for reelection in say Germany.

There are two different goals here “Save the Euro,” and/or “Save the PIIGS.” Everyone is for the idealistic Euro. Europe is not ready to save the Greeks. The bar of soap is on the shower floor, and no one has any intention, to bend over and pick it up. Refinancing Greece’s debt, in a world economy that is plunging into the abyss, has very little chance of success. You are only adding more debt to the system. It could be time to cut and run. Sometimes doing nothing is the solution, the problem solves itself.

My advice, go to the concession stand and get a box of popcorn and a drink and find a seat, the show is about to begin. In this episode, Ben is going to save the Euro with American Dollars from the IMF. Aw gee, I guess I spoiled the ending—sorry.

Sunday, May 02, 2010

The Eye of the Hurricane

The newspapers are all claiming that the housing market is coming back. Something isn’t quite right here. The banks aren’t about to loan any one money for a home unless they have a 20% down payment. Of course, if you want to buy a Fannie Mae foreclosure, all you need is 5% down and the government gets another bad loan off the books. This isn’t a bank loan; it’s a government loan that happens to be part of the national debt. The phrase "No skin in the game," seems to echo in the background.

Then you hear about the 20% of house sales that are completely cash sales. You have to wonder, where did they get the money? With 1 out of 17 homes in the US facing the possibility of foreclosure and then we have 1 out of 5 buyers paying all cash? I find it hard to believe. Common sense suggests, why buy one house? Investors only need 20% down, buy 5 and share the risk with the bank, the interest rate can’t be beat.

Three years ago, anyone that wanted a loan could have gotten one. And now you can’t get a loan without a substantial down payment. The marginal buyers (no doc’s) are gone and so is their demand for housing.

The housing market is not coming back, the surge of baby boomers has peaked, the Silver Foxes are looking for smaller retirement homes, not the McMansions that have been built. Real demand is declining. Our government wants to keep home prices from collapsing so people don’t take a walk; otherwise Freddie and Fanny get more home loans to eat. They have painted themselves into a real neat corner; 5% down moves you in and of course they’ll throw in $20,000 for repairs.

Right now the housing market is in the eye of a hurricane, enjoying the calm. The 5/30 interest only loans are starting to convert to conventional loans. Unemployment is getting worse. State tax collections are abysmal. On top of that, the baby boomers are getting ready to retire; they will be trying to sell their homes and move to Arizona (Mexico’s Northern most State). Why buy a home from a Silver Fox when you can buy one from Fannie Mae and get cash back? I just love these government programs, sure beats renting.

Then you hear about the 20% of house sales that are completely cash sales. You have to wonder, where did they get the money? With 1 out of 17 homes in the US facing the possibility of foreclosure and then we have 1 out of 5 buyers paying all cash? I find it hard to believe. Common sense suggests, why buy one house? Investors only need 20% down, buy 5 and share the risk with the bank, the interest rate can’t be beat.

Three years ago, anyone that wanted a loan could have gotten one. And now you can’t get a loan without a substantial down payment. The marginal buyers (no doc’s) are gone and so is their demand for housing.

The housing market is not coming back, the surge of baby boomers has peaked, the Silver Foxes are looking for smaller retirement homes, not the McMansions that have been built. Real demand is declining. Our government wants to keep home prices from collapsing so people don’t take a walk; otherwise Freddie and Fanny get more home loans to eat. They have painted themselves into a real neat corner; 5% down moves you in and of course they’ll throw in $20,000 for repairs.

Right now the housing market is in the eye of a hurricane, enjoying the calm. The 5/30 interest only loans are starting to convert to conventional loans. Unemployment is getting worse. State tax collections are abysmal. On top of that, the baby boomers are getting ready to retire; they will be trying to sell their homes and move to Arizona (Mexico’s Northern most State). Why buy a home from a Silver Fox when you can buy one from Fannie Mae and get cash back? I just love these government programs, sure beats renting.

Sunday, April 25, 2010

Risk Has Left the Building

The financial collapse of AIG wasn’t an accident. The conditions were just right for individuals of every walk of life to make a killing on the way the financial system reacted to the real estate boom. The basic mistake was the misallocation of resources. The world didn’t need all of this new housing, but it was very profitable to build and finance. The increased property values implied that the banks couldn’t lose on any loan. The tax base increased proportionally and government expanded (exploded). It was only "short bus" math to figure out that over 30 years, a person earning $35,000 per year was not going to have the resources to pay off, a 30 year, one million dollar mortgage.

All of a sudden it stopped, the bubble burst. AIG and several hedge funds collapsed. The side bets (derivatives/insurance/credit-default swaps) covering those exposed to loss came to the surface. These hedge funds were writing insurance on everything including the kitchen sink.

