Right now our government is balanced on a swords edge, fall one way and its a major depression. Fall the other way, and its hyperinflation.

The motivating force to hyper inflation, is that the Congress wants to get reelected. It has to deliver more and it is in a bind to do so, so they have to cheat. Its very easy to pay for health care costs with printed money, its very hard to tax and raise it at this time, the amount needed is more than is being taken in.

The fixed cost for social security is increasing and if you figure in medical costs, you get numbers that are out of whack. A heart bypass is $50,000. How many people have contributed over $50,000 total into social security?

Now if you figure that there is a 12 trillion dollar real estate bubble out there and it is funded by private institutions (Mutual Funds or what ever you call your retirement fund), you now begin to see the size of the problem.

The losses cannot be guaranteed to be paid by Congress, I fear they are way too large. The problem at this point in time is, that we are looking into a dilemma, which way will it go?

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Monday, August 21, 2006

Saturday, August 19, 2006

The Man who lived through 1929

Let's go back and picture a man from the 1929 era. He would have been born about 1890 and been about 40 at the time. His world had gone from horse and buggy to the automobile. Between 1908 and 1927 Ford had produced 15,000,000 model T's. In 1904 there were three million telephones, by 1915 you could call coast to coast (the cost was prohibitive). By 1906, the electric light bulb was commercially feasible to produce. Radio came into its own in the 1920's. By 1924 there were 3 million radios in use in the US. The airplane had come on line. It was used to speed up mail delivery; commercial aviation was still a few years away. Technology had turned his life into something new and different.

The banks were loaning money out, 100% financing, interest only, 5 year loans that had to be refinanced at the end of the term. Also, you could borrow any amount you desired from your stock broker just pay the interest. Buying stocks on margin (10% down) was the name of the game.

Another thing to come of age, was installment buying. GMAC was created in 1919 to help sell more cars, and it did just that. There had been a stigma attached to not paying cash and through advertising, it became more acceptable. By the eve of the great depression, it had become a way to acquire the American Dream. You didn't have to wait and save up for what you wanted, you could have it now.

From 1915 to 1930 we had been transitioning from an agrarian economy to a more industrialized economy. Technology had changed our way of life without any perceived realization of it by the general population. A farmer was 10 times more productive with modern machinery. Agricultural prices were dropping because of this over supply. The speculation that had been going on in farm land was unsustainable. A bigger farm did not increase your return on investment, just the opposite.

Things started to go bad in 1926 with the Florida Hurricane, land speculation lost its appeal (severe understatement). Then in June of 1928 there was a mini stock market crash, a precursor to the big one. In October of 1929 the big crash came and "rearranged" the financial markets. In 1930 Congress passed The Smoot-Hawley Tariff Act, which some claim was responsible for the unemployment rate climbing to 25% (over the next two years). Bank failures started to be a problem in 1929 only to get worse in 1930, 1,352 banks failed. In 1931, 2,294 banks bit the dust.

So what happened to our gentleman? If he had a 5 year I/O loan that was due for renewal, it wasn't renewed; the bank wanted and needed the cash. Result, the bank got the house. He stood a 1 in 4 chance of being unemployed. If his bank had failed, he might have no savings left. Anything bought on installment might have to be returned or a payment made on it.

He probably survived with memories of the rough times he had. People from that generation were seasoned with these memories. They acted differently as so to avoid making the same mistakes over again.

Today, in the world of 2006, the "group memory" of these people is no longer with us. Are we destined to make the same mistakes as they did so long ago?

The evolution of the Internet is comparable to Radio of that time. And Google stock isn't quite as high as RCA's stock got to, before the crash. Then, there was the installment buying and interest only loans of the 1920's, verses the credit card of today and the same old loan formula (use their money not mine).

Almost sounds like an eerie episode of The Twilight Zone, doesn't it?

The banks were loaning money out, 100% financing, interest only, 5 year loans that had to be refinanced at the end of the term. Also, you could borrow any amount you desired from your stock broker just pay the interest. Buying stocks on margin (10% down) was the name of the game.

Another thing to come of age, was installment buying. GMAC was created in 1919 to help sell more cars, and it did just that. There had been a stigma attached to not paying cash and through advertising, it became more acceptable. By the eve of the great depression, it had become a way to acquire the American Dream. You didn't have to wait and save up for what you wanted, you could have it now.

From 1915 to 1930 we had been transitioning from an agrarian economy to a more industrialized economy. Technology had changed our way of life without any perceived realization of it by the general population. A farmer was 10 times more productive with modern machinery. Agricultural prices were dropping because of this over supply. The speculation that had been going on in farm land was unsustainable. A bigger farm did not increase your return on investment, just the opposite.

