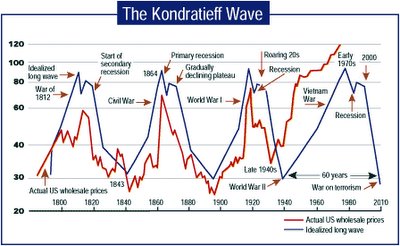

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

As an addition to the original post, here is a little bit of video from You-Tube that everyone is carrying.

24 comments:

People are consuming more and more, and with that, comes the creation of more debt.

Jim, I look forward to the day credit is NOT easily obtained. Where people can't put tens of thousands of dollars on credit cards.

It wasn't too long ago where credit cards could not be used to purchase food, correct? I doubt we'll see something like this reversed, but why not? Too much credit is used like a form of welfare.

It's time for people to start living WELL WITHIN THEIR MEANS. But it will have to happen by force.

Hi Tyrone

I know what you mean. I get 3 credit card aps a week that I have to shred. I just can't figure out where these Credit Card Companies are coming from. Reality seems far removed from real life.

When I was an academic, financial people would sneer about my failure to live in "real life" and mock my prognostications about the coming calamity. I'd laugh if I weren't so frightened.

What most people don't understand about the Kondratieff Wave is that it was considered treasonous because the main purpose of it was to debase communism by showing that capitalism is cyclical and even when it appears to self-destruct it always, at least historically, comes back strongly. That is the real message.

Nutjobs galore, during the early 80's, like Howard Ruff and Harry Browne, popped up then to say we were experiencing the Kondratieff Wave down cycle then, but they were wrong.

I do agree with the basic tenets of the K wave, but trying to rationalize why this is just a delay and this mess is just a repeat of history, is dangerous. Many cycles go on coincidentally and also intersect. HISTORY never repeats itself exactly. It simply is not mathematically possible. Is the K wave meaningful for consideration, now? Yes, but just one of many tools. It can easily lead a person astray, just like it did in the early 80's. What is most important is to not be locked into any ideology, or forecast, but be open to something not exactly the same as what has happened before.

....Joseph

What is of the utmost and vital importance is what Thomas Paine just said in the video attached to this article. This insanity will continue and we will lose our country (if it is not already lost) if we don't unite as we the people and revolt on as many effective levels as possible. We need the greatest non-violent revolution to occur in the history of the USA if there is any hope of turning things around.

This from Denninger's post today:

Many people played the "roll it over" game with credit cards for years, taking the balance on one card and rolling it to some new card before they had to pay it off. That game can continue for quite some time but eventually you reach the end of the rope where lenders will no longer finance this charade, and you're once again forced to cough it up or go under.

The credit thing has got to stop.

Jim:

Gold and silver are too volatile to be considered currency. They are, in fact, just commodities and unlike oil, they have no practical use in society.

Ben Bernanke has assured us that the recession will end by the end of the year. Can we please give him and Obama a chance?

Hi Anon 6:25

I don't see gold and silver as commodities. Show me a country that didn't at one time use the two for currency. The last step in debauching the currency is to move away from gold and silver. The reason for that is that governments can't print gold or silver.

As for "They have no practial use to society," makes me think you are pulling my leg.

"Ben Bernanke has assured us that the recession will end by the end of the year." I love your humor!

Your quote,"Can we please give him and Obama a chance?" confuses me. I wrote this piece three years ago. Obama was an unknown at that time.

As for this dynamic duo fixing this mess by the end of the year, I disagree. We should have a full world collapse within the next two months. Obama's mission is similar to trying to catch a 50 pound sand bag dropped from the 10th floor. Catching it, is not the problem.

Hi Tyrone

I agree. What I have mentioned in the past is that the credit card companies will drop dead before the people owing the debt. Each household that miss manages their credit cards is one thing. But when you have several thousand accounts that aren't paying, you have a problem. This gets exacerbated by the fact that the people in trouble probably have 10 to 20 credit cards.

Thanks for pointing out Denningers post on it. I'm glad it was at the beginning of his post. That guy must get paid by the word.

Jim,

Here is my summary on this. Would you agree?