Risk had been removed from the business model. It’s hard to lose money if you place the right side bets (that’s without even including Fannie and Freddie in this mess). Too much “insurance coverage” had been written. The insurance premiums were collected and went into someone’s pocket. The estimated 40 to 80 trillion of derivatives written to insure against financial loss will never be paid.

For example, Greek bonds have a substantial risk, but buy insurance and your worries are gone. If you are the Greek government, buy the insurance (you can’t lose). If you work for the Greek government, why buy the bonds? Just buy the insurance and when Greece goes belly up, retire to the good life. Greece will make that glaringly apparent when they collapse (after receiving their bail out money).

The real fault with this "insurance" is that you don’t have to have a relationship to the asset being insured. There is nothing to stop you from insuring your neighbor’s home and then burning it down. Plus if the neighborhood has "a gut feeling about that house," there’s going to be several policies written on that home. Then when the expected happens, (it burns to the ground) everyone gets rich. It’s as if, AIG was the insurer for anyone placing a bet on that house. Geithner and Bernanke saved the day; everyone got paid on that one.

Three questions arise. Were the insurance rates too low for the coverage written? Should the contracts have been allowed to be written in the first place? Shouldn’t you have to prove your vested interest in the insured, in order to purchase the product?

The Panic of 1907 led to legislation that made this sort of "insurance" illegal; the bucket shops which sold it, were banned in 1909. And then 91 years later, Congress rolled that law back. We were smarter now and knew what we were doing. Just as a our person making $35,000 a year can't pay off that million dollar loan, the 50 trillion dollars in risk arbitrage can't be paid either. The risk in the market is real, the "insurance" isn't. And, as in all fairy tales, everyone lives happily ever after.

All of a sudden it stopped, the bubble burst. AIG and several hedge funds collapsed. The side bets (derivatives/insurance/credit-default swaps) covering those exposed to loss came to the surface. These hedge funds were writing insurance on everything including the kitchen sink.

Risk had been removed from the business model. It’s hard to lose money if you place the right side bets (that’s without even including Fannie and Freddie in this mess). Too much “insurance coverage” had been written. The insurance premiums were collected and went into someone’s pocket. The estimated 40 to 80 trillion of derivatives written to insure against financial loss will never be paid.

For example, Greek bonds have a substantial risk, but buy insurance and your worries are gone. If you are the Greek government, buy the insurance (you can’t lose). If you work for the Greek government, why buy the bonds? Just buy the insurance and when Greece goes belly up, retire to the good life. Greece will make that glaringly apparent when they collapse (after receiving their bail out money).

The real fault with this "insurance" is that you don’t have to have a relationship to the asset being insured. There is nothing to stop you from insuring your neighbor’s home and then burning it down. Plus if the neighborhood has "a gut feeling about that house," there’s going to be several policies written on that home. Then when the expected happens, (it burns to the ground) everyone gets rich. It’s as if, AIG was the insurer for anyone placing a bet on that house. Geithner and Bernanke saved the day; everyone got paid on that one.

Three questions arise. Were the insurance rates too low for the coverage written? Should the contracts have been allowed to be written in the first place? Shouldn’t you have to prove your vested interest in the insured, in order to purchase the product?

The Panic of 1907 led to legislation that made this sort of "insurance" illegal; the bucket shops which sold it, were banned in 1909. And then 91 years later, Congress rolled that law back. We were smarter now and knew what we were doing. Just as a our person making $35,000 a year can't pay off that million dollar loan, the 50 trillion dollars in risk arbitrage can't be paid either. The risk in the market is real, the "insurance" isn't. And, as in all fairy tales, everyone lives happily ever after.

Tuesday, April 20, 2010

Mortgage Market Meltdown (reprinted)

This piece was written August 4, 2006. I thought it might bear a review.I get irritated when I watch the PBS feeds of the Congressional committees, who ask why no one saw this real estate mess coming? Congress has to assume the biggest share of the blame. If I could see it, they could too. Of course this was bringing in a lot of tax dollars, which they could spend on new toys; Spend-------ad infinitium.

Lets look at an organization named Fannie Mae. Picture it as a 4 x 4 x 4 foot black box with the words Fanny Mae printed in white on it. Envision Mr. or Ms. "Mortgage Market" dropping into the box all of their 80% finance loans and when the box gets to $1 million it spits out an investment certificate for 1 million paying 5%, face amount guaranteed, which is purchased by Mr. or Ms. "Unknown Entity," AKA "mark" or "sucker."