Things started to go bad in 1926 with the Florida Hurricane, land speculation lost its appeal (severe understatement). Then in June of 1928 there was a mini stock market crash, a precursor to the big one. In October of 1929 the big crash came and "rearranged" the financial markets. In 1930 Congress passed The Smoot-Hawley Tariff Act, which some claim was responsible for the unemployment rate climbing to 25% (over the next two years). Bank failures started to be a problem in 1929 only to get worse in 1930, 1,352 banks failed. In 1931, 2,294 banks bit the dust.

So what happened to our gentleman? If he had a 5 year I/O loan that was due for renewal, it wasn't renewed; the bank wanted and needed the cash. Result, the bank got the house. He stood a 1 in 4 chance of being unemployed. If his bank had failed, he might have no savings left. Anything bought on installment might have to be returned or a payment made on it.

He probably survived with memories of the rough times he had. People from that generation were seasoned with these memories. They acted differently as so to avoid making the same mistakes over again.

Today, in the world of 2006, the "group memory" of these people is no longer with us. Are we destined to make the same mistakes as they did so long ago?

The evolution of the Internet is comparable to Radio of that time. And Google stock isn't quite as high as RCA's stock got to, before the crash. Then, there was the installment buying and interest only loans of the 1920's, verses the credit card of today and the same old loan formula (use their money not mine).

Almost sounds like an eerie episode of The Twilight Zone, doesn't it?

Friday, August 18, 2006

What Happens Next?

Let’s say housing hits 50,000 units for sale in San Diego. What happens next?

At some point, we have second trust deed holders going ga ga. Then we have the trust deed market increasing in trustee sales. At that point, we will see REO's with 20% drops in purchase price offered for sale.

This is where things get dicey in stage two. You want to sell your house because you can't make the payment and there is an REO down the block $150,000 less that what you are selling for. Well it isn’t going to sell! So you go to the bank and get a "been there, done that, routine."

What happens next? The buyer walks or declares bankruptcy. If you walk, that means that other than the house, your financial state is not bad.

From here, its conjecture on my part. Bankruptcy should give you a few more months in the house, but from what I’ve read, that’s a false assumption. But either way, credit card consumption would continue, and lets face it, if you are going down, go down in style. Get the root canal done, the crown, dental bridge, tummy tuck and breast augmentation. Use your imagination; your card has instant pleasure at your beck and call.

Ask yourself one question, “Why would a lender loan money to just about anyone?” Could it be the easy monthly payment? It couldn’t be the FICO score under 400 could it? The answer to that question could be yes—hey we can charge 26% interest on this turkey, go for it.

So let’s see if we’ve got this right, the strapped homeowner needs something, he has to use his credit card at 26% interest because of a missed house payment. The question arises, at what point is the individuals credit card balance so far out of whack that the lending institution has to throw in the towel. I personally think that they keep raising the bar. Otherwise, as a lender you would have to confront the issue

Credit Bubble? Not on your life (if you issue credit cards).

“Hold on tight, it’s only a bump,” said a crew member of the Titanic.

I personally think that its the retirement assets of a nation that will go down the drain. I sincerely hope that I am wrong.

At some point, we have second trust deed holders going ga ga. Then we have the trust deed market increasing in trustee sales. At that point, we will see REO's with 20% drops in purchase price offered for sale.

This is where things get dicey in stage two. You want to sell your house because you can't make the payment and there is an REO down the block $150,000 less that what you are selling for. Well it isn’t going to sell! So you go to the bank and get a "been there, done that, routine."

What happens next? The buyer walks or declares bankruptcy. If you walk, that means that other than the house, your financial state is not bad.

From here, its conjecture on my part. Bankruptcy should give you a few more months in the house, but from what I’ve read, that’s a false assumption. But either way, credit card consumption would continue, and lets face it, if you are going down, go down in style. Get the root canal done, the crown, dental bridge, tummy tuck and breast augmentation. Use your imagination; your card has instant pleasure at your beck and call.

Ask yourself one question, “Why would a lender loan money to just about anyone?” Could it be the easy monthly payment? It couldn’t be the FICO score under 400 could it? The answer to that question could be yes—hey we can charge 26% interest on this turkey, go for it.

So let’s see if we’ve got this right, the strapped homeowner needs something, he has to use his credit card at 26% interest because of a missed house payment. The question arises, at what point is the individuals credit card balance so far out of whack that the lending institution has to throw in the towel. I personally think that they keep raising the bar. Otherwise, as a lender you would have to confront the issue

Credit Bubble? Not on your life (if you issue credit cards).

