The homeowner that has bought into this real estate mess in the last two years can probably classify him or herself as a slave to the bank, or to whoever owns the note on their house.

Here is a definition of Slavery from Wikipedia:

"Slavery is a condition in which one person, known as a slave, is

under the control of another person, group, organization, or state.

Slavery almost always occurs for the purpose of securing the labor

of the slave. A specific form, known as chattel slavery, is defined

by the absolute legal ownership of a person or persons by another

person or state, including the legal right to buy and sell them just

as one would any common object."

It sounds as if I am being facetious, but think about it. This homeowner is going to pay up to 55% of their income to keep up the house payments. This is after tax income. So add 10% onto the 55% and you get 65% of income spent on the home. Add another 10% for expenses like heat, water, trash electricity and you are up to 75% of their income. This leaves 25% left for enjoyment of living; food, clothes, restaurants, movies, cars, insurance (health, car, life, home) and maybe a payment on their credit card. Add a Home Equity Line of Credit (HELOC) and you could be dead meat!

At this point, you have to ask yourself, can the owner of the contract perform as expected by the bank and everyone else? On an individual case basis, the answer is “maybe,” but homeowners as a group, the answer is “no.”

The concept of slavery, is that someone else will profit from most of the efforts of your labor. The homeowner has no concept of the slavery issue—Lincoln freed the slaves, and buddy, I have news for you. Your Realtor, Bank and Appraiser, found a new way to hook you up to that wagon of serfdom. The real irritating thing is, that you let them help you into the mess, and thanked them for it, to boot!

The new homeowner reading this claims says; "Hey I’m not a slave, I own, I don’t rent." Well, I’ll give you two years before your wife and kids file for divorce and leave you. This satisfies the last part of being a slave, the right to buy and sell the slave. What is not realized is that the wife and kids want more out of life, and it is not happening. Money problems break up most marriages. So your wife leaving is the equivalent of being sold to another owner. Admittedly this is very far fetched, but what the hey, its only a blog!

So remember New Homeowner, slavery is a concept that is invisible, only because everyone else is doing it. When the music stops, they are not taking away one chair, the sad truth is, there will be only one chair left!

The only advice I can give, if you are married, and find yourself in this situation, is to not blame each other. Once you realize that the situation is bad and that mistakes were made, work to a solution together. The most common reflex is to blame someone else for your situation, and this is normal, no one wants to be labeled as a cause of present problems. A divorce is a lose, lose situation and often seems like the easiest route out of the disaster, don’t do it. You are at this point in your life only because several professional people made a lot of money off of you and your family.

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Thursday, June 29, 2006

Sunday, June 25, 2006

The Invisible Derivative's Market

Call it gamblers insurance. The most common derivatives are Puts and Calls. If you think that Google is going to go down and you want to still hold it because of its upside potential you would buy a Put at say $375. So if Google was to drop to $200, you could "put it" to the option seller at $375. The cost of this insurance option varies, depending on the volatility of the stock. Now, if you thought Google was going to go to $1,000 you could purchase a Call at $400 strike price. If the stock rose to $600 you could exercise the Call and get the stock at the $400 dollar price or the difference between the Call price and the current value.

The figures vary somewhat, but about 90% of all options expire worthless in the U.S. Stock Market.

Enter the Gunslinger (slang term for wet behind the ears Mutual Fund trader) (never seen a real bear market in his life---there hasn't been one). This guy gets the bright idea to sell both Puts and Calls. As long as the market lumbers along the guy is raking in the coin.

Say the Dow has a bad day and drops 300 points. It seems like a big move, but since it is a measure of 30 stocks bought in 1910, multiply the 300 point drop in value by the Dow divisor .122834016 and you get a real dollar loss of $36.85 on the Dow. Divide that by the 30 Dow stocks and you get $1.22 per stock. If that were to happen, no big deal pay out to the Puts exercised. Notice, you only get burned on the Puts OR the Calls NOT BOTH in any one point in time. I stress the words "point in time."

The Derivatives Market is bigger than our stock market. One analogy used the comparison of an elephant to a mouse; here is a graph from one source that puts it at 35 trillion dollars.

This graph of the Derivatives Market is from www.gold-eagle.com.

Now suppose the Dow Jones drops 1000 points. Then by some miracle the market comes back to even at lunch time. Then, it soars up 1,000 points by the close. The gunslinger gets hit going down and nailed again when it goes up (the double whammy). He would be selling Calls like crazy while the market is going down trying to recoup losses from his naked Puts, then as the market heads north he gets eaten alive by the Calls he wrote earlier.