The little black box is a great transformer and redistributer of debt. Nobody wanted to touch that crap until they built the little black box. By God everyone is entitled to the American dream of home ownership rah! rah! rah!

So we have this box and the question arises, "What the hell do they do inside that box?" My guess--absolutely nothing.

There is really no problem with the design model aspect of the black box. It will perform within its parameters. After all, its rather absurd to have a real estate market drop 20% isn't it? (Believe that, and I have a bridge to sell you). What is not realized is that the market can drop 50 to 70 percent. In this scenario, the little black box fails to function as expected. It doesn't have the funds necessary to back the claims it made in the past. What funds does it have for back up of bad loans? My guess, is none. Say you need one or two trillion dollars to back up the investors who bought these certificates---total tax collections for the US of A is about 1 trillion a year. Sounds like someone is going to get short sheeted!

The question arises who's holding all of the crap and who is going to get burned?

My guess is mutual funds and IRA's and I could be wrong.

Lets look at an organization named Fannie Mae. Picture it as a 4 x 4 x 4 foot black box with the words Fanny Mae printed in white on it. Envision Mr. or Ms. "Mortgage Market" dropping into the box all of their 80% finance loans and when the box gets to $1 million it spits out an investment certificate for 1 million paying 5%, face amount guaranteed, which is purchased by Mr. or Ms. "Unknown Entity," AKA "mark" or "sucker."

The little black box is a great transformer and redistributer of debt. Nobody wanted to touch that crap until they built the little black box. By God everyone is entitled to the American dream of home ownership rah! rah! rah!

So we have this box and the question arises, "What the hell do they do inside that box?" My guess--absolutely nothing.

There is really no problem with the design model aspect of the black box. It will perform within its parameters. After all, its rather absurd to have a real estate market drop 20% isn't it? (Believe that, and I have a bridge to sell you). What is not realized is that the market can drop 50 to 70 percent. In this scenario, the little black box fails to function as expected. It doesn't have the funds necessary to back the claims it made in the past. What funds does it have for back up of bad loans? My guess, is none. Say you need one or two trillion dollars to back up the investors who bought these certificates---total tax collections for the US of A is about 1 trillion a year. Sounds like someone is going to get short sheeted!

The question arises who's holding all of the crap and who is going to get burned?

My guess is mutual funds and IRA's and I could be wrong.

Tuesday, April 13, 2010

Off Track Betting

40 years ago I had a summer job working for Delco as an Engineer in training. It impressed me that there was this one guy that would get off early and go to the race track. Naturally everyone would give him a couple of dollars to bet on a horse or two. On one particular race day several of the requested bets won big. The guy didn’t come back to work for a while. It seems he had been pocketing the money and betting on his own tips. Two workers had asked for a Trifecta ticket of say 711. Those 3 horses won and the payout was astronomical; but no tickets for that combination were sold at the race track. So it got added to the payout for the next day.

This might seem unrelated to the stock market, but look at options. 90% of all options expire worthless. So a big brokerage, could take the orders and not place them, and cover them internally. And on expiration the brokerage gets the money. If there is a small winner, pay the guy off.

If you were to change your mutual fund holdings, and move from investment x to investment y, the question comes up; does the mutual fund go out and change what they are doing just because you move a few things around? Probably not.

Take gold and silver bullion storage facilities. It is not unreasonable to suspect that these companies only keep less than 10% of the demanded holdings in actual metal. It’s rather tempting to hold the rest as some sort of certificate, and invest the proceeds in selling puts and calls on the “bullion in storage?” Remember 90% of options expire worthless.----everyone is not going to ask for their gold at once. Hmmmm--- What happens if they do?

The amount of physical gold and silver in the world to date is a measured known amount. Just like everything else, as long as the system has no real stress applied to it, things function quite well. If everyone decided to take possession of their gold or silver, it just might not be there. It has been suggested that only one ounce of gold for every 100 under contract could be delivered, if demanded. The neat thing about gold and silver, is that the FDIC/Treasury can’t print either one.

The people we trust are not doing what we ask because they can buy an option to satisfy our requirements. The trouble is, these option tools may prove to be very inadequate in a panic. As Buffett suggests, we will see who was swimming nude, the irritating thing is, it could be us.

This might seem unrelated to the stock market, but look at options. 90% of all options expire worthless. So a big brokerage, could take the orders and not place them, and cover them internally. And on expiration the brokerage gets the money. If there is a small winner, pay the guy off.

If you were to change your mutual fund holdings, and move from investment x to investment y, the question comes up; does the mutual fund go out and change what they are doing just because you move a few things around? Probably not.

