How do you tell a good asset from a bad one? Over your lifetime, it will change in perspective.

Gold is OK. Its not productive, it just preserves buying power no more. Keeping 10% in your portfolio shouldn't hurt you, its NOT an investment, it is a form of insurance.

Treasury Bills are excellent as a short term investment, but a rather poor long term investment. Backed by the US government. The three month, six month and one year bills are the easiest to manage. This is their web page

T-Bills

So, if you had $100,000 to invest in T-Bills you could basically invest $33,000 each month in 90 day t-bills over the course of three months and then when each individual issue came due, you would renew the T-Bill, otherwise it would dump into your checking account. That way you would have access to one third of your account in any 30 day period if you needed it.

Rental property is an excellent investment if you can buy it for 100 times the monthly rental. If it rents for $1,000 per month, and you have 20% down invested. After 20 years, you'll have it paid off, and the rental income is inflation biased. Two Units and your retirement will be comfy. If you can buy at this price ratio, you can afford to have it managed, which will help you with your blood pressure, its defiantly not for everyone.

A home can be a store of value, if you bought it before the price surge and its about paid off. With this this asset, you really don't need gold, your home has the same hedge against inflation as gold.

Stocks that pay dividends and have a good 20 year track record are another good investment strategy. Take delivery of the certificates. Do not leave them in "The Street Name." It was so nice during the crash of 1987 to walk into a full service brokerage house and sell a stock in 2 minutes, while you couldn't even get a discount broker on the phone, the lines were busy.

New Item I saw the other day, Union Bank is offering FDIC IRA accounts. It seems you can spring board from there into Mutual funds Stocks etc that are privately insured.

If your about ready to retire, looks like a safe way to protect your account, the total FDIC insurance limit is $250,000.

Things that I would avoid;

Any government sponsored program that give you a tax break or changes the way you do business. The main reason for this, is that the government is always changing the rules. Plus most of the money in these Ira's etc are not FDIC insured. They are privately insured by the SPIC. Here is a quote from my brokerage account,

"SPIC insurance is for funds held at brokerages. It insures your

funds against the brokerage going bankrupt, but does not insure

the value of your investments."

Mutual funds, the biggest game in the world -- have never seen a REAL bear market. Say you have $100,000 in one and the stock market takes a dive. They mark it to market and post the results to your account, now you have $20,000. Closed End funds have another peculiarity, they can trade below the price of the items held in the fund. Two of my friends lost over $100,000 each with their mutual funds in 2001. One even postponed his retirement because of it.

Avoid gold and silver storage institutions and or gold and silver certificates of ownership. I have no real issues with this group, but I emphasize the words "due vigilance." There is nothing worse than being too trusting.

Avoid second trust deeds, the economy is going the wrong way, and the spread between risky junk and t-bill's is so small, you're not getting much risk premium.

Things to consider, if your bank was to go belly up, your saving and checking accounts might not be accessible for a month or two. There might be a limit on withdrawal amounts like what FDR did in the '30's. You will have access to your safety deposit box, put some money away there.

I'm just touching on a few things, nothing written in stone, just experience mixed with common sense.

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Monday, May 29, 2006

The Pop and Drop Monetary Implosion

You are beginning to read about the coming bubble collapse, and the people forming corporations to buy distressed property that will come on the market, in the coming months. "We're going to get rich."

There is this concept that no one wants to accept; the collapse will not be a one-item event. It is all intertwined with the financial markets. This house of cards will fall. What will trigger it, is anybody's guess.

We can pretty well surmise that about 6 trillion dollars worth of house equity will evaporate. Credit card companies are going to be severely stressed. Bankruptcies could turn what could be a rather fast pop and drop into a slow pop and flop (in court).

All of the second trust deed holders aren't going to sit in a barrel waiting to be shot. They are going to discount their paper until there are no more buyers. At 20 cents on the dollar, it might be worth the risk of purchasing one or two.

At this point, when average homeowners need to raise cash, they are going to want to sell cars, plasma TV's, you name it. Now, Wal-Mart has a competitor that can undercut them. This is where the recession starts.

All of the Starbucks Coffee, fast food, high speed internet, cable TV will be paired down by families trying to save money. These items will slowly become less and less of an item of consumption.