We only picked one market; there is the bond market, the commodities market, and foreign exchange markets, to name a few. At this point, the gunslinger is in a situation that looks like the kiddy game, where you have a hammer and hit the head that pops out of one of many different holes. The model turns into a real mess, when you realize that there are thousands of Mutual Fund Managers that will all be playing this game in real time. Naturally these different markets will be doing different things. The word "panic" comes to mind.

My suspicion with Mutual Funds and IRA's, is that when you specify how you want your portfolio invested, they are not moving your money from one investment to another, they are purchasing a derivative to satisfy your demands of asset allocation. This leaves them free to pursue the line of investment they feel most confident with.

So much for "what ifs," the Derivatives Market is a Fantasy Land with some of their latest derivatives dealing with real estate options. Where will it end? My best guess; somewhere between Ab Surdum and Ad Nausea (no, they are not towns in Iraq).

The figures vary somewhat, but about 90% of all options expire worthless in the U.S. Stock Market.

Enter the Gunslinger (slang term for wet behind the ears Mutual Fund trader) (never seen a real bear market in his life---there hasn't been one). This guy gets the bright idea to sell both Puts and Calls. As long as the market lumbers along the guy is raking in the coin.

Say the Dow has a bad day and drops 300 points. It seems like a big move, but since it is a measure of 30 stocks bought in 1910, multiply the 300 point drop in value by the Dow divisor .122834016 and you get a real dollar loss of $36.85 on the Dow. Divide that by the 30 Dow stocks and you get $1.22 per stock. If that were to happen, no big deal pay out to the Puts exercised. Notice, you only get burned on the Puts OR the Calls NOT BOTH in any one point in time. I stress the words "point in time."

The Derivatives Market is bigger than our stock market. One analogy used the comparison of an elephant to a mouse; here is a graph from one source that puts it at 35 trillion dollars.

This graph of the Derivatives Market is from www.gold-eagle.com.

Now suppose the Dow Jones drops 1000 points. Then by some miracle the market comes back to even at lunch time. Then, it soars up 1,000 points by the close. The gunslinger gets hit going down and nailed again when it goes up (the double whammy). He would be selling Calls like crazy while the market is going down trying to recoup losses from his naked Puts, then as the market heads north he gets eaten alive by the Calls he wrote earlier.

We only picked one market; there is the bond market, the commodities market, and foreign exchange markets, to name a few. At this point, the gunslinger is in a situation that looks like the kiddy game, where you have a hammer and hit the head that pops out of one of many different holes. The model turns into a real mess, when you realize that there are thousands of Mutual Fund Managers that will all be playing this game in real time. Naturally these different markets will be doing different things. The word "panic" comes to mind.

My suspicion with Mutual Funds and IRA's, is that when you specify how you want your portfolio invested, they are not moving your money from one investment to another, they are purchasing a derivative to satisfy your demands of asset allocation. This leaves them free to pursue the line of investment they feel most confident with.

So much for "what ifs," the Derivatives Market is a Fantasy Land with some of their latest derivatives dealing with real estate options. Where will it end? My best guess; somewhere between Ab Surdum and Ad Nausea (no, they are not towns in Iraq).

Saturday, June 24, 2006

Similarities to previous Bubbles?

If you look at the Tulip Mania in Holland in the 1600's it ruined a lot of people. Demand for bulbs dropped to zero. From then on, if you grew tulip bulbs, you were looking for a second job to support your family.

With the South Sea Bubble of 1720, there was a very fast evaporation of assets. Stockbrokers were looking for that second job.

With the current real estate bubble things should be somewhat different. There is an asset with a rental value. Rental values are pretty constant. At some point, the distressed property owner is going to realize that renting might be cheaper than paying on his present mortgage. The real owner of the property, shares ownership with the note holder. If the owner walks, the note holder is left holding the bag. Notice nothing has really happened, just a change of who is responsible for the asset. At this point the note holder has picked up a very healthy negative interest rate on his investment. No interest payments, property tax accrual, building maintenance and management.

Lets take a $600,000 house. It will take 9 months to foreclose unless they hand you the keys. Figure $27,000 in missed interest payments, $4,000 in property taxes. Now figure that the neighbor sells his for $550,000. Even though prices only dropped $50,000, the note holder has taken a $81,000 bath. In reality, they gave someone an interest free loan for 9 months and then paid their property taxes to boot. If there is Mello Roos, joke gets even worse!

The first thing to go "poof," is the second trust deed. The first trust deed still has some cushion albeit not much.

Second trust deeds would be a hot potato. There would be the urge to sell them. Say you have a $200,000 trust deed at 10% interest and you want to unload it fast. Discount the note so it pays 20% interest and sell it for $100,000 cash. Notice that you salvage 50% of a almost certain loss. What happened to the interest rate on the second trust deed market? it jumped to 20%! At this point, there is still no shortage of money yet, just a shortage of suckers looking for a steal. Raise the discount, you get more "investors." The aspect of risk is returning to the market.