Take gold and silver bullion storage facilities. It is not unreasonable to suspect that these companies only keep less than 10% of the demanded holdings in actual metal. It’s rather tempting to hold the rest as some sort of certificate, and invest the proceeds in selling puts and calls on the “bullion in storage?” Remember 90% of options expire worthless.----everyone is not going to ask for their gold at once. Hmmmm--- What happens if they do?

The amount of physical gold and silver in the world to date is a measured known amount. Just like everything else, as long as the system has no real stress applied to it, things function quite well. If everyone decided to take possession of their gold or silver, it just might not be there. It has been suggested that only one ounce of gold for every 100 under contract could be delivered, if demanded. The neat thing about gold and silver, is that the FDIC/Treasury can’t print either one.

The people we trust are not doing what we ask because they can buy an option to satisfy our requirements. The trouble is, these option tools may prove to be very inadequate in a panic. As Buffett suggests, we will see who was swimming nude, the irritating thing is, it could be us.

Friday, April 09, 2010

4 Trillion Dollars worth of Inflation

Let’s examine the housing bubble. For this example, we will use a million dollar home (before the bubble it was worth 300K). The buyer secures a 30 year loan for one million dollars. The home's seller puts the untaxed windfall gain in the bank.

The housing market tanks and now million dollar homes are worth 300K again. Each homeowner signed an agreement with the bank, to pay on the loan for 30 years. Assume these home owners walk and send the keys to the bank. The homeowner’s loss is probably negligible.

The bank now has a problem. Instead of a steady income stream for 30 years, they have many 300K homes and a loss on each home of 700K. The bank is now insolvent and the FDIC insurance will step in to make good on the bad loans.

At this point, two things are evident. The money that was to be paid back by the buyer, was to be done with earnings over 30 years. The money paid by the FDIC to the bank to cover the bad loan was printed money paid immediately. So the contract to pay on the home for 30 years has been canceled, this money if it had been paid, would have been real money, i.e. earnings.

In our example, the bank now owns the house worth 300k and receives from the FDIC the other 700K. Instead of the banks getting 1/30th of their investment (plus interest) back every year, they get 7/10ths back right away and the rest when they unload the home.

When you realize that a 30 year home loan has a payoff of 2 ½ times the amount borrowed, the 4 trillion dollar loss currently projected would represent 10 trillion of real earnings over 30 years. This would have been money that could not be used for consumption, it was already under contract. Under the FDIC plan, the banks get immediate remuneration with printed money and their depositors are still whole. It’s painless; no one had to work for it.

So, everyone that sold their house before the bubble popped is a winner, everyone that walked away from their bad investment, after the pop, is a winner and everyone with money in the bank is a winner (A real fairy tale ending). The government pours 4 trillion dollars into a banking system that expected that sum back with interest over a 30 year time frame. Now the bankers have all of this money to lend with no one credit worthy enough to loan it to. Where do the banks go next to lend money? Greece, Portugal, Spain, Ireland—they can’t lose, they’re FDIC insured. And of course there is no inflation, the person who sold his house for 700k more that he paid for it, gets to keep it. The bank that lost the 700k (when the new buyer walked), gets reimbursed by the FDIC. We have a bank owned house still worth 300k and 1.4 million dollars of new money in the banking system.

The thing to realize here is that the new homeowners never really had the earnings to pay these loans off, 30 years down the pike. But our government will pick up the tab on this failed dream of riches. Real estate was a get rich quick scheme and an obvious bubble. America is the new Wonderland; you wonder how we will pay for all of this. You won't have to wonder long.

The housing market tanks and now million dollar homes are worth 300K again. Each homeowner signed an agreement with the bank, to pay on the loan for 30 years. Assume these home owners walk and send the keys to the bank. The homeowner’s loss is probably negligible.

The bank now has a problem. Instead of a steady income stream for 30 years, they have many 300K homes and a loss on each home of 700K. The bank is now insolvent and the FDIC insurance will step in to make good on the bad loans.

At this point, two things are evident. The money that was to be paid back by the buyer, was to be done with earnings over 30 years. The money paid by the FDIC to the bank to cover the bad loan was printed money paid immediately. So the contract to pay on the home for 30 years has been canceled, this money if it had been paid, would have been real money, i.e. earnings.

In our example, the bank now owns the house worth 300k and receives from the FDIC the other 700K. Instead of the banks getting 1/30th of their investment (plus interest) back every year, they get 7/10ths back right away and the rest when they unload the home.

When you realize that a 30 year home loan has a payoff of 2 ½ times the amount borrowed, the 4 trillion dollar loss currently projected would represent 10 trillion of real earnings over 30 years. This would have been money that could not be used for consumption, it was already under contract. Under the FDIC plan, the banks get immediate remuneration with printed money and their depositors are still whole. It’s painless; no one had to work for it.