We've got a Fed Reserve that is going to print. We've got an administration that wants to enlarge government. We've got a Congress that is corrupt and out of touch with the real world (they all should be removed from their positions). Our leaders are arrogant and stubborn and will not stop trying to cure the economy. So we can expect another year or two of deflationary climate as the remaining wealth destruction takes its toll. Once we begin to have a recovery period and growth starts up we can expect high interest rates and inflation. Learn to do well in deflationary times. And also prepare by learning how to do well in inflationary times (two different economic worlds... understand the rules of each). Each individual has to work out his own economic solution. Those not financially educated or sophisticated will suffer.

This country will eventually lose its place as the world super power because it is not doing what is the situation calls for (dramatic leadership; a war like effort to boom technology in the energy arena and become the innovators of new forms of energy and an exporter of these; a huge effort to rebuild our manufacturing base; a move away from corporate and private welfare and other socialist policies; etc.)

(Note: There is also the chance that a recovery may not take place for up to 10 years: this scenario would mean hard time economically and revolts and civil unrest and many happenings that you would never have expected would happen in America the beautiful.)

Hi An Inquiring Mind

Your scenario plays out too neatly for me, you could be right but I expect the unexpected.

I picture three big dogs (Congress, Fed+Treasury and Federal institutions) and one small dog (state governments) all ripping and pulling on a large towel. The towel could represent several things, but the one certain thing is that, who gets what is really a big unknown.

State governments will be the big losers, they have to balance their budget. The Fed will have to help bail them out.

I don't think we will lose our ranking as a world power. Our military is very strong and our technology is quite advanced.

Since our economy has been producing things no one wanted for the last five years (housing and cars), I think we will see the US retool and make more of what they need rather than import it as you suggest.

I think that the real thing to realize here, is that what ever happens next will be totally unexpected to the people in charge.

I'm not much on figuring out when things will get back to normal, but 30 years sounds more realistic than 10. Our last housing recession lasted 6-8 years and we are only one year into this, and it's worse by double already.

If we use the past as a measure of the future, common sense will give you the numbers, and give you a reasonable future expectation.

The government needs us to spend to make things like they were and this isn't going to happen. Cars and houses now cost real money and nobody has any! I don't think that the governments expectations of us will live up to what they need in real revenues.

I never imagined in my wildest flights of fancy, that the US government would guarantee GM's vehicles. We need to call for a urine test or two here. These guys are smoking dope and jumping rope--and of course, they don't inhale.

As a bit of useful information, some bloggers are suggesting that you buy a handgun for the coming fiasco. I recommend buying a shotgun, you don't have to aim it and it isn't going to carry a mile. Plus you can't miss.

I agree about shotguns. Rounds ain't cheap though.

Since when are these United States a Democracy? Republic...maybe...Democracy, no.

Term limits...term limits...term limits...

Publicly funded elections...publicly funded elections...publicly funded elections...

It's the lobbyists....and pay for play....we need reform now.

...some bloggers are suggesting that you buy a handgun...I recommend buying a shotgun.

Buy both.

Snoop-Diggity-DANG-Dawg

something is wrong with this site.

the video is missing off the article. you can't get into the blog to post.

malfunction! malfunction!

webmaster!

200 years ago we would've kicked our fat assed representatives out of the capital building, tar and feathered them and run them out of DC on a rail. Maybe draw and quarter some of the real offenders.

But these are modern times. So the next time you see Bernanke hovering overhead in his helicopter... shoot him down with your stinger missle.

And give the coordinates of the capital building to one of those US drone planes that are bombing Pakistan all the time.

And smoke out everyone in the Fed Reserve building and all the Fed Res bank building and turn them into libraries.

Thomas Paine III

Hi Snoop-Diggity-DANG-Dawg

I don't think that a handgun will give you the security you need. A lot of the people who buy a handgun and drink a 12 pack, end up in prison. I personally don't own any firearms, but I can see maybe the reason for buying one, to protect yourself from rioting. The trouble is, if you shoot someone, they're liable to come back to your house and burn you out. There are no police that will take your call when we talk riots.

With government order, you might be within your rights to shoot someone, the police will defend you. That assumption could be a bad one if all hell breaks loose, you don't want to shoot anyone.

Threaten and scare, and that is what a shotgun is for, one round makes a lot of noise even if you fire it above their heads.

Thats what the war in Palestine and Israel is all about; to get even for killing my brother.

Hi Anon 12:17

Some business block web content of a certain nature. You might be able to view it at home, but not at work. The system is up and running ok. I do question your statement that you could not post a comment. You might want to file a 1D10-T form with the webmaster.