What needs to be realized, is that this is a balancing act. Things can still be in harmony with everything so obviously out of whack. Nothing has really happened to make people want to "Throw in the towel." Something will trigger the fall, something very unexpected; a huge earthquake, a big bankruptcy , something we never dreamed possible.

With the South Sea Bubble of 1720, there was a very fast evaporation of assets. Stockbrokers were looking for that second job.

With the current real estate bubble things should be somewhat different. There is an asset with a rental value. Rental values are pretty constant. At some point, the distressed property owner is going to realize that renting might be cheaper than paying on his present mortgage. The real owner of the property, shares ownership with the note holder. If the owner walks, the note holder is left holding the bag. Notice nothing has really happened, just a change of who is responsible for the asset. At this point the note holder has picked up a very healthy negative interest rate on his investment. No interest payments, property tax accrual, building maintenance and management.

Lets take a $600,000 house. It will take 9 months to foreclose unless they hand you the keys. Figure $27,000 in missed interest payments, $4,000 in property taxes. Now figure that the neighbor sells his for $550,000. Even though prices only dropped $50,000, the note holder has taken a $81,000 bath. In reality, they gave someone an interest free loan for 9 months and then paid their property taxes to boot. If there is Mello Roos, joke gets even worse!

The first thing to go "poof," is the second trust deed. The first trust deed still has some cushion albeit not much.

Second trust deeds would be a hot potato. There would be the urge to sell them. Say you have a $200,000 trust deed at 10% interest and you want to unload it fast. Discount the note so it pays 20% interest and sell it for $100,000 cash. Notice that you salvage 50% of a almost certain loss. What happened to the interest rate on the second trust deed market? it jumped to 20%! At this point, there is still no shortage of money yet, just a shortage of suckers looking for a steal. Raise the discount, you get more "investors." The aspect of risk is returning to the market.

What needs to be realized, is that this is a balancing act. Things can still be in harmony with everything so obviously out of whack. Nothing has really happened to make people want to "Throw in the towel." Something will trigger the fall, something very unexpected; a huge earthquake, a big bankruptcy , something we never dreamed possible.

Wednesday, June 21, 2006

What Will Make the Housing Bubble Pop?

The answer to that question is LACK OF FINANCING. Reality, is a banker that already has enough bad loans. That is not even close to happening. Most of the 100% loans that are resetting have value. The bank can sell the property for more than the note.

Inventory in San Diego has risen above 20,000 units and sales are at 4,000 for the month. Instead of calling this "5 months of inventory," lets call it what it is; a buyer seller ratio. There is one buyer for every 5 properties listed. Calling it "inventory" suggests that it would sell if only they had more time. More likely, its too high priced and would not sell, thats why the inventory numbers are increasing. The increasing numbers indicate the "block head mentality" of "what it use to be worth."

Another good indicator of a collapse would be an abundace of VA Repo's for sale. There are none right now, there were 3 last month for the whole state of California,--real dogs at outragious prices.

San Diego just passed the 1995 inventory high for housing that was set during the last BOTTOM in the real estate market. If you consider that a "train wreck," we are not even close to hitting anything yet. Phoenix has almost 50,000 listing and they are still selling real estate. In our area here, there are now about 5 cars in front of every house. It didn't use to be that way.

Noticeably, the papers are picking up on this phenomenon of excess housing. It is an item that is not really understood. Prices are stable and inventory is going up. What they need to realize, is that rich people can always afford to buy, it us poor people that can't afford these prices. So when nothing but high end houses sell, the average sale price increases or in this case stays about the same.

Right now, real estate is a one item event that cannot wreck on its own. Its going to need help. The capital financing this market is far from dead.

The other shoe has to drop, and I think that its name is Fannie Mae.

Inventory in San Diego has risen above 20,000 units and sales are at 4,000 for the month. Instead of calling this "5 months of inventory," lets call it what it is; a buyer seller ratio. There is one buyer for every 5 properties listed. Calling it "inventory" suggests that it would sell if only they had more time. More likely, its too high priced and would not sell, thats why the inventory numbers are increasing. The increasing numbers indicate the "block head mentality" of "what it use to be worth."

Another good indicator of a collapse would be an abundace of VA Repo's for sale. There are none right now, there were 3 last month for the whole state of California,--real dogs at outragious prices.

San Diego just passed the 1995 inventory high for housing that was set during the last BOTTOM in the real estate market. If you consider that a "train wreck," we are not even close to hitting anything yet. Phoenix has almost 50,000 listing and they are still selling real estate. In our area here, there are now about 5 cars in front of every house. It didn't use to be that way.

