What we are talking about is the Federal funds rate on overnight loans to banks. When the Fed funds rate was 1%, banks lined up at the window for almost free money loans. Now with the rate at 5.25 there are no lines at that window.

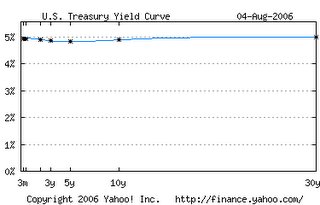

They have raised this rate 17 times and the 30 year bond has yet to jump a full point. In fact the 3 year bond dropped to a 4.85% interest rate. The three month treasury is at 5.13% interest and the 30 year is at 5%.

Every financial want-to-be or is-a-be floats around waiting for what Bernanke is about to do or say. The fact is, that when the Fed rate exceeded the bond rate, it no longer mattered how high they raise the rates. If the cheapest price is at Walmart, you buy at Walmart and the Fed right now is no Walmart.

The Fed figures that they have some sort of John Wayne swagger effect. Its just not there. If Bernanke walks into the bar, China is going to tell him to raise his hand for permission if he wants to use the bathroom.

What we are looking at here is an entity that at one time was very powerful. But in the computer age, a mouse click can circumvent anything that Berneke can attempt to control. With everything computerized, the overnight Fed funds rate doesn't really come in to play much. The banks have it pretty well sorted out.

What we are really looking at is a man going through the motions of, "I am in control, have faith and I will get you through this mess." No one out there will challenge his ability to push on a string. With that said, I believe that everyone in Wall Street will ride the ride, on his say so.

So what happens from here? Bernanke either raises the rates or he doesn't and the people on Wall Street will salute this guy as the new god of finance.

Doesn't really make much cents does it? If Bernanke raised rates to an absurd level of say 20% it wouldn't change the 30 year bond rate, but at that point, it would be very obvious that the Fed was no longer in the loop. The reason that they are no longer as effective, is because they are just a small part the very large global market.

Where does Bernenke fit in? He is being groomed to be the scape goat for the coming mess. Its pretty obvious that one is going to be needed soon.

7 comments:

Agreed,

However... and you knew I was going to say that, right?

The FED has a lot more power using reserve requirements than with interest rates. At this point, interest rates are just window dressing. When reserve requirements for bad debt losses rise, then we'll see a return to sanity with lending. Not before then. Because, as you said, they are pushing on a string. In the meantime, a lot of banks are overleveraged with MBS garbage and reserves are not set high enough to account for funny-munny loans in a deflationary environment. Once that happens, all hell breaks loose (as if it already hasn't?)

John Doe

I had completely forgotten about that option. Raising the reserve requirements would be a good one. Kind of a choke and die approach. I think I'd save that move for April Fools day if I were Bernenke-span

a little off the posted topic: for the sake of simplicity, let's just say there's one owner of a house, John, who's about loose the house from a foreclose due to no payment on his 5yr ARM and somewhere out there is Sarah who has offered this mortgage on that house... (i guess she's holding a MBS?)

when the home "owner" goes under and say that the house foreclosed at less than the loaned amount, and suppose it was "backed" by the US government, how will this now worth-less MBS be compensated by the government?

would sarah see the full amount right away? or would she see the full agreed upon payment cycle?

what is the incentive of sarah (or i guess the bank who is executing the foreclose) to try to find the highest bidder if she's getting saved by the government?

(btw: i will be out of internet connection for 7 days starting tomorrow)

If the house was bought for 500,000 the MBS would be for 80% or 400,000. In reasonable times its very hard for a house to loose 20% of its equity in a down market.

If the house is foreclosed and goes to a Trustee Sale, the bank has an automatic bid of 400,000 and the property is theirs with all secondary liens dropping off. If you bid 400,001 at the auction, you would be the lucky owner and the bank would have its full amount.

Now if the bank can't sell it without further loss, and its an MBS (Mortgage Backed Security), I believe they would return the item to Fannie Mae and Fannie Mae would pay off the loan that was attached to the MBS package or bundle of loans.

The bank through this mess, is just managing the Trust Deed for the holder Fannie Mae. The bank is managing these loans for a 1/2% fee. It might not sound like much, but if you turn over 200 half a million dollar houses in a year you'll earn a half million in management fees for the length of each loan.

What happens to the house from this point, I'm not sure. The note holder is going to want fast liquidation of the house in order to get capital back, for at least partial reimbursement of what had to be paid to the MBS fund holder.

At some point if enough loans drop in face value substantially below 80%, the package backing the MBS if marked to market, would force the question "Is the government backing these instruments with the full faith and credit of the U.S. Treasury." The answer has been assumed to be yes, only because Fannie Mae is a GSE (Government Sponsored Enterprise).

Notice how the Second Trust Deed goes to hell in a hand basket as soon as the trustee sale executes. It goes Poof!

I don't know that much about MBS's to know if they also deal in Second Trust Deeds. If there is such an animal, its going to be the first to be taken out, and shot!

IF you go to the Fannie Mae website you will see that these MBSs are not backed by the government. As a government backed entity, Fannie Mae just gets tax breaks, and breaks on other requirements that banks don't get--in exchange for loaning money to people who are too risky for banks.

If you buy MBS they are backed by Fannie Mae. If Fannie Mae goes belly up, then what you you get is nothing. Considering that Fannie Mae is the giant octupus at the center of the most disturbing lending practices of the housing bubble.

What is really troubling is that a great deal of MBS are held by pensions of many boomers. Today many boomers feel wealthy because of the values of their homes, and their portfolios. I think that we'll see a lot of this percieved weath evaporate in the next two years.

I agree with Anonymous completely. Unfortunately the real world sometimes changes the rules. Fannie Mae is so big that it is assumed by many that the government will step in to stop it from collapsing. Its the implied assumption that everyone is banking on.

The collapse of Fannie Mae is Game Over. Everyone looses.

Here's something to contemplate..

Remember when Greenspan puzzled over why long term interest rates failed to go up as much as short term rates? It was at that point in time that he called this particular phenomenon a 'conundrum':

[Link]

Here we are again with Bernanke. Short term rates have flattened out and look like they may be starting to go down..

Now, suppose that this time around, the Fed faces a different type of 'conundrum' in which long term rates go up while shorter term rates go down (at least for the time being).

Maybe we have reached the point in which the Fed is like the proverbial tail that wags the dog.

Just a thought..

Post a Comment