Bottoms up!

Hi Thomas Paine III

I think that your point view is off a bit. Congress didn't really create this mess. They just made it easier to happen. It was pure greed that made what we were doing, a problem. Now we have to pay the piper.

Everyone was going to get rich and sail into the sunset. The trouble is, the boat bought leaks like a sieve.

What about the theory that "you'll never get rid of greed", it is always there (a good thing, and a natural element of human behaviour) and that the purpose of regulation being in place and enforced is to keep it from going out of orbit?

TP III

Jim, at 39 & in the military, I too had never owned or particularly wanted a personal firearm. I carried one on deployements, but never felt the need for one at home until now.

Perhaps I'm getting paranoid in middle age, but I see very disturbing trend lines in our society, and feel reluctantly compelled to have some means to defend my family from chaos.

I now own a shotgun, which I believe IS the best overall home defense weapon, especially for my wife, who doesn't like to think about things like taking careful aim.

I'm also thinking very seriously about buying a simple revolver, as well. Shotguns are bulky & they quickly get heavy, whereas one could clip a little 22lr to a belt & basically forget it's there until you need it.

Snoop-Diggity-DANG-Dawg

Everyone should have and be skilled with a handgun, rifle and shotgun. That is basic survival 101. It is even more important with the social unrest, etc. that is sure to come as this country sinks deeper into the depression.

Snoop Diggity: rethink the .22 idea. If you use a .22 you have to kill someone. (Only a skilled shooter could use that to carefully place a round in an assailant's brain pan.) Many .22 rounds can go right through an assailant (especially if they are pumped up on alcohol or drugs) without stopping them. They can still get to your wife, child or you before they finally crumble. A shotgun is the true manstopper. But you need a high caliber pistol to have some manstopping capability... ideally a compact .45 like a Glock. A .40 is a good accurate round but I'd always go with a .45 because it will do the most damage. Pump two shots into the chest and they'll go down pretty quickly. You'll either blow up the heart and lungs or their blood pressure will drop quickly and they'll go down. If they are truly violent and still a danger after 2 to the chest, than it is time for the headshot. Don't ever take the headshot unless it is 100% necessary. Judges and juries frown on them.

Hi Aim

Your goal is noble, to teach everyone about fire arms, but I think it's a lost cause. As a computer tech, I am amazed at what people can do to a computer without thinking. I see nothing wrong with the right to bear arms, I feel though it ought to follow the lines intended by the framers of the constitution--flint lock pistols and rifles.

As a side thought, I sleep walk and as a kid, I nearly got run through with a fencing foil in the dark by my cousin. 30 years later I was at a friends house and nearly got shot while sleep walking again.

I think that guns create more problems than they solve. If you have a gun in the house, it would kind of suck to have a burglar pump a few rounds into you for coming home early with your own gun.

Plus a gun in the house could intimidate your wife and your marriage. There is nothing that is clear cut about this issue.

I disagree. There are too many sociopaths in our society and our economic crisis will bring more crime. Lethal force is the LAST alternative. All other avenues must be attempted before coming to that. But one must be trained and equipped to protect themselves, their family and loved ones as well as the weak or innocent if conflict arises. Woe to someone who is not trained and equipped if a violent intruder or intruders enter into their home, place of business, etc.

The few mishaps or accidents that may occur because of guns is a small price to pay for the overall protection and safety they give us. The thing that isn't done properly is the teaching of gun safety on a large and deep scale. No one should be able to own a gun unless they have taken considerable training first starting with all aspects of gun safety.

Hi Aim

7 cops killed in the last week and 14 innocent people in Binghamton, suggest that guns can do a lot more than keep people from ripping you off.

If you extend it out, that means that several thousand burglars had to have been shot while invading a home in the last week.

My dog is better than any hand gun. He makes the big decisions.

Bear in mind I am kidding with you a bit, AIM, I don't disagree with your opinion, but there are a lot of people out there that might be willing to sacrifice their rights to bear arms for a more secure environment from the off the wall element.

Guns are becoming a statement of "How many people can I take with me when I chose to end it all?" There are no laws to punish people willing to die for what they believe in, we can only restrict them.

The real question is this, how many people can you kill with a steak knife verses a hand gun?

I guess we have the right to differ in our opinions.

Take care, and thank you for your comments, they help to show the real world out there.

Post a Comment