Noticeably, the papers are picking up on this phenomenon of excess housing. It is an item that is not really understood. Prices are stable and inventory is going up. What they need to realize, is that rich people can always afford to buy, it us poor people that can't afford these prices. So when nothing but high end houses sell, the average sale price increases or in this case stays about the same.

Right now, real estate is a one item event that cannot wreck on its own. Its going to need help. The capital financing this market is far from dead.

The other shoe has to drop, and I think that its name is Fannie Mae.

Tuesday, June 20, 2006

The Forever Impending Housing Collapse

A lot of the Bubble blogs are repeating the fact that we are about to have a housing collapse. I kind of think that this is rather like a Tsunami about to come in and the waters recede. At this point someone points out that there is going to be a seawater shortage.

The problem that is perceived is an over abundance of housing for SALE, NOT an over abundance of housing. There is a fine line here, but it is worthy to notice it. Somebody owns every one of these units. What we are looking at is an asset that has become less fungible (convertible to cash). It's less convertible because its price suddenly has no reliable point of reference. Ergo housing collapse.

I suggest a different venue. Its going to be the banks and loan companies that finance these loans that will hit the dust first. This will be reflected by a massive shrinkage of the money supply. All of this debt has to disappear, through BK or whatever. Once this happens, reality will hit the Real Estate Market.

The irritating thing about all of this, is that the Real Estate Bubble People think that this will be a single item event. There are going to be some bankruptcy's and most probably a trashing of the bond market. After that, when you find your IRA has been marked to market at an 80% loss, real estate, just might drop in price. Your dreams are dashed and you cannot afford to retire at age 65.

Sound ridiculous,doesn't it? It happened in 1929, history doesn't repeat itself, believe that and I have another for you.

The problem that is perceived is an over abundance of housing for SALE, NOT an over abundance of housing. There is a fine line here, but it is worthy to notice it. Somebody owns every one of these units. What we are looking at is an asset that has become less fungible (convertible to cash). It's less convertible because its price suddenly has no reliable point of reference. Ergo housing collapse.

I suggest a different venue. Its going to be the banks and loan companies that finance these loans that will hit the dust first. This will be reflected by a massive shrinkage of the money supply. All of this debt has to disappear, through BK or whatever. Once this happens, reality will hit the Real Estate Market.

The irritating thing about all of this, is that the Real Estate Bubble People think that this will be a single item event. There are going to be some bankruptcy's and most probably a trashing of the bond market. After that, when you find your IRA has been marked to market at an 80% loss, real estate, just might drop in price. Your dreams are dashed and you cannot afford to retire at age 65.

Sound ridiculous,doesn't it? It happened in 1929, history doesn't repeat itself, believe that and I have another for you.

Thursday, June 15, 2006

Models We Build and Use to Interact with our Enviroment.

A rather long title, and a concept that is almost transparent unless you look for it. Lets start with an example or two

Clapping your hands keeps the elephants away. Its a valid model as long as no elephants show up.

A rabbit foot is lucky to hold. Also a valid model unless you are having a bad run of luck.

Stocks will always go up and we will get rich. Valid but more like a wish.

Gold is where to put your cash. Valid but arguable.

Mother-in-laws are good cooks. Arguable, but it is your world that you are viewing

Real estate is a good investment. If it works, you will keep on doing it.

Now when you build your model that you use to interact with the outside world, it might include views on gun control, abortion, the environment, politics, religion and what ever.

In our thinking, (or lack of) each of us is unique. It is from this perspective that we are trying to live out our existence comfortably with the least amount of excess effort.

Some of us because of the models we use are becoming more aware of problems that may or may not be of concern anyone else.

Right now, the financial world, to me, seems poised to fall off of a cliff. The models and my perspective suggest that, but just as mine suggest that, another person's model may suggest a different perspective. The one thing that I can guarantee, is that every perspective will differ, some more than others.

Right now we are at a point in time where some of these models are starting to fail. For example, real estate is a good investment. This model worked for years, and now it doesn't sound so enticing.

There are two reasons for failure, the model has stayed the same and the environment has changed, or an elephant has appeared and hand clapping doesn't seem to validate the model. If your thinking has failed to recognize the change or your thinking has always been out of whack then the model was never really tested.

What really needs to be realized, what ever model you use, your goals are probably the same, to survive and exist comfortably. The way you go about it can be quite different than everyone else.

We may, or may not be, aware of the present possible failure of our model in the real world. This is just what happened in 1929. People were not stupid, they knew how to "turn a trick," the trouble was the game changed and their model fell apart.

Clapping your hands keeps the elephants away. Its a valid model as long as no elephants show up.

A rabbit foot is lucky to hold. Also a valid model unless you are having a bad run of luck.