So, everyone that sold their house before the bubble popped is a winner, everyone that walked away from their bad investment, after the pop, is a winner and everyone with money in the bank is a winner (A real fairy tale ending). The government pours 4 trillion dollars into a banking system that expected that sum back with interest over a 30 year time frame. Now the bankers have all of this money to lend with no one credit worthy enough to loan it to. Where do the banks go next to lend money? Greece, Portugal, Spain, Ireland—they can’t lose, they’re FDIC insured. And of course there is no inflation, the person who sold his house for 700k more that he paid for it, gets to keep it. The bank that lost the 700k (when the new buyer walked), gets reimbursed by the FDIC. We have a bank owned house still worth 300k and 1.4 million dollars of new money in the banking system.

The thing to realize here is that the new homeowners never really had the earnings to pay these loans off, 30 years down the pike. But our government will pick up the tab on this failed dream of riches. Real estate was a get rich quick scheme and an obvious bubble. America is the new Wonderland; you wonder how we will pay for all of this. You won't have to wonder long.

Saturday, April 03, 2010

Reading Between the Lines

With Friday's job report, the message is “We have turned the corner on the recession.” This reinforces my belief that in bad times people want to hear good news. There are some serious miscalculations here. A lot of the jobs that have been lost are not coming back; people will have to be retrained for new types of work. In the 1930’s we switched from an agrarian economy to a manufacturing one. The switch is happening again. We need computer skills to fit into the new world of Information Technology. The problem is trying to retrain those over the age of 45 with these new job skills.

Housing also seems to be picking up. It seems like savvy investors are picking up rental property. Think about that for one moment, if housing prices drop below what renters are paying for rent, why rent? Buy a house. So as housing prices decrease, the rental market goes to hell. In some places like Detroit Michigan or Helmet, California, home prices have hit $80,000, that’s the construction cost of the house with zero land value. The net result home builders disappear. $600 dollars a month would move you into a home. I hear Fannie and Freddie Blowin' In The Wind; get a free toaster with your purchase of a house.

Then we have state budgets and legislators on the road to nowhere. The recently elected New Jersey governor Chris Christie is starting to get the state moving in the right direction. Here is a Link worth watching, it's about 26 minutes . He has the right ideas. He knows what he’s doing, won’t get him re elected. Maybe some of the right people, to fix this mess, are getting elected.

And finally, public employee retirement plans are making the news. Taxpayers are beginning to realize the retirement benefits are a bit on the extravagant side. The state financing (nationwide) needed to keep these plans funded, are a couple of trillion dollars short, three to be exact (so far). It will be interesting to see where this money comes from.

If you are wealthy, you’re oblivious to today’s hard times. Some Indian father threw a $200,000 wedding in downtown San Diego yesterday. He even rented an elephant, see the picture below.

It kind of makes one wonder about the distribution of wealth in the world. Opulent consumption of this sort during hard times never sits well with the masses. The quote “Let them eat cake” comes to mind and we know how that turned out.

Housing also seems to be picking up. It seems like savvy investors are picking up rental property. Think about that for one moment, if housing prices drop below what renters are paying for rent, why rent? Buy a house. So as housing prices decrease, the rental market goes to hell. In some places like Detroit Michigan or Helmet, California, home prices have hit $80,000, that’s the construction cost of the house with zero land value. The net result home builders disappear. $600 dollars a month would move you into a home. I hear Fannie and Freddie Blowin' In The Wind; get a free toaster with your purchase of a house.

Then we have state budgets and legislators on the road to nowhere. The recently elected New Jersey governor Chris Christie is starting to get the state moving in the right direction. Here is a Link worth watching, it's about 26 minutes . He has the right ideas. He knows what he’s doing, won’t get him re elected. Maybe some of the right people, to fix this mess, are getting elected.

And finally, public employee retirement plans are making the news. Taxpayers are beginning to realize the retirement benefits are a bit on the extravagant side. The state financing (nationwide) needed to keep these plans funded, are a couple of trillion dollars short, three to be exact (so far). It will be interesting to see where this money comes from.

If you are wealthy, you’re oblivious to today’s hard times. Some Indian father threw a $200,000 wedding in downtown San Diego yesterday. He even rented an elephant, see the picture below.

It kind of makes one wonder about the distribution of wealth in the world. Opulent consumption of this sort during hard times never sits well with the masses. The quote “Let them eat cake” comes to mind and we know how that turned out.

Subscribe to:

Posts (Atom)