If you are a veteran and want to live in California or have been living there for years as a homeowner, boy, do we have a deal for you. California veterans are entitled to buy a home up to $649,999 dollars with no money down. At present interest rates, that's about a $3,000 a month payment.

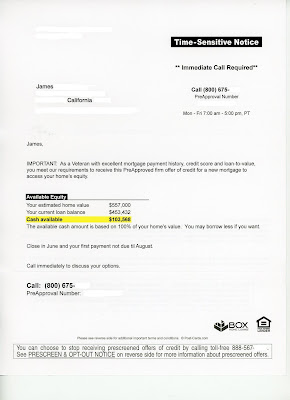

My wife and I bought our home for about 500k and put 50k down for a down payment about 18 months ago. We have been getting 3 to 10 letters a week like the one below to refinance our mortgage and drag out another 100K in cash.

Something is wrong here, this refinancing with nothing down as a veteran is insane. The 10 solicitations a week to refinance our home loan sounds like an exaggeration of what we are receiving in the mail but it isn’t. Back in 2005 I wrote Greenspan a letter about the abuses in the real estate market and got a form letter back and these were published in my blog back in Aug 28, 2009. Here is a Link

You have to wonder why a lender would want to give any VA home owner all of the equity in their home including the appreciation. I am still trying to figure out why they wrote me a thirty year loan at the age of 70 , I'll be a hundred years old when I pay it off.

8 comments:

The Japanese were pioneers of the multi-generation mortgage loan, I believe.

I'm impressed by your loan to age 100. The highest I've read about for the UK is age 85.

That's excepting "equity release" or "reverse" mortgages, which run on until the survivor

of you dies or goes into "care". My wife is in fine health and comes from a long-lived family.

I'm the opposite. Our house may have to pay for her very old age if my financial planning

proves unsuccessful.

As for a future crash: one member of my extended family was ruined in the last UK housing

market crash. It's having to sell in the slump that does the damage.

Here's a type of mortgage that's new to me. It's interest-only and it could run past age 100 if you are lucky. Well, well.

https://www.telegraph.co.uk/personal-banking/mortgages/lifetime-mortgage-retirement-interest-only-right/

Hi dearieme

I checked out the link. I Don't like those reverse mortgages, because when you move to the rest home, the bank gets the home. All it takes is a stroke and your dream home goes up in smoke.

My bank wants $2700 every month until I reach 100. I am working and paying the mortgage, I'm just not sure that I will be around at age 100. That makes a for a very interesting dilemma. Realistically, its not my problem and it should be. Go figure!

" I am working and paying the mortgage, I'm just not sure that I will be around at age 100"

You'll be fine Jim, and if and when you can't pay that, there will be a line of people trying to buy your property. It is boldly apparent that you are not comfortable with the increase in the cost of living, even though you mention inflation and its theft.

It's simple, everyone in the world, and I mean literally everyone in the world, wants to move to the u.s., and specifically, places like California. This is a fact, whether you are greek, an Italian, or a Chinese national, places like San Diego, los Angeles, and the like are the preferred destination of your capital.

So, if for some random reason, you dont't pay your mortgage, there will be a line of people wanting to buy your place. Just curious, with all the inflation you talk about, how much do you think it will cost to build your current residence, not including the property? please be fair and realistic. Beer and steaks can't cost a small fortune, while conveniently lumber and drywall are given away cheap. You can't play both sides if you preach inflation and the theft of money through it, which i agree happens, you can't also ignore that thesis when it comes to housing and cost of living.

I can see it now, your home will appreciate, but you will continually claim that the appreciation is fake, while you go to the store and pay more for ice cream and beer.

The reality is that inflation is alive and well, and those who are offering such financing products you speak of, are no dummies. The financiers know that there is a good chance that the home they are lending on will appreciate, and the veteran living in it, is a fighter, a responsible soul, and he or she will do their best to maintain their household, and in the long run, that borrower is not high risk. Especially given the fact that the financier has federal guarantees for loans like this.

Time will prove this. I was one of the people like you that called the correction of 2006-2008, however, I don't see that doom and gloom yet, even though we are getting closer. Even then, these veteran loans will outperform the market.

let us wait and see, cheers.

Hi Anon 5:24

I don't disagree with what you have said, but I do see the abuse that this program could create. I put down 50K and now one year later, I can refinance and pull out 105K. Something is a little wrong here. It looks like a veteran can keep pulling money out of his home with no vision of every paying off the loan. The assumption is that if interest rates rise, the refinancing will not be that advantageous for the borrower.

What I am pointing to is the young veteran that gets this offer. Is this going to help him or make things more difficult for him down the road? And we both know the answer to that question.

On mature reflection, Jim, why not take the cash and buy gold?

Hi dearieme

I believe that gold and a home are really the same investment. Both protect you from inflation. Only one puts a roof over your head. Gold is invisible as far as government is concerned. Houses are taxable.

The neat thing about gold silver and platinum, there is no probate when you die, if you know what you are doing. Plus if you are being wheeled into a retirement home, those assets are invisible. Of course, I didn't say that, did I?

With all due respect, the bank knows the collateral is valuable and will increase in value over the long-term, 7-10 years.

When interest rate are low, like they are now, investors are pushed to take "more" risk for yields.

You thought your home was worth what it was 18 months ago and you even admit to having equity, so you thought this investment made sense?! The fact you are 70, doesn't matter bc it's not your lifespan the lending party cares about but the underlying asset, and a few other things.

You are under the impression that when someone takes out a loan, they have to pay it back over 30 years, that's completely wrong!!!!! These days, people refinance their home multiple times while owning. The "Brady Bunch days are gone, we live in a new paradigm and everyone who wants to be sucessful, beter not forget history but also learn from the current and new times!

God bless.

Post a Comment