Stocks will always go up and we will get rich. Valid but more like a wish.

Gold is where to put your cash. Valid but arguable.

Mother-in-laws are good cooks. Arguable, but it is your world that you are viewing

Real estate is a good investment. If it works, you will keep on doing it.

Now when you build your model that you use to interact with the outside world, it might include views on gun control, abortion, the environment, politics, religion and what ever.

In our thinking, (or lack of) each of us is unique. It is from this perspective that we are trying to live out our existence comfortably with the least amount of excess effort.

Some of us because of the models we use are becoming more aware of problems that may or may not be of concern anyone else.

Right now, the financial world, to me, seems poised to fall off of a cliff. The models and my perspective suggest that, but just as mine suggest that, another person's model may suggest a different perspective. The one thing that I can guarantee, is that every perspective will differ, some more than others.

Right now we are at a point in time where some of these models are starting to fail. For example, real estate is a good investment. This model worked for years, and now it doesn't sound so enticing.

There are two reasons for failure, the model has stayed the same and the environment has changed, or an elephant has appeared and hand clapping doesn't seem to validate the model. If your thinking has failed to recognize the change or your thinking has always been out of whack then the model was never really tested.

What really needs to be realized, what ever model you use, your goals are probably the same, to survive and exist comfortably. The way you go about it can be quite different than everyone else.

We may, or may not be, aware of the present possible failure of our model in the real world. This is just what happened in 1929. People were not stupid, they knew how to "turn a trick," the trouble was the game changed and their model fell apart.

Wednesday, June 14, 2006

The Fed and the Flat Yield Curve

The Fed so far has raised interest rate 16 times and the 30 year bond has gone up 1/2 percent to 5%. Now the 3 month T-bills, and everything up to the 2 year bond, has incremented accordingly. Right now the graph is flat, there should be a 3% difference between the 30 and 2 year bond (More time implies more risk).

The Fed appears to be pushing on a string, the world bond market is too big for them to have any real influence.

The flat yield curve could be a precursor to a recession. It tends to suggest that the banks are flush with too much cash, and/or it could also imply that short term maturities are where the major players are putting their money.

If you can raise the Fed Funds rate 4 percent and the 30 year bond doesn't maintain a 3% spread with the 2 year bond, then you can safely deduce that something is running counter to the market and common sense.

If you disregard the Fed as a Player, then the market seems less out of kilter. There is also another factor that could be a prime mover of the US Bond market. Years back, the government (financing the National Debt) got caught borrowing long on the 30 year Treasury's at a high interest rate. Somebody pointed out at the time that the government could do better (interest wise) if they borrowed in the short term market at lower rates and just turned the bonds over (reissue them). Even with the flat yield curve they are not at a loss. Notice also how the 30 year bond reappeared after being phased out? The government could be changing horses here, going from short term maturities to long.

Another thing to consider, the concept of risk seems to have left the building.

The Fed appears to be pushing on a string, the world bond market is too big for them to have any real influence.

The flat yield curve could be a precursor to a recession. It tends to suggest that the banks are flush with too much cash, and/or it could also imply that short term maturities are where the major players are putting their money.

If you can raise the Fed Funds rate 4 percent and the 30 year bond doesn't maintain a 3% spread with the 2 year bond, then you can safely deduce that something is running counter to the market and common sense.

If you disregard the Fed as a Player, then the market seems less out of kilter. There is also another factor that could be a prime mover of the US Bond market. Years back, the government (financing the National Debt) got caught borrowing long on the 30 year Treasury's at a high interest rate. Somebody pointed out at the time that the government could do better (interest wise) if they borrowed in the short term market at lower rates and just turned the bonds over (reissue them). Even with the flat yield curve they are not at a loss. Notice also how the 30 year bond reappeared after being phased out? The government could be changing horses here, going from short term maturities to long.

Another thing to consider, the concept of risk seems to have left the building.

Saturday, June 10, 2006

Perceived Reality

Ever hear the story about the bum in New York City clapping his hands? When asked why he was doing it , he says, "To keep the elephants away." The listener replies, "There aren't any elephants in NYC!" The bum quips, "See, it works!"

In this case, the level of absurdity sets off warning signs and that casts doubt into your mind. But lets get to the not so obvious.

"Why rent and make the landlords house payment?"

"Owning a house is better than renting."

"Investing in Real Estate is the way to wealth."

What people don't realize is that the value and the validity of the statements change over time. It was pure truth in 1964, it is not so certain in the world of 2006. The human mind has a rough time with changes in perspective. We get stuck in a rut.