Most economists see a rather dull forward projection of the economy; “Everything is great and gee there sure are a lot of houses for sale.” Its kind of like the two star crossed lovers in India on a ferry boat 10 years back, that decided to commit suicide. Everyone on board rushed to one side to witness the event, and the boat rolled over--a couple hundred people inadvertently joined the couple and drowned with them.

I think what can be agreed upon at the present time, is, there is no fear of what is about to happen. There is no perceived crisis. It's probably a good time to be looking for a life vest.

There is this concept that no one wants to accept; the collapse will not be a one-item event. It is all intertwined with the financial markets. This house of cards will fall. What will trigger it, is anybody's guess.

We can pretty well surmise that about 6 trillion dollars worth of house equity will evaporate. Credit card companies are going to be severely stressed. Bankruptcies could turn what could be a rather fast pop and drop into a slow pop and flop (in court).

All of the second trust deed holders aren't going to sit in a barrel waiting to be shot. They are going to discount their paper until there are no more buyers. At 20 cents on the dollar, it might be worth the risk of purchasing one or two.

At this point, when average homeowners need to raise cash, they are going to want to sell cars, plasma TV's, you name it. Now, Wal-Mart has a competitor that can undercut them. This is where the recession starts.

All of the Starbucks Coffee, fast food, high speed internet, cable TV will be paired down by families trying to save money. These items will slowly become less and less of an item of consumption.

Most economists see a rather dull forward projection of the economy; “Everything is great and gee there sure are a lot of houses for sale.” Its kind of like the two star crossed lovers in India on a ferry boat 10 years back, that decided to commit suicide. Everyone on board rushed to one side to witness the event, and the boat rolled over--a couple hundred people inadvertently joined the couple and drowned with them.

I think what can be agreed upon at the present time, is, there is no fear of what is about to happen. There is no perceived crisis. It's probably a good time to be looking for a life vest.

Saturday, May 27, 2006

Soft or Hard Landing

There is a lot of discussion about whether the housing bubble will or has popped, and also whether or not the housing market will have a soft landing. The common perception, is that this is a one item event. This is probably a too simplistic approach.

Take any house approaching foreclosure or a motivated seller putting his house on the market. There is a good chance of a divorce, and also a bankruptcy. The house payment is not going to be the only bill not payed.

The rate at which the real estate housing supply is increasing, should indicate that there are people already heading for the exits.

The idea that the housing market can fall flat and nothing will happen to the rest of the economy seems too much like wishful thinking.

Somebody loaned us all of this money.

Just as a lark, lets say its 100% foreign banks. American banks wouldn't be that stupid (believe that and I'd like to be the first to sell you a bridge in NYC). If a foreigner, holding a $1,000,000 bond paying 6% wanted to sell fast, they could discount it say 50%, in order to sell it. So the seller gets the million dollar bond for$500,000. The discounted note is now paying 12% interest. Now in the United States, which bond would you buy, one from Fannie Mae paying 6% or one held by a foreign banker paying 12%? The bridge is still for sale if your still interested.

At this point, interest rates will be determined by the panic of foreigners trying to get their money out of US financial instruments. It won't take much to realize that Bernanke and the Federal Reserve are out of the loop.

Here is where 1929 and 2006 are different. The speed of the collapse will be faster. And all of those investment trusts in 1929 that dropped dead???--Hold On! The ride is about to begin!

Take any house approaching foreclosure or a motivated seller putting his house on the market. There is a good chance of a divorce, and also a bankruptcy. The house payment is not going to be the only bill not payed.

The rate at which the real estate housing supply is increasing, should indicate that there are people already heading for the exits.

The idea that the housing market can fall flat and nothing will happen to the rest of the economy seems too much like wishful thinking.

Somebody loaned us all of this money.

Just as a lark, lets say its 100% foreign banks. American banks wouldn't be that stupid (believe that and I'd like to be the first to sell you a bridge in NYC). If a foreigner, holding a $1,000,000 bond paying 6% wanted to sell fast, they could discount it say 50%, in order to sell it. So the seller gets the million dollar bond for$500,000. The discounted note is now paying 12% interest. Now in the United States, which bond would you buy, one from Fannie Mae paying 6% or one held by a foreign banker paying 12%? The bridge is still for sale if your still interested.