“Hold on tight, it’s only a bump,” said a crew member of the Titanic.

I personally think that its the retirement assets of a nation that will go down the drain. I sincerely hope that I am wrong.

The Unseen Bubble

All the media is now talking about the housing bubble. They've got it wrong, it's really not the big issue. But if you want to miss the forest because of the trees, you're about to become a victim.

I was listening to a radio ad yesterday, "Have bad credit, a bankruptcy coming up or a FICO score under 500 and need to refinance, call 1-800-***-loan." They were offering up to 1/2 million at 7.4 APR, with a real nice intro rate for 2 years.

Let's combine the two ideas and elaborate a little. Housing bubble, the homeowners ATM machine has bit the dust, no more free money from equity. So you have bad credit, no problem here's a 1/2 million dollar loan, sign on the bottom line. What we have is a Credit Bubble of monster proportions.

The bubble is starting to unwind. Ford is cutting back production 25%. Boeing is going to lay off 6,000 workers. GM did it all already. Housing bubble you say, it doesn't really matter if you have lost your job. It makes the Realtors statement ring so hollow, "The house interest is deductible from your taxable income." Subtract it from what, when you're unemployed.

See the post from last week Life is Becoming more Difficult

It seems as if credit consumption has kept the economy moving with the appearance of growth. It is this credit consumption that has to be paid for in the future.

The credit bubble is still growing, just go to your mail box and count the credit card applications. The housing bubble points directly at the Credit Bubble. If you can fog a mirror and can sign your name, you can have it NOW!

If people start tightening their belts, consumption will fall faster than it normally would. Unemployment will make it worse. The major gripe of people about to be laid off at Boeing, was, "I'm too old to find another job that pays this good." I didn't even touch on the loss of health insurance.

It's all downhill from heeeeeeeeeeeeeeerrrrrrreeeee. Set back and enjoy the ride, your neighbor's credit fling paid for it (using your retirement savings).

I was listening to a radio ad yesterday, "Have bad credit, a bankruptcy coming up or a FICO score under 500 and need to refinance, call 1-800-***-loan." They were offering up to 1/2 million at 7.4 APR, with a real nice intro rate for 2 years.

Let's combine the two ideas and elaborate a little. Housing bubble, the homeowners ATM machine has bit the dust, no more free money from equity. So you have bad credit, no problem here's a 1/2 million dollar loan, sign on the bottom line. What we have is a Credit Bubble of monster proportions.

The bubble is starting to unwind. Ford is cutting back production 25%. Boeing is going to lay off 6,000 workers. GM did it all already. Housing bubble you say, it doesn't really matter if you have lost your job. It makes the Realtors statement ring so hollow, "The house interest is deductible from your taxable income." Subtract it from what, when you're unemployed.

See the post from last week Life is Becoming more Difficult

It seems as if credit consumption has kept the economy moving with the appearance of growth. It is this credit consumption that has to be paid for in the future.

The credit bubble is still growing, just go to your mail box and count the credit card applications. The housing bubble points directly at the Credit Bubble. If you can fog a mirror and can sign your name, you can have it NOW!

If people start tightening their belts, consumption will fall faster than it normally would. Unemployment will make it worse. The major gripe of people about to be laid off at Boeing, was, "I'm too old to find another job that pays this good." I didn't even touch on the loss of health insurance.

It's all downhill from heeeeeeeeeeeeeeerrrrrrreeeee. Set back and enjoy the ride, your neighbor's credit fling paid for it (using your retirement savings).

Saturday, August 12, 2006

Credit Card Debt

Let's go back to 1971 when I was young. Just out of college and I did not have a credit card. I also had no credit experience as far a Master Card and Visa was concerned so they wouldn't issue me a card. I had always paid cash. The only way to build your credit was to go out and buy something on the installment plan at some local store charging 18-36% interest. So I financed a microwave oven for $400--easy monthly payments of $60 per month. After 8 months of paying, I qualified for a Master Card. The card arrived two weeks after I was laid off from my job. Admittedly I used it as a tool and it got me through some rough times where I need 30 or 60 days until my unemployment check came. At that point in my life I took a risk and purchased a lawn mower with the card and started a successful lawn care business.

Fast forward to today, I still use a credit card. Its an easy way to purchase on line. Its also very nice if your doubtful of the stores return policy. If I Visa and item and they won't refund my money, it costs them $40 to dispute my claim. Notice one thing, its used as a tool not as an extension of my future earning power. I pay it off every month.