Go into your closet and make a mental note, "Tomorrow I am going to wear something I bought 20 years ago." Try it on. Does it fit? Would you feel embarrassed wearing it? Will it make you feel young again? Do you still like it? Did this exercise change your perspective about time a little bit?

A lot of our mental values fall into the same boat. We need to have the ability to realize that our perspective needs to change as we get older. Values that seem to be constant need to be re-examined.

Remember this, if something is repeated again and again as fact, then it must be true and and society will accept it as such. For 2,000 years people though the common house fly had 8 legs until someone decided to count them.

So how does this tie into The Great Depression of 2006? I am trying to point out, that you could get caught up in the coming mess, if your values don't change to accommodate the times, as they are-a-changing.

In this case, the level of absurdity sets off warning signs and that casts doubt into your mind. But lets get to the not so obvious.

"Why rent and make the landlords house payment?"

"Owning a house is better than renting."

"Investing in Real Estate is the way to wealth."

What people don't realize is that the value and the validity of the statements change over time. It was pure truth in 1964, it is not so certain in the world of 2006. The human mind has a rough time with changes in perspective. We get stuck in a rut.

Go into your closet and make a mental note, "Tomorrow I am going to wear something I bought 20 years ago." Try it on. Does it fit? Would you feel embarrassed wearing it? Will it make you feel young again? Do you still like it? Did this exercise change your perspective about time a little bit?

A lot of our mental values fall into the same boat. We need to have the ability to realize that our perspective needs to change as we get older. Values that seem to be constant need to be re-examined.

Remember this, if something is repeated again and again as fact, then it must be true and and society will accept it as such. For 2,000 years people though the common house fly had 8 legs until someone decided to count them.

So how does this tie into The Great Depression of 2006? I am trying to point out, that you could get caught up in the coming mess, if your values don't change to accommodate the times, as they are-a-changing.

Friday, June 09, 2006

Convergence of pecularities

There is a real estate bubble that refuses to collapse. We have the Fed raising interest rates (16 times) while the prime rate for home loans has jumped a whopping 1/2 a percent. The stock market is acting rather funky. The spread between high risk and low risk, in the bond market, more or less indicates that the risk of default is just about non existent. It kind of like putting a skunk, a dog and a cat in a burlap bag and tying it shut. You're not sure what you will end up with, but you can bet your bottom dollar that it will smell bad.

We also have an inverted yield curve for interest rates. It costs more to borrow short term that it does to borrow long term. This would suggest that most of the bond activity is in the short term market. Nobody wants a 30 year bond paying 5%. If the interest rate jumps to 10% that bond will take a 50 percent haircut.

Right now, people are sweating the next Fed interest rate hike saying its bad for the economy. Just to exaggerate, say Berneke doubles the interest rate, it would probably do nothing to the banks or their prime interest rates. The apparent disconnect might spook the bond investor, because there is an expected correlation.

If there is a shortage of financial funds, raising the Fed interest rates would have a definite effect, the real interest rate would rise. When there is an oversupply of money, looking for a haven to invest in, the Federal Reserve is a third leg. The Fed in the current market is pushing on a string. Until the surplus cash reserves dry up, it matters very little, what the Fed does.

The housing market is not going away, its just getting bigger. Many people have bought way beyond their means. Money problems and a plethora of divorces could speed up the downturn. How do you inflict enough pain on the real estate market for it to collapse? Double the current interest rate? Berneke can't do that, this will be driven by a lack of monetary reserves . What could cause this? A contraction of the real money supply---like the failure of a very big bank. As for banks to put on that list, I would mention Fannie Mae(walks like a bank), Bank of Japan, and China.

The first indication of a problem will be when the interest rates jump, and Berneke is not the attributed cause. An increase of two or three percentage points would indicate a shortage of investors unwilling to loan capital at non rewarding rates.

We also have an inverted yield curve for interest rates. It costs more to borrow short term that it does to borrow long term. This would suggest that most of the bond activity is in the short term market. Nobody wants a 30 year bond paying 5%. If the interest rate jumps to 10% that bond will take a 50 percent haircut.

Right now, people are sweating the next Fed interest rate hike saying its bad for the economy. Just to exaggerate, say Berneke doubles the interest rate, it would probably do nothing to the banks or their prime interest rates. The apparent disconnect might spook the bond investor, because there is an expected correlation.

If there is a shortage of financial funds, raising the Fed interest rates would have a definite effect, the real interest rate would rise. When there is an oversupply of money, looking for a haven to invest in, the Federal Reserve is a third leg. The Fed in the current market is pushing on a string. Until the surplus cash reserves dry up, it matters very little, what the Fed does.