At this point, interest rates will be determined by the panic of foreigners trying to get their money out of US financial instruments. It won't take much to realize that Bernanke and the Federal Reserve are out of the loop.

Here is where 1929 and 2006 are different. The speed of the collapse will be faster. And all of those investment trusts in 1929 that dropped dead???--Hold On! The ride is about to begin!

Monday, May 22, 2006

A Play on Words

Lately, many blogger's posting are referring to gold and housing as "investments." There is a point being missed here. If you consider either of those items as an investment, you are speculating.

It probably didn't start out that way, you bought the house because you needed it and you bought the gold to diversify. Both were considered a store of value. The problem arises after the asset has doubled or tripled in value.

Lets examine these two assets over the last 40 years.

In the 60's, buying a house was cheaper than renting. The saying "Buying a house is the worse investment you'll ever make, but a necessary one" made sense back then. That whole concept has been turned upside down.

Gold backed the dollar in the 60's, and it jumped from 32 dollars per troy ounce to 320 dollars, and Nixon withdrew gold from backing the dollar(Foreigners were dumping dollars for gold. If he hadn't done that, we would have lost all of our gold reserves). Without gold backing our currency, the government could turn on the presses. Gold has been dead as an investment, but its perceived image, has changed to that of a commodity. It is not viewed as a "store of value." If you examine most commodities, they get used up, and when supplies are short prices rise. Well, there is just as much gold in the world today as there was yesterday, and contrary to "implyed thinking,"it isn't being used up.

Examine the mindset of todays house buyer. The increase in home values, a 1940 1400 sq ft in Los Angles going for 1 million is getting a bit wild to say the least.

Take gold, in 1964 a pack of smokes was 24 cents, a gallon of gas was 21 cents and gold was 32 dollars an ounce. Today a pack of cigarettes is $3.50 and a gallon of gas is $3.35. An ounce of gold will still buy you just as many cigarettes and gas as it did in 1964. Ever wonder why? You can't print gold.

Notice, your perspective changes over time. It went from asset to investment. A large change in value, changed the way you perceived the item.

Whether it is a house, or an ounce of gold, it was purchased with a thought of what it was to represent, an asset or the preservation of assets. It was time that changed your perception of the asset, and if you loose track of the original concept of purchase, your well thought out plans formulated in the past can fall apart in the future. The reason, the model changed drastically, but so slowly that it was not noticed.

It probably didn't start out that way, you bought the house because you needed it and you bought the gold to diversify. Both were considered a store of value. The problem arises after the asset has doubled or tripled in value.

Lets examine these two assets over the last 40 years.

In the 60's, buying a house was cheaper than renting. The saying "Buying a house is the worse investment you'll ever make, but a necessary one" made sense back then. That whole concept has been turned upside down.

Gold backed the dollar in the 60's, and it jumped from 32 dollars per troy ounce to 320 dollars, and Nixon withdrew gold from backing the dollar(Foreigners were dumping dollars for gold. If he hadn't done that, we would have lost all of our gold reserves). Without gold backing our currency, the government could turn on the presses. Gold has been dead as an investment, but its perceived image, has changed to that of a commodity. It is not viewed as a "store of value." If you examine most commodities, they get used up, and when supplies are short prices rise. Well, there is just as much gold in the world today as there was yesterday, and contrary to "implyed thinking,"it isn't being used up.

Examine the mindset of todays house buyer. The increase in home values, a 1940 1400 sq ft in Los Angles going for 1 million is getting a bit wild to say the least.

Take gold, in 1964 a pack of smokes was 24 cents, a gallon of gas was 21 cents and gold was 32 dollars an ounce. Today a pack of cigarettes is $3.50 and a gallon of gas is $3.35. An ounce of gold will still buy you just as many cigarettes and gas as it did in 1964. Ever wonder why? You can't print gold.

Notice, your perspective changes over time. It went from asset to investment. A large change in value, changed the way you perceived the item.

Whether it is a house, or an ounce of gold, it was purchased with a thought of what it was to represent, an asset or the preservation of assets. It was time that changed your perception of the asset, and if you loose track of the original concept of purchase, your well thought out plans formulated in the past can fall apart in the future. The reason, the model changed drastically, but so slowly that it was not noticed.

