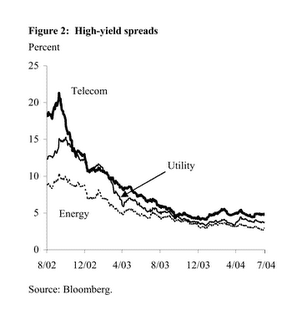

Todays Wall Street Journal has a bit on this C section page 1. The graph I have selected only shows to 2004. Its value hasn't changed since then. The thing that is not really that obvious, is the fact that this is Junk that they are comparing the Treasury's too. When you examine the "high grade bonds" they are trading ridiculously close to par with Treasury's.

Here is the way I look at it, Treasury's are guaranteed full faith and credit investments--no limit on the amount. High grade investment bonds should be 3 percentage points or better above Treasury's depending on the maturity. This is an assumption on my part just call it common sense (implied value pulled out of thin air and experience). This three percent spread difference, could be called the "fear factor."

Junk bonds normally command a 10% interest rate or more. What we are looking at here are a lot of investors that are just happy with a higher than Treasury return with no regard to the risk involved. There is no fear factor.

The thing that worries me right now, is the fact, that a lot of the people investing in these instruments are probably retired, looking to max out their income. In an up market, it can't really hurt you. The mutual funds might also be playing this with options and derivatives.

I would suggest, that if you are in bonds as a retirement asset, and you are not getting 3% better than 5 year Treasury's, convert to Treasury's. You are not getting the premium you deserve for the greater risk.

Remember a bond holder is ahead of the stockholder in a bankruptcy. There is no line to wait in for redemption if you hold Treasury's.

No comments:

Post a Comment