The housing market is not going away, its just getting bigger. Many people have bought way beyond their means. Money problems and a plethora of divorces could speed up the downturn. How do you inflict enough pain on the real estate market for it to collapse? Double the current interest rate? Berneke can't do that, this will be driven by a lack of monetary reserves . What could cause this? A contraction of the real money supply---like the failure of a very big bank. As for banks to put on that list, I would mention Fannie Mae(walks like a bank), Bank of Japan, and China.

The first indication of a problem will be when the interest rates jump, and Berneke is not the attributed cause. An increase of two or three percentage points would indicate a shortage of investors unwilling to loan capital at non rewarding rates.

Thursday, June 08, 2006

The Contraction

Stock ownership in some countries is becoming not so fashionable. Especially in Japan, their market seems to be dropping off a cliff. What seems to be worrisome, is the fact that the treasury rate in Japan is 0%. In essence, a bank over there, in search of low risk with a good rate of return, is probably purchasing U. S. Treasury's. Now, if the dollar starts to drop, in relation to the yen, the bank gets eaten alive on the currency conversion. Or, just maybe they break even, using put and call currency options.

Taiwan is also a close clone right now. It may suggest, that these two countries could be the canaries in the "World Economy's Coal Mine."

The Japanese already have had a stock crash and a real estate collapse. Those two items together should have created a bank collapse but peculiarly, they didn't. I think that they printed their way out of it. If so, the "printed money," invested in Treasury's would have given them a 2-5% return for the last 10 years, at little or no cost, a US, subsidy to their banking system.

China just had a real estate collapse in Shanghai last year. A speculative bubble took off and then popped and dropped. It demonstrates a large amount of cash came from somewhere and went no where.

There is a world wide housing bubble that no one wants to talk about. Granted there is a housing bubble here and there, but no body is using words like "world wide."

In San Diego here, we are sitting on 21,000 used houses for sale (no real numbers on the new ones). At the bottom of the last housing market here, there were only 19,000 houses for sale, and we haven't even come close to seeing the prices drop one iota, let alone, see a bottom in the market.

The contraction has started. Every stock, and every house has an owner. Somebody will be in possession while it is finding its "new value."

What will trigger the decline, I fear it may be a bank, a national bank in some foreign country, thats what started it in 1929.

Taiwan is also a close clone right now. It may suggest, that these two countries could be the canaries in the "World Economy's Coal Mine."

The Japanese already have had a stock crash and a real estate collapse. Those two items together should have created a bank collapse but peculiarly, they didn't. I think that they printed their way out of it. If so, the "printed money," invested in Treasury's would have given them a 2-5% return for the last 10 years, at little or no cost, a US, subsidy to their banking system.

China just had a real estate collapse in Shanghai last year. A speculative bubble took off and then popped and dropped. It demonstrates a large amount of cash came from somewhere and went no where.

There is a world wide housing bubble that no one wants to talk about. Granted there is a housing bubble here and there, but no body is using words like "world wide."

In San Diego here, we are sitting on 21,000 used houses for sale (no real numbers on the new ones). At the bottom of the last housing market here, there were only 19,000 houses for sale, and we haven't even come close to seeing the prices drop one iota, let alone, see a bottom in the market.

The contraction has started. Every stock, and every house has an owner. Somebody will be in possession while it is finding its "new value."

What will trigger the decline, I fear it may be a bank, a national bank in some foreign country, thats what started it in 1929.

Wednesday, June 07, 2006

The Illogical Mutual Fund Market

Our Mutual Funds and Investment Retirement Accounts have built up assets, by "investing" in the stock market and the bond market. They know nothing about the psychology of the market. However, they do know how to purchase stocks and bonds. The real problem, the market is not logical in its execution, to borrow some famous words by Mr. J.P. Morgan, "The market fluctuates."

As long as the market goes up, mutual funds and IRA's will do OK. It's the drop that will ruin the investor. At first, most will hold on, those profit and loss statements only arrive every quarter. No one will even notice the initial drop. Want to pull the money out? Well, the penalties are more than one would expect. There is the early withdrawal penalty from the fund, and income tax consequences--what a nightmare. Adding insult to injury, the losses are not tax deductible.

The question that comes to my mind is this; while the market goes up everyone hops on and rides the wave, when the market starts to drop, where is the alternate plan of action? This drop in the market will leave the mutual fund managers in a vacuum. People will soon realize that these managers don't know any more than anyone else. If these guys are so good at what they do, why do they need your money? Answer; there is no risk if they use your money.

Note also, investments recommended by the government tend to burn you in the long run. The government has always done its best to mess up the person saving for retirement by changing the rules after the game has started.

What happens when all these fund managers start to sell? The real question you need to ask is, "Who's going to be buying?"