The San Diego Bubble

People are waiting around for the housing bubble to collapse. What is missing is fear in the market. Inventory is growing and 20,000 units seem like a lot, but if you travel to the Phoenix area they are north of 43,000 units.

This entire market is fed by banks and lending institutions. What people don't realize, is that institutions that are about to go bankrupt are holding on by their fingernails until the last moment when their fingers give out.

The most crucial element in this whole mess is the interest rate. So far the Fed has increased rates 16 times and yawn, it did nothing. The Feds are pushing on a string.

The real issue here, is if the money supply rapidly collapses, interest rates have to rise. This could be accomplished by no one showing up for the next treasury auction. You need money, be willing to pay more for it.

A sudden snap in the interest rate to say 8% could cause a panic and put fear into the housing market. Where would it come from, a major bankruptcy, a run on a foreign bank, Fannie Mae drops dead take your pick.

This entire market is fed by banks and lending institutions. What people don't realize, is that institutions that are about to go bankrupt are holding on by their fingernails until the last moment when their fingers give out.

The most crucial element in this whole mess is the interest rate. So far the Fed has increased rates 16 times and yawn, it did nothing. The Feds are pushing on a string.

The real issue here, is if the money supply rapidly collapses, interest rates have to rise. This could be accomplished by no one showing up for the next treasury auction. You need money, be willing to pay more for it.

A sudden snap in the interest rate to say 8% could cause a panic and put fear into the housing market. Where would it come from, a major bankruptcy, a run on a foreign bank, Fannie Mae drops dead take your pick.

Sunday, May 21, 2006

Old Fashion Values

I remember back to the ‘70’s when you heard the statement, “A house will be the worst investment you ever make, but it is a necessary one.”

Also there was the fact, that there was an added premium for renting over purchasing a home. You paid more for the option to rent a house over buying it. You could pick up and leave at any time, so to rent meant paying more than a homeowner would pay.

There is also the concept of saving money for retirement. Savings means that you surrender buying now, for buying later. This saving, is how we, as a group, finance retirement and investment.

Now when a house appreciates 400,000 dollars, where do this idea of savings by surrendered consumption, enter into the picture? It doesn’t.

If everyone can buy a house and sell it to someone else for more money, what would you call it? A chain letter might be a good label.

Now, turn on your radio, and listen to “have you recently had a bankruptcy and need to refinance….” Somebody is buying these loans, and you and I know that they are probably very high risk if (or when) the housing market drops.

You want to buy someone’s house and the price is outrageous, say 800,000. You may get back 80,000 dollars from the seller, and zero down, what a deal. The joke is in qualifying for a loan, can you fog a mirror?

There is a problem here, I studied the Great Depression, and I was always confused as to why people would finance a home for only 5 years back then. Then when you read a little further, you discover that these were interest only loans. What the hey, they will be worth twice as much tomorrow and then we’ll flip them. The loans were called and not renewed—real tough luck.

Now you see where we are at today, a place where we have been before, but there isn’t anyone alive that has first hand experience, and therefore no déjà vu.

Also there was the fact, that there was an added premium for renting over purchasing a home. You paid more for the option to rent a house over buying it. You could pick up and leave at any time, so to rent meant paying more than a homeowner would pay.

There is also the concept of saving money for retirement. Savings means that you surrender buying now, for buying later. This saving, is how we, as a group, finance retirement and investment.

Now when a house appreciates 400,000 dollars, where do this idea of savings by surrendered consumption, enter into the picture? It doesn’t.

If everyone can buy a house and sell it to someone else for more money, what would you call it? A chain letter might be a good label.

Now, turn on your radio, and listen to “have you recently had a bankruptcy and need to refinance….” Somebody is buying these loans, and you and I know that they are probably very high risk if (or when) the housing market drops.

You want to buy someone’s house and the price is outrageous, say 800,000. You may get back 80,000 dollars from the seller, and zero down, what a deal. The joke is in qualifying for a loan, can you fog a mirror?

There is a problem here, I studied the Great Depression, and I was always confused as to why people would finance a home for only 5 years back then. Then when you read a little further, you discover that these were interest only loans. What the hey, they will be worth twice as much tomorrow and then we’ll flip them. The loans were called and not renewed—real tough luck.

Now you see where we are at today, a place where we have been before, but there isn’t anyone alive that has first hand experience, and therefore no déjà vu.