From here, it is only a short step to start using it as a creature comfort I-need-it-now card. There are many things at work here with this mind set. First the person has been trained to look at the paycheck and how much they can afford in monthly payments. If the house payment is $1500 and they have $600 left over, then the $300 dollar car payment fits in, $200 insurance and $75 utilities. No sweat on the $2,000 Visa card payment--send them $25. Second, they are living from month to month. Anybody doing that needs to sit down and figure a way out of that, you are at a dead end. Third if you are married, its a very uncomfortable life to live, arguing over what to purchase with what little money you have left, with your spouse.

I get very irritated by a TV ad on the radio every day about some worker meant to sound uneducated, telling how this company was able to sell him a $2000 flat screen and not charge him the $500 to mount it to his wall. This is a well rehearsed ad not something spontaneous--its two people reading a script--great acting. Its meant to get you down there and sign on the bottom line. If you are breathing, they want to sell you a flat screen TV. They don't give a damn about what it will do to your family and finances.

Of course it can be played the other way, my stepmother who is about 75 has about 6 credit cards that she got while my dad was still alive. I imagine that she is into the banks for over $100,000. She use to do a phone cash advance transfer from one account to another to make a minimum payment without having to pay a late penalty (its an extra $27 to do a phone transfer). I wish her well.

So where are we? We are between Visa and Master card, at the corner of Walk and Don't Walk. I don't see either credit card company surviving this mess. Chase Manhattan Bank is the bank that my step mother loves so we know who's first in line.

Go ahead buy the flat panel wide screen, YOU DESERVE IT!--miss one payment and PAY FOR THE REST OF YOUR LIFE. Sign on the dotted line. Its painless (I'm lying).

Fast forward to today, I still use a credit card. Its an easy way to purchase on line. Its also very nice if your doubtful of the stores return policy. If I Visa and item and they won't refund my money, it costs them $40 to dispute my claim. Notice one thing, its used as a tool not as an extension of my future earning power. I pay it off every month.

From here, it is only a short step to start using it as a creature comfort I-need-it-now card. There are many things at work here with this mind set. First the person has been trained to look at the paycheck and how much they can afford in monthly payments. If the house payment is $1500 and they have $600 left over, then the $300 dollar car payment fits in, $200 insurance and $75 utilities. No sweat on the $2,000 Visa card payment--send them $25. Second, they are living from month to month. Anybody doing that needs to sit down and figure a way out of that, you are at a dead end. Third if you are married, its a very uncomfortable life to live, arguing over what to purchase with what little money you have left, with your spouse.

I get very irritated by a TV ad on the radio every day about some worker meant to sound uneducated, telling how this company was able to sell him a $2000 flat screen and not charge him the $500 to mount it to his wall. This is a well rehearsed ad not something spontaneous--its two people reading a script--great acting. Its meant to get you down there and sign on the bottom line. If you are breathing, they want to sell you a flat screen TV. They don't give a damn about what it will do to your family and finances.

Of course it can be played the other way, my stepmother who is about 75 has about 6 credit cards that she got while my dad was still alive. I imagine that she is into the banks for over $100,000. She use to do a phone cash advance transfer from one account to another to make a minimum payment without having to pay a late penalty (its an extra $27 to do a phone transfer). I wish her well.

So where are we? We are between Visa and Master card, at the corner of Walk and Don't Walk. I don't see either credit card company surviving this mess. Chase Manhattan Bank is the bank that my step mother loves so we know who's first in line.

Go ahead buy the flat panel wide screen, YOU DESERVE IT!--miss one payment and PAY FOR THE REST OF YOUR LIFE. Sign on the dotted line. Its painless (I'm lying).

Taxation and Our Government

Every day you hear some Congressman talking about taxing the rich, and more welfare reform for the poor. If we go back in history to the times of Rome and Greece, every male owed one month of labor to the state. The state did not classify people as poor. You either came up with someone to work for you or you did the month of labor.

Now lets advance several thousand years. Today in the US, we have the rich, the middle class, and the poor. We know the poor don't pay much in taxes. The middle class is the real bread winner for the government. Then we have the rich. They don't really have to pay taxes either. Once you make the money, you can't be taxed on it a second time. We do have people that make over $100,000 a year working two and three jobs with the wife's wages added in, and these people are considered the rich that need to be taxed, neat huh?