As long as the market goes up, mutual funds and IRA's will do OK. It's the drop that will ruin the investor. At first, most will hold on, those profit and loss statements only arrive every quarter. No one will even notice the initial drop. Want to pull the money out? Well, the penalties are more than one would expect. There is the early withdrawal penalty from the fund, and income tax consequences--what a nightmare. Adding insult to injury, the losses are not tax deductible.

The question that comes to my mind is this; while the market goes up everyone hops on and rides the wave, when the market starts to drop, where is the alternate plan of action? This drop in the market will leave the mutual fund managers in a vacuum. People will soon realize that these managers don't know any more than anyone else. If these guys are so good at what they do, why do they need your money? Answer; there is no risk if they use your money.

Note also, investments recommended by the government tend to burn you in the long run. The government has always done its best to mess up the person saving for retirement by changing the rules after the game has started.

What happens when all these fund managers start to sell? The real question you need to ask is, "Who's going to be buying?"

Monday, June 05, 2006

Treasurys vs Junk Bond Spread

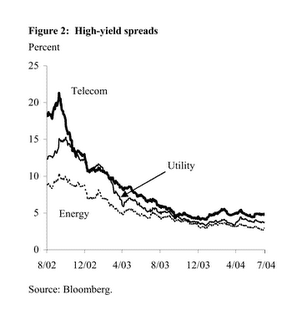

Todays Wall Street Journal has a bit on this C section page 1. The graph I have selected only shows to 2004. Its value hasn't changed since then. The thing that is not really that obvious, is the fact that this is Junk that they are comparing the Treasury's too. When you examine the "high grade bonds" they are trading ridiculously close to par with Treasury's.

Here is the way I look at it, Treasury's are guaranteed full faith and credit investments--no limit on the amount. High grade investment bonds should be 3 percentage points or better above Treasury's depending on the maturity. This is an assumption on my part just call it common sense (implied value pulled out of thin air and experience). This three percent spread difference, could be called the "fear factor."

Junk bonds normally command a 10% interest rate or more. What we are looking at here are a lot of investors that are just happy with a higher than Treasury return with no regard to the risk involved. There is no fear factor.

The thing that worries me right now, is the fact, that a lot of the people investing in these instruments are probably retired, looking to max out their income. In an up market, it can't really hurt you. The mutual funds might also be playing this with options and derivatives.

I would suggest, that if you are in bonds as a retirement asset, and you are not getting 3% better than 5 year Treasury's, convert to Treasury's. You are not getting the premium you deserve for the greater risk.

Remember a bond holder is ahead of the stockholder in a bankruptcy. There is no line to wait in for redemption if you hold Treasury's.

Saturday, June 03, 2006

The Experts at Investing

People seem to think that these Mutual Fund Managers and IRA Fund managers (and throw in a Stock Broker) know what they are doing.

They know how to handle the paper work, but ask yourself one question. Is the reason that thing have been so great, is it, because the market has been climbing to the sky?

None of these rookies has ever seen a bear market. Let me explain a bear market to you. Say GM finds a way make gasoline out of thin air, you would find the stock dropping $10 per share. That seems impossible, but thats the way the '60's and 70's went.

So far in this new millinium structure, things have been going up. Sometime in the near future stocks will start their downward slide. This time it will be different, people will be expecting a recovery and it will not be there. They will hold on until it is so obvious and then it will be too late.

The stock market has stopped its climb, but the obvious things that would allow it to stay at this level deny all expectations. The dividend level is pathetic. If you are about ready to retire, ask yourself, what investment will pay a good dividend at retirement? Very few it seems.

If thats the case, where do all of the IRAs, Mutual Funds, and 401K figure on getting the money for payout on retirement income plans? Selling their principle investments, I think not! They have a song and dance, and when the music stops, its going to be different, different than anything that you could ever imagine.

They know how to handle the paper work, but ask yourself one question. Is the reason that thing have been so great, is it, because the market has been climbing to the sky?

None of these rookies has ever seen a bear market. Let me explain a bear market to you. Say GM finds a way make gasoline out of thin air, you would find the stock dropping $10 per share. That seems impossible, but thats the way the '60's and 70's went.

So far in this new millinium structure, things have been going up. Sometime in the near future stocks will start their downward slide. This time it will be different, people will be expecting a recovery and it will not be there. They will hold on until it is so obvious and then it will be too late.

The stock market has stopped its climb, but the obvious things that would allow it to stay at this level deny all expectations. The dividend level is pathetic. If you are about ready to retire, ask yourself, what investment will pay a good dividend at retirement? Very few it seems.

If thats the case, where do all of the IRAs, Mutual Funds, and 401K figure on getting the money for payout on retirement income plans? Selling their principle investments, I think not! They have a song and dance, and when the music stops, its going to be different, different than anything that you could ever imagine.

Subscribe to:

Comments (Atom)