The Misallocation of Assets

Most of the time you would probably think that a famine somewhere in the world is just that, no food. But think again, it could be caused by misallocation of resources.

It happened in Africa 20 years ago. People were raising cattle and a mans wealth was measured in cattle. This started a cattle boom. More and more cattle were being raised. Finally it got to a point to where the price of animal feed started to rise. Up it went. As it went up, people started to unload cattle. The price of cattle dropped to nothing. From there the cattle starved to death and then the owner found himself next in line. If you had money, you could still buy food. Through the rush to become wealthy they ended up bankrupt and literally starved to death as a penalty.

The housing boom doesn't really seem like a misallocation of resources, now does it? Builders are still building, there is a profit still to be had. They can undercut any homeowner in the market. What going to kill the market? The cost of money.

A builder is going to want about a 20% or better return on his money. If he starts to get squeezed and figures that he could end up with only 10% return. Thats too much risk especially if interest rates rise up to say 10%. The builder will put his money in the bank, the hell with construction. At this point, a lot of homeowners will stop feeding their mortgage. Then the death spiral starts.

It happened in Africa 20 years ago. People were raising cattle and a mans wealth was measured in cattle. This started a cattle boom. More and more cattle were being raised. Finally it got to a point to where the price of animal feed started to rise. Up it went. As it went up, people started to unload cattle. The price of cattle dropped to nothing. From there the cattle starved to death and then the owner found himself next in line. If you had money, you could still buy food. Through the rush to become wealthy they ended up bankrupt and literally starved to death as a penalty.

The housing boom doesn't really seem like a misallocation of resources, now does it? Builders are still building, there is a profit still to be had. They can undercut any homeowner in the market. What going to kill the market? The cost of money.

A builder is going to want about a 20% or better return on his money. If he starts to get squeezed and figures that he could end up with only 10% return. Thats too much risk especially if interest rates rise up to say 10%. The builder will put his money in the bank, the hell with construction. At this point, a lot of homeowners will stop feeding their mortgage. Then the death spiral starts.

Wednesday, May 17, 2006

The Collapse of Hypthocated Assets

There is a problem that is beginning to be realized: "Are my assets safe for retirement." Sadly the answer is no. Your mutual fund or IRA, buys stocks, bonds options and whatever.

These Mutual funds etc have been rising in price since 1982. That's pretty much when this bull market started, I don't even count a bear market unless its at least 4 years in length. The last real one was about 12 years long. The one after the great depression was about 20 years long in the tooth.

The real irritating thing about a lot of these stock assets is that they don't even pay a dividend. As long as it goes up--who cares? Most of the people who own them have never seen a bear market.

When I mention bear market from 1966 to 1982 we are talking Dow 500 to Dow 1000 back and forth never higher. How many Mutual Fund advisors are old enough to remember back then? The herd mentality is working very well for them up to now. With stocks that do pay a dividend, their price tends to increase as the dividend increases and vice versa. This is what you want to invest in, if you want retirement income.

A market goes up when more people want to buy, than those that want to sell. Well, all of these first time home buyers have no spare cash for the Stock Market. The Baby Boomer's, sometime in the future are going to want to sell. The question arises, "Sell to Whom?"

A lot of these stocks could be marked to market if no one wants them. Remember Lucent at $160--it split 2 for one and is now at $2.50 a share. Talk about evaporation of equity. Remember you have to do absolutely nothing for this to happen, your neighbor can sell his stock for whatever and that determines the present new value of your holding. Neat isn't it?

These Mutual funds etc have been rising in price since 1982. That's pretty much when this bull market started, I don't even count a bear market unless its at least 4 years in length. The last real one was about 12 years long. The one after the great depression was about 20 years long in the tooth.

The real irritating thing about a lot of these stock assets is that they don't even pay a dividend. As long as it goes up--who cares? Most of the people who own them have never seen a bear market.

When I mention bear market from 1966 to 1982 we are talking Dow 500 to Dow 1000 back and forth never higher. How many Mutual Fund advisors are old enough to remember back then? The herd mentality is working very well for them up to now. With stocks that do pay a dividend, their price tends to increase as the dividend increases and vice versa. This is what you want to invest in, if you want retirement income.

