A pension plan is a form of savings that allows one to retire with a predetermined monthly income. It’s a little like putting money in a savings bank until you retire. A pension fund is a little more sophisticated they employ all sorts of advisors to figure out what your monthly payment from them will be when you choose to retire. In order to come up with these projections, they have to know beforehand your monthly contribution, the average life expectancy and a projection of future interest rates. From there it is a pretty cut and dry calculation.

Let’s examine it in a more simplified form. Assume that we have a person ready to retire with one million dollars in cash in the bank. That’s his total retirement. If we compute the interest rate on that at 12%, it comes out to about $120,000 a year. At 8% we get $80,000, at 4% we get $40,000, at 2% we get $20,000 and at 1% figure a whopping $10,000. Just examining the return rates here, it is easy to realize that a mistaken assumption of where interest rates will be, changes your spending habits and could force you to tap into the principle as well.

Examine the rule of 72. Divide the interest rate into 72 and you have a pretty good idea how many years it takes for your savings to double. It also works quite well for inflation. Divide the inflation rate into 72; only in this case we are not doubling, we are halving. Figure that the banks are paying 2% interest. That is about 36 years to double your money. Inflation is around 6% so figure 12 years down the road, you’ll still have a million dollars, but only half the buying power.

The difference between say CalPERS (California Public Employees' Retirement System) and an individual savings account used for retirement is that the left over funds in a savings account goes to your heirs. Pension funds don’t need a big cushion. They know that everyone as a group will drop dead at age 78 by using actuary tables.

Every year in the past CalPERS was asked, "Is there enough money in the plan to carry everyone to the drop dead age?" At 7.75% interest with no loss of principle, the answer was "Yes." Well, CalPERS lost 56 billion and the interest rate is now about 1.5%. Rates can’t stay this low for 20 years, like Japan, now can they? So this is only temporary. Now that you’ve bought the bridge, can we interest you in a toll booth to go with it?

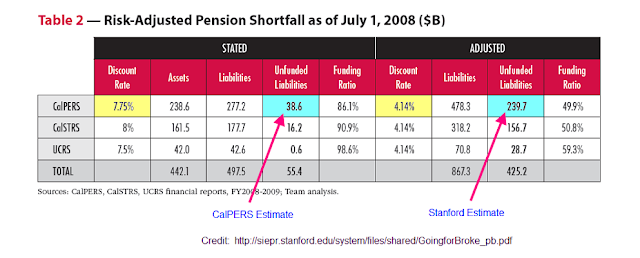

The picture below is an excerpt from a Stanford study requested by the Governator's office, published in April of 2010. Here's a Link to it. Notice that CalPERS is using a 7.75% interest rate for their calculations and Stanford at the time chose 4.14%.

Double click for a larger view

The present attainable interest rates are in a range of 2 to 4 percent. CalPERS whole financial structure was built on 8%. This low interest rate was not anticipated. If we were to take their present asset base and double it, that doubling would generate the interest income needed, to keep the fund solvent.

As usual, I could be shot for this over simplification. It seems certain that things are going to get worse before they get better. This Stanford projection of future pension costs appears quite reasonable. The three retirement funds cited in the report could have a half trillion dollar short fall. The size of the shortfall amount appears absurdly large, the possible reality of it, is rather unsettling.

Governor Schwarzenegger has stated that the California pension plan program is unsustainable. At the same time CalPERS wants 600 million more of State funds for just this year. Who do you listen to? One thing to consider, our next governor won't work for $1 a year.

6 comments:

A bridge too far? How about a Boom too far?... (caution: language alert)

BP Fails F**king Booming School!

Hi Tyrone

You have me lost. I don't see a link between CalPERS and BP. The latter is pumping oil and the former is pumping retirees.

I'm in an old-fashioned pension plan. We have to pay in for forty years and then we can retire at 65 on 60% of pay.

Compared to our deal American public service deals seem ludicrously extravagant.

Unfortunately our deal costs too much so we are having a rather fraught discussion on what to do about it. By contrast, US public service unions seem to live in cloud cuckoo land.

Public pension plans are unsustainable and detrimental to our future. Many who thought they would get a free ride from them won't. Cops and fireman with a base salary of 60k retiring at 40 and getting lifetime pensions of 100k plus is shameful. This mentality of ripping off your company, your city, your state, the federal government or your fellow tax payers has got to go. And it will eventually. Politicians won't touch this issue until they are forced to. When the money isn't there any longer and things can't be propped up or pushed forward any longer this whole pension imbalance will crash.

Hi Dearieme

I could retire next year at 65 on Social Security. I'm going to keep on working.

I've got an old fashion plan also, its called savings.

I tend to agree that our government pension plans are out in Wonderland.

It won't be long before they start wondering about what is happening. The cuts are coming.

Here's hoping your plan gets straightened out alright.

Take care.

Hi Anon 8:52

No argument from me. I think that the politicians are out of the loop on this one, the bankruptcy courts get to play with this.

Remember though, while the party was in full swing, no one cared about retirement benefits. Now that the party is over, we get to enjoy the hangover.

For a real bad hangover, there is the Bernanke cure--start the morning with a couple of Vodka Bloody Marys, then chase it down with a 12 pack of beer.

Post a Comment