Now here is where we get into the tax structure with an item called real estate taxes. Real Estate is visible wealth and is taxed as such. So if your house value triples in price, your house taxes also jump--California is an exception. Prop 13 limited the increase to a small yearly amount based on purchase price.Thats little consolation if you bought in the last two years. Notice that it is the Want-To-Be-Rich group of home owners that pay a disproportional part of their income in real estate taxes. And hey its all tax deductible. But loose your job and have no income, deduct it from what?

Now let the economic slowdown begin. Back in the 1920's local governments had been spending their new found wealth. Then in the 30's with the collapse of housing, the tax base for local communities collapsed. Schools closed because they couldn't meet the payroll. Here is a quote from The Great Depression pg. 93 by David Shannon

So we have the rich, the middle class, and the poor. The only ones that have lost their way, are the middle class. These are the people about to enter a new world, called bankruptcy.

Another compounding factor back in the 1930's was the legislative stupidity that figured "If you raise taxes and fees, it will bring in more income." Well, to their surprise it brought in less. I see examples of this same mentality in California today all around. Can you imagine a young driver running a photo street light having to pay $380 fine--Why not skip town and leave the State? My wife got caught, and she paid the fine, but there are a lot of people out there that this could result in a major change in their way of life.

Remember Economics 101. If you double the tax rate, you don't double the amount of taxes collected. The amount collected will be considerably less than what you previously collected before you doubled them. Unfortunately, intelligence is not a prerequisite when running for public office.

Now lets advance several thousand years. Today in the US, we have the rich, the middle class, and the poor. We know the poor don't pay much in taxes. The middle class is the real bread winner for the government. Then we have the rich. They don't really have to pay taxes either. Once you make the money, you can't be taxed on it a second time. We do have people that make over $100,000 a year working two and three jobs with the wife's wages added in, and these people are considered the rich that need to be taxed, neat huh?

Now here is where we get into the tax structure with an item called real estate taxes. Real Estate is visible wealth and is taxed as such. So if your house value triples in price, your house taxes also jump--California is an exception. Prop 13 limited the increase to a small yearly amount based on purchase price.Thats little consolation if you bought in the last two years. Notice that it is the Want-To-Be-Rich group of home owners that pay a disproportional part of their income in real estate taxes. And hey its all tax deductible. But loose your job and have no income, deduct it from what?

Now let the economic slowdown begin. Back in the 1920's local governments had been spending their new found wealth. Then in the 30's with the collapse of housing, the tax base for local communities collapsed. Schools closed because they couldn't meet the payroll. Here is a quote from The Great Depression pg. 93 by David Shannon

People never enjoy paying taxes. With the lower incomes of the depression came widespread demand for retrenchment and lower local taxes. Indeed, many citizens and property owners were quite unable to pay their taxes at all.

Since a large part of the revenues of local government is spent for public education, it was perhaps inevitable that the tax crisis should produce cutbacks in the schools. Many communities decreased their school spending severely. In effect, they passed the burden on to the teachers, the students, or both.

So we have the rich, the middle class, and the poor. The only ones that have lost their way, are the middle class. These are the people about to enter a new world, called bankruptcy.

Another compounding factor back in the 1930's was the legislative stupidity that figured "If you raise taxes and fees, it will bring in more income." Well, to their surprise it brought in less. I see examples of this same mentality in California today all around. Can you imagine a young driver running a photo street light having to pay $380 fine--Why not skip town and leave the State? My wife got caught, and she paid the fine, but there are a lot of people out there that this could result in a major change in their way of life.

Remember Economics 101. If you double the tax rate, you don't double the amount of taxes collected. The amount collected will be considerably less than what you previously collected before you doubled them. Unfortunately, intelligence is not a prerequisite when running for public office.

Sunday, August 06, 2006

Life is becoming more Difficult.

Its not hard to realize that the economy is starting to deteriorate at a more pronounced level. People are being laid off around the country, companies are downsizing, and the cost of energy is rising to stressful levels.

Right now we have hundreds of analogies about the state of the economy that relate to canaries in coal mines. All I can surmise is that they are selling a lot of imaginary canary gas masks.

What we have to look at here, is the "credit card looting" going on. If you know that you are about to loose your house to the bank, it makes sense to run up the credit cards--bankruptcy then foreclosure and you start over.

What is really laughable, is the credit card CEO's thinking that this is just an anomaly. Lets look back at 1930's

I shredded two more credit card applications that I received in the mail this week, so I guess that the party isn't over yet. Let the good times roll.

Right now we have hundreds of analogies about the state of the economy that relate to canaries in coal mines. All I can surmise is that they are selling a lot of imaginary canary gas masks.