A market goes up when more people want to buy, than those that want to sell. Well, all of these first time home buyers have no spare cash for the Stock Market. The Baby Boomer's, sometime in the future are going to want to sell. The question arises, "Sell to Whom?"

A lot of these stocks could be marked to market if no one wants them. Remember Lucent at $160--it split 2 for one and is now at $2.50 a share. Talk about evaporation of equity. Remember you have to do absolutely nothing for this to happen, your neighbor can sell his stock for whatever and that determines the present new value of your holding. Neat isn't it?

The New Chinese Market

The first thing that we need to realize, is that China is a Communist country. Its hampered by the economics of the free world. Rules are made to be broken.

The second thing that needs to be realized, is that this country's government has never taken economics 101. It doesn't have to, and because of that, it has no idea what we are referring to.

The third thing to realize is that the rest of the world is taking this "Nine year old kid" and selling them the "Candy Store" for U.S. dollars. The real problem, we are paying them in funny money.

If and when the Chinese, "smarten up," they should become net gold buyers using U.S. dollars.

This might be hard to swallow, but ask yourself, what is China doing with these new reserves? Somebody is buying a lot of Treasury's each Tuesday. If the Chinese have no idea of what is going on, the present discount rate makes sense. You can't stuff it in a mattress.

If they catch on to what is happening, you could see interest rates jump a quarter point at each auction. No body would be buying.

The second thing that needs to be realized, is that this country's government has never taken economics 101. It doesn't have to, and because of that, it has no idea what we are referring to.

The third thing to realize is that the rest of the world is taking this "Nine year old kid" and selling them the "Candy Store" for U.S. dollars. The real problem, we are paying them in funny money.

If and when the Chinese, "smarten up," they should become net gold buyers using U.S. dollars.

This might be hard to swallow, but ask yourself, what is China doing with these new reserves? Somebody is buying a lot of Treasury's each Tuesday. If the Chinese have no idea of what is going on, the present discount rate makes sense. You can't stuff it in a mattress.

If they catch on to what is happening, you could see interest rates jump a quarter point at each auction. No body would be buying.

Wednesday, May 10, 2006

Loans and the cost of risk

Right now, if you can fog a mirror, the bank will lend you money. The question arises, who's money is it, that they are lending you? Don't know don't care?

Its probably your retirement income fund. IRA, 401K, teachers retirement fund, CALPERS. The people managing these funds have never seen a bear market. If you were 20 years old in the last bear market, you would have have to have been born before 1948. So as far as it goes with money managers born after 1960, the bear market is a myth. "Things are different now," "That can't happen in todays world." Good solid thinking, " balls to the wall," invest fully don't leave anything in cash. There is no commission on cash held in reserve.

The only real question right now, is where are we?

There can't be more that a 1% spread between junk bonds and T-bills. This tells you that there are an awful lot of trusting fools out there right now. you would expect to see about a 5% difference between no risk and risk.

The perspective of risk is not apparent in todays market, everyone is covered with puts, calls, indexes and derivatives.

In 1929 the Federal Reserve was berated for not raising the interest rate until after the crash, it probably would have made no difference, the damage had already been done.

Its probably your retirement income fund. IRA, 401K, teachers retirement fund, CALPERS. The people managing these funds have never seen a bear market. If you were 20 years old in the last bear market, you would have have to have been born before 1948. So as far as it goes with money managers born after 1960, the bear market is a myth. "Things are different now," "That can't happen in todays world." Good solid thinking, " balls to the wall," invest fully don't leave anything in cash. There is no commission on cash held in reserve.

The only real question right now, is where are we?

There can't be more that a 1% spread between junk bonds and T-bills. This tells you that there are an awful lot of trusting fools out there right now. you would expect to see about a 5% difference between no risk and risk.

The perspective of risk is not apparent in todays market, everyone is covered with puts, calls, indexes and derivatives.

In 1929 the Federal Reserve was berated for not raising the interest rate until after the crash, it probably would have made no difference, the damage had already been done.

Tuesday, May 09, 2006

Is gold king?

The price of gold is going up, but ask yourself one question, is it really going up or is the government printing way too much money?

Oil has gone from $17 a barrel to $70 ever wonder why? I remember buying cigarettes in 1963 for 24 cents a pack and gas was 21 cents a gallon.