What we have to look at here, is the "credit card looting" going on. If you know that you are about to loose your house to the bank, it makes sense to run up the credit cards--bankruptcy then foreclosure and you start over.

What is really laughable, is the credit card CEO's thinking that this is just an anomaly. Lets look back at 1930's

"The average person began to spend less for consumer goods, although for a while this fact was hidden by an increase in buying on the installment plan. When hard times came, this merely aggravated the situation since families could not find the money to pay the installment collector.Quoted from "The Thirties" by Fon W. Boardman Jr 1967

I shredded two more credit card applications that I received in the mail this week, so I guess that the party isn't over yet. Let the good times roll.

Saturday, August 05, 2006

Bernanke, The Mouse that Couldn't Roar

There is another interesting interest rate hike coming up this week and all of the pundit's are discussing its ramifications. The argument revolves around whether it will be bad or good for the economy.

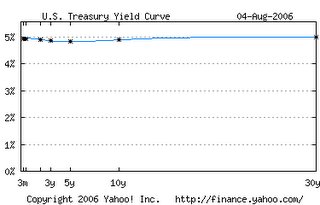

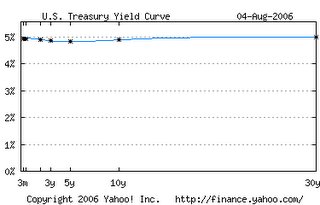

What we are talking about is the Federal funds rate on overnight loans to banks. When the Fed funds rate was 1%, banks lined up at the window for almost free money loans. Now with the rate at 5.25 there are no lines at that window.

They have raised this rate 17 times and the 30 year bond has yet to jump a full point. In fact the 3 year bond dropped to a 4.85% interest rate. The three month treasury is at 5.13% interest and the 30 year is at 5%.

Every financial want-to-be or is-a-be floats around waiting for what Bernanke is about to do or say. The fact is, that when the Fed rate exceeded the bond rate, it no longer mattered how high they raise the rates. If the cheapest price is at Walmart, you buy at Walmart and the Fed right now is no Walmart.

The Fed figures that they have some sort of John Wayne swagger effect. Its just not there. If Bernanke walks into the bar, China is going to tell him to raise his hand for permission if he wants to use the bathroom.

What we are looking at here is an entity that at one time was very powerful. But in the computer age, a mouse click can circumvent anything that Berneke can attempt to control. With everything computerized, the overnight Fed funds rate doesn't really come in to play much. The banks have it pretty well sorted out.

What we are really looking at is a man going through the motions of, "I am in control, have faith and I will get you through this mess." No one out there will challenge his ability to push on a string. With that said, I believe that everyone in Wall Street will ride the ride, on his say so.

So what happens from here? Bernanke either raises the rates or he doesn't and the people on Wall Street will salute this guy as the new god of finance.

Doesn't really make much cents does it? If Bernanke raised rates to an absurd level of say 20% it wouldn't change the 30 year bond rate, but at that point, it would be very obvious that the Fed was no longer in the loop. The reason that they are no longer as effective, is because they are just a small part the very large global market.

Where does Bernenke fit in? He is being groomed to be the scape goat for the coming mess. Its pretty obvious that one is going to be needed soon.

What we are talking about is the Federal funds rate on overnight loans to banks. When the Fed funds rate was 1%, banks lined up at the window for almost free money loans. Now with the rate at 5.25 there are no lines at that window.

They have raised this rate 17 times and the 30 year bond has yet to jump a full point. In fact the 3 year bond dropped to a 4.85% interest rate. The three month treasury is at 5.13% interest and the 30 year is at 5%.

Every financial want-to-be or is-a-be floats around waiting for what Bernanke is about to do or say. The fact is, that when the Fed rate exceeded the bond rate, it no longer mattered how high they raise the rates. If the cheapest price is at Walmart, you buy at Walmart and the Fed right now is no Walmart.

The Fed figures that they have some sort of John Wayne swagger effect. Its just not there. If Bernanke walks into the bar, China is going to tell him to raise his hand for permission if he wants to use the bathroom.

What we are looking at here is an entity that at one time was very powerful. But in the computer age, a mouse click can circumvent anything that Berneke can attempt to control. With everything computerized, the overnight Fed funds rate doesn't really come in to play much. The banks have it pretty well sorted out.

What we are really looking at is a man going through the motions of, "I am in control, have faith and I will get you through this mess." No one out there will challenge his ability to push on a string. With that said, I believe that everyone in Wall Street will ride the ride, on his say so.