What are we looking at? Is the price of gold increasing, or is the value of the dollar decreasing?

"Black gold," oil has tripled in value so it stands to reason that gold should also triple.

What we are looking at is an economy under extreme stress.

Cigarettes are $3.35 a pack, what did the Arabs do to cigarettes? I don't think that we can blame them for everything.

Oil has gone from $17 a barrel to $70 ever wonder why? I remember buying cigarettes in 1963 for 24 cents a pack and gas was 21 cents a gallon.

What are we looking at? Is the price of gold increasing, or is the value of the dollar decreasing?

"Black gold," oil has tripled in value so it stands to reason that gold should also triple.

What we are looking at is an economy under extreme stress.

Cigarettes are $3.35 a pack, what did the Arabs do to cigarettes? I don't think that we can blame them for everything.

Monday, May 08, 2006

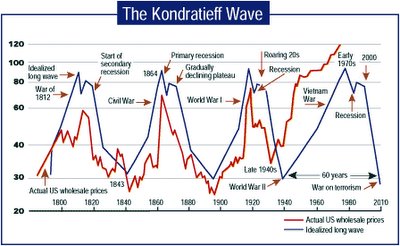

Surfing the Kondratieff Wave

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

Sunday, May 07, 2006

The Beginning of a Great Depression

I found a book in the library 20 years ago that so impressed me, that I made a copy of it. Its called The Great Depression by David A. Shannon. What really amazed me about the book was its style, it was more or less presented as a blog. Using that as a focus point, I decided to create my own blog instead of trying to add to someone else's. So here we go.

A depression is an economical state where things that worked real good, now don't work or are doing the opposite. There is also a general confusion as to cause and effect for given situations.

The first clue that something was amiss was the dot com bubble collapse. This showed us that when things were in play, money could be made.

Then after that, the spread between long bonds and T-bills got very small, then the spread between Treasury's and Junk bonds narrowed. You use to get a good laugh over asking if anybody had bought any Peruvian Bonds.

From then, carry forward to today. Real estate has been hypothecated to death. Now the Fed has raised interest rates 15 times, and the 30 year loan inched up only 1/2 a point. Hmmmm, are we there yet.

Real estate for sale, the quantity on hand, has gotten up to about 9 months supply. Never mind that there is no one left that can afford to buy a house. Foreclosures are climbing.

The baby boomer's are about to retire. Imagine what will happen when they decide to withdraw money from their retirement accounts because Social Security, just isn't enough.

How about the fund manager, who will notice that more money is leaving the fund than is being deposited. Common sense tells him to sell the dogs in his portfolio and hold on to Google.

Is it my imagination, that the airlines and the auto industry just had a pay cut.

Gasoline and gold doubled in price? Or did we devalue the dollar without telling anyone?

When the depression hit in 1929, it took people 3 years to figure out that they were in one. Are we there yet, or just getting close? More to come.

A depression is an economical state where things that worked real good, now don't work or are doing the opposite. There is also a general confusion as to cause and effect for given situations.

The first clue that something was amiss was the dot com bubble collapse. This showed us that when things were in play, money could be made.

Then after that, the spread between long bonds and T-bills got very small, then the spread between Treasury's and Junk bonds narrowed. You use to get a good laugh over asking if anybody had bought any Peruvian Bonds.

From then, carry forward to today. Real estate has been hypothecated to death. Now the Fed has raised interest rates 15 times, and the 30 year loan inched up only 1/2 a point. Hmmmm, are we there yet.

Real estate for sale, the quantity on hand, has gotten up to about 9 months supply. Never mind that there is no one left that can afford to buy a house. Foreclosures are climbing.

The baby boomer's are about to retire. Imagine what will happen when they decide to withdraw money from their retirement accounts because Social Security, just isn't enough.

How about the fund manager, who will notice that more money is leaving the fund than is being deposited. Common sense tells him to sell the dogs in his portfolio and hold on to Google.

Is it my imagination, that the airlines and the auto industry just had a pay cut.

Gasoline and gold doubled in price? Or did we devalue the dollar without telling anyone?

When the depression hit in 1929, it took people 3 years to figure out that they were in one. Are we there yet, or just getting close? More to come.

Subscribe to:

Posts (Atom)