So what happens from here? Bernanke either raises the rates or he doesn't and the people on Wall Street will salute this guy as the new god of finance.

Doesn't really make much cents does it? If Bernanke raised rates to an absurd level of say 20% it wouldn't change the 30 year bond rate, but at that point, it would be very obvious that the Fed was no longer in the loop. The reason that they are no longer as effective, is because they are just a small part the very large global market.

Where does Bernenke fit in? He is being groomed to be the scape goat for the coming mess. Its pretty obvious that one is going to be needed soon.

Friday, August 04, 2006

Mortgage Market Meltdown

Lets look at an organization named Fannie Mae. Picture it as a 4 x 4 x 4 foot black box with the words Fanny Mae printed in white on it. Envision Mr. or Ms. "Mortgage Market" dropping into the box all of their 80% finance loans and when the box gets to $1 million it spits out an investment certificate for 1 million paying 5%, face amount guaranteed, which is purchased by Mr. or Ms. "Unknown Entity," AKA "mark" or "sucker."

The little black box is a great transformer and redistributer of debt. Nobody wanted to touch that crap until they built the little black box. By God everyone is entitled to the American dream of home ownership rah! rah! rah!

So we have this box and the question arises, "What the hell do they do inside that box?" My guess--absolutely nothing.

There is really no problem with the design model aspect of the black box. It will perform within its parameters. After all its rather absurd to have a market drop 20% isn't it? (Believe that, and I have a bridge to sell you). What is not realized is that the market can drop 50 to 70 percent. In this scenario, the little black box fails to function as expected. It doesn't have the funds necessary to back the claims it made in the past. What funds does it have for back up of bad loans? My guess, is none. Say you need one or two trillion dollars to back up the investors who bought these certificates---total tax collections for the US of A is about 1 trillion a year. Sounds like someone is going to get short sheeted!

The question arises who's holding all of the crap and who is going to get burned?

My guess is mutual funds and IRA's and I could be wrong.

The little black box is a great transformer and redistributer of debt. Nobody wanted to touch that crap until they built the little black box. By God everyone is entitled to the American dream of home ownership rah! rah! rah!

So we have this box and the question arises, "What the hell do they do inside that box?" My guess--absolutely nothing.

There is really no problem with the design model aspect of the black box. It will perform within its parameters. After all its rather absurd to have a market drop 20% isn't it? (Believe that, and I have a bridge to sell you). What is not realized is that the market can drop 50 to 70 percent. In this scenario, the little black box fails to function as expected. It doesn't have the funds necessary to back the claims it made in the past. What funds does it have for back up of bad loans? My guess, is none. Say you need one or two trillion dollars to back up the investors who bought these certificates---total tax collections for the US of A is about 1 trillion a year. Sounds like someone is going to get short sheeted!

The question arises who's holding all of the crap and who is going to get burned?

My guess is mutual funds and IRA's and I could be wrong.

Thursday, August 03, 2006

Investing for Success

The word "Investing," is thrown around by everyone and more or less implies some form of sophistication on the part of the user. Invest in gold, invest in real estate, invest in the stock market, you hear these phrases every day.

Now lets examine another word; "speculation." Speculation is like betting on the horse races, and pays well if you are right. You stand to loose it all if you're wrong.

Now when you invest, you get "a" return on your money and "the" return of your money over a certain time span.

The thing you need to consider about an investment is the rule of 72. Divide the interest rate into 72. A bank paying 5% interest would result in your money doubling every 14.4 years. Not a very good return, but you have fast access to your funds.

Investment real estate is and even better one if you can purchase the rental for 100 times the monthly rent payment (very unlikely here in San Marcos). So if the rent is $800 per month, a purchase price of $80,000 would be a moneymaker. In this example the bank would give you a loan if you put down 20%. Your original investment of $20,000 after you pay off the mortgage would give you $10,000 a year in retirement income. Not to mention a hedge on inflation a tax deduction, and 5 to 1 leverage with bank money.

Stocks used to be a good investment; they paid a 3% to 6% dividend. Its hard to find one that even pays a dividend today. Which brings up a pivotal point an asset can change from an investment to a form of speculation. Housing in our area is purely speculation, nobody is buying rental real estate.

You could start a business or whatever, "Invest in yourself," is a great credo.

The true test of your investment is that it provides a consistent yearly return. So if someone comes up to me and says they are investing in the stock market or real estate, I know what they expect to accomplish but in reality, they are at the two dollar window betting on the daily double.

My portfolio has 10% in pure speculation. I buy what everyone else is selling. Also at the other end of being conservative, I have 10% in gold and silver and I don't even consider it an investment. It is an emergency form of cash. I bought $1,000 worth of 50 cent pieces back in 1985 for $3,500--it probably worth $12,000 today. Trying to store 63 pounds of silver in a safety deposit box is a real joke and a certified pain in the butt especially if you change banks. Gold is a little easier to store. Neither one of them returns any interest, so all you get in return, is true purchasing value in the future. That leaves 80% of your assets to be invested.

And at this point you need to stop and ask yourself one question, do I have the time to research and invest for my future? If you answer "no" you don't have the time, you are in a world of hurt. Your last few years in a rest home with the words running through your mind, "if I had only spent more time managing my money," is a hell of a way to review your life.

Right now real estate is a very poor investment. Stocks don't pay any dividend, it like giving an interest free loan to the kids--you might get it back. The banks are paying 5% which is not something to really get excited about. So where to we go from here?

As a 10% value of your portfolio investment, I suggest gold and silver. Gold could be fairly valued at $13,000 an ounce if valued at 1932 prices and as backing of the US dollar (we know that is not going to happen). Silver, the 100 oz Englehart bars make very decorative door stops. Just don't go whacko--10% and stop there.

From here, you ask the question what's a good investment at this time? The answer is, there aren't any. It sounds strange, but with real estate collapsing, the stock market paying no dividends and the interest rate so low, we have to wait. Something is about to happen, what it will be is anybody's guess. A little patience, say a year wait, should see opportunity knocking. Patience is a virtue

Now lets examine another word; "speculation." Speculation is like betting on the horse races, and pays well if you are right. You stand to loose it all if you're wrong.

Now when you invest, you get "a" return on your money and "the" return of your money over a certain time span.

The thing you need to consider about an investment is the rule of 72. Divide the interest rate into 72. A bank paying 5% interest would result in your money doubling every 14.4 years. Not a very good return, but you have fast access to your funds.

Investment real estate is and even better one if you can purchase the rental for 100 times the monthly rent payment (very unlikely here in San Marcos). So if the rent is $800 per month, a purchase price of $80,000 would be a moneymaker. In this example the bank would give you a loan if you put down 20%. Your original investment of $20,000 after you pay off the mortgage would give you $10,000 a year in retirement income. Not to mention a hedge on inflation a tax deduction, and 5 to 1 leverage with bank money.

Stocks used to be a good investment; they paid a 3% to 6% dividend. Its hard to find one that even pays a dividend today. Which brings up a pivotal point an asset can change from an investment to a form of speculation. Housing in our area is purely speculation, nobody is buying rental real estate.

You could start a business or whatever, "Invest in yourself," is a great credo.

The true test of your investment is that it provides a consistent yearly return. So if someone comes up to me and says they are investing in the stock market or real estate, I know what they expect to accomplish but in reality, they are at the two dollar window betting on the daily double.

My portfolio has 10% in pure speculation. I buy what everyone else is selling. Also at the other end of being conservative, I have 10% in gold and silver and I don't even consider it an investment. It is an emergency form of cash. I bought $1,000 worth of 50 cent pieces back in 1985 for $3,500--it probably worth $12,000 today. Trying to store 63 pounds of silver in a safety deposit box is a real joke and a certified pain in the butt especially if you change banks. Gold is a little easier to store. Neither one of them returns any interest, so all you get in return, is true purchasing value in the future. That leaves 80% of your assets to be invested.

And at this point you need to stop and ask yourself one question, do I have the time to research and invest for my future? If you answer "no" you don't have the time, you are in a world of hurt. Your last few years in a rest home with the words running through your mind, "if I had only spent more time managing my money," is a hell of a way to review your life.

Right now real estate is a very poor investment. Stocks don't pay any dividend, it like giving an interest free loan to the kids--you might get it back. The banks are paying 5% which is not something to really get excited about. So where to we go from here?

As a 10% value of your portfolio investment, I suggest gold and silver. Gold could be fairly valued at $13,000 an ounce if valued at 1932 prices and as backing of the US dollar (we know that is not going to happen). Silver, the 100 oz Englehart bars make very decorative door stops. Just don't go whacko--10% and stop there.

From here, you ask the question what's a good investment at this time? The answer is, there aren't any. It sounds strange, but with real estate collapsing, the stock market paying no dividends and the interest rate so low, we have to wait. Something is about to happen, what it will be is anybody's guess. A little patience, say a year wait, should see opportunity knocking. Patience is a virtue

Subscribe to:

Posts (Atom)