Financial bubbles collapse and usually initiate a depression. Whether it’s tulips in Holland or livestock in Africa, when it hits, the rich become suddenly poor. People starve to death in a lot of cases because their wealth vaporized in front of their eyes, now they have no money.

We are looking at people very well off that all of a sudden become destitute, through no real fault of their own. You have a million dollar tulip that drops to zero, or 1,000 head of cattle that you can no longer afford to feed. A miss allocation of resources given enough time, the expected outcome changes into to something unimaginable.

The Great Depression of 1929 was one of them, only it didn’t start in 1929, more probably closer to 1926 with the hurricanes hitting the Florida coast. And of course, it didn’t come into full bloom until 1934 and some argue 1937. At that point people thought they were in a bottomless pit and things could only get worse. There was no unemployment insurance, or food stamps, or welfare and the old people in the streets scavenging trash cans for food was probably enough of a government embarrassment to start up Social Security. The wealth of a nation had gone down the drain. Between the banking system and the stock market the average saver had lost 90 percent of their savings and investments. And when you examine the era, it was the age of Radio, the light bulb, the telephone, airplane travel, motor cars, harvest machines, and tractors.

Then we come to today and everyone believes that things are different now, we have avoided a Great Depression. Food stamps and unemployment insurance have eliminate the food kitchens and the people queuing up to be fed. So there is an invisibility factor that leaves this great depression labeled the “Great Recession.” The stock market has not crashed, and the bond market is paying zero interest, which is an absurdity beyond comprehension.

The Great Depression was ended by a world war. Half of the world was destroyed and our economy produced what they needed to get back on line. This is what brought us out of the Great Depression. What may not have been observed is the savings of our middle class ready for retirement was destroyed in this fiasco in 1929. If you were ready to retire, you were ruined. The World War also ruined those retired in Europe. The process of a depression or war is selective, it is the retirees that pay the ultimate price.

So now we have a country that has figured out that it can spend our collective savings because we have no need for it until retirement. It has borrowed 17 trillion which is the collective amount that we have saved, I wonder if that is a coincidence? You can’t borrow what isn’t there.

From here, we have a problem with the recovery. Everyone owes money. There are no destroyed world economy’s to rebuild. So what we have, is a world that has everything and needs nothing really, unless you are talking about a new Iphone or Galaxy.

Gold silver and Platinum have dropped below their mining profitability price. Looks like people are in a need to raise money. I always joke about stock traders selling the blue chips and holding on to the dogs hoping they will come back. But if you’re broke, you are going to sell whatever has the highest value and least utility, like wedding rings, and old silver. The things that have held their value well will be sold first, it is human nature to not want to suffer a loss on an investment. And you don’t realize the loss until you sell it.

Our national debt is at 17 trillion and if the interest rate went to 10 percent, we would be in default in a matter of minutes. Food stamps, unemployment insurance and Social Security would not necessarily stop, but our government would not have the option to borrow, only to print. At that point, the government would be called upon to redeem the debt in some manner. The most likely scenario is to issue new dollars that are each worth 10 of the old dollars. So the national debt would lose a zero and become 1.7 trillion, which would be economically manageable. At this point we could be facing very severe deflationary spiral. Or keep printing, until the minions no longer accept the dollars. Toilet paper could reach $1,000 a roll and what the heck put it on your credit card, you get 1 ½% back on all purchases, what a deal.

The question, “Where too from here,” comes to mind. If the government cannot pay back what it has borrowed, at the stated interest rate, and is in default, does the absurdity of the amount borrowed from the banks have any relevance? Or does the absurdity of the amount borrowed leave one to wonder how the act was accomplished without using a gun.

In a financial bubble, of which this one is worldwide, currencies can fluctuate in value all the way to zero. Precious metals have a base price. An ounce of gold can fluctuate from a week’s wages to a month’s wages. Silver can fluctuate between a day’s wages and a week. The neat thing about precious metals is that the price is independent of government control.

Then there is the argument that gold, platinum and silver have lost half of their value in 3 years. Many investments fall out of fashion and drop in price only to later come back. Gold, Silver and Copper have dropped out of our coinage. The penny became worth more than a penny (it cost the government 1 ½ cent to buy the copper to make it). From that you can kind of figure even if you don’t understand the mechanics of inflation, that something isn’t quite right.

Let’s do a comparison 100 ounces of gold purchased at $1,200 an ounce verses 120K in the bank. If the government does a 10 for 1 conversion of the120k, you net $12,000. That $12,000 will now buy 10 ounces of gold. Notice you had to do nothing for the conversion to take effect, it is automatic. For every dollar of debt you held, you would get 10 cents in the new currency. Using this method, our government could wipe 15.5 trillion dollars of debt off of the books with the stroke of a pen. Social Security, unemployment, welfare and food stamps could again be funded with further borrowing. What do you want gold or currency?

The neat thing is that if you are dead broke, you lose nothing. So the poor won’t riot in the streets from the loss of funds, but if you are an employer trying to make payroll, you may come up a tad bit short on the conversion.

The only thing that we can really extract from a global financial collapse is the mobility of precious metals. All other assets are subject to what the buyer is willing to pay for it and what the seller will accept. Those with a lot of toys, might find the taxes too high to pay to keep them. Most rich people only have a vague idea of what they are worth, it is the cash flow pumping through their empire that keeps everything afloat. Destroy the cash flow and most of the real rich will wither away. I’m not talking about someone with one million in the bank, I’m talking about someone who has a payroll of one million a month and if he has to sell the place from a lack of business, he gets 100k because no one wants to buy the company.

The bottom line is this, things are not as they appear. World governments have stepped in and manipulated the financial markets to their advantage. The only people that they can borrow beg and steal from are the savers. They have done that. They cannot possibly repay what they have borrowed, they can barely pay all of the benefits promised to the people waiting in line for them.

We are at a peculiar point in time, the spread between gold and platinum is only one hundred dollars. It could be time to trade some of your gold for platinum. It is 30 times scarcer than gold. It is almost a given certainty that a new model of international trade has to emerge. And it will have to be based on gold and silver, but platinum could be the new guy on the block.

I am not sure where we are going, but if you think that our government has your best interest in mind, you’d better think again. If you are broke, penniless, and illegal, they have your interests in mind, we know that. So where to from here? Somewhere between nowhere and the poorhouse. You can save all of your life and still go broke, go figure. The scary question, will this just involve the United States? --To quote Shakespeare; "Methinks not."

Its a place undefined in time, a location that no one would ever willingly travel to. Are we there yet? The answer is yes. But its going to take 7 to 8 years for the reality to sink in.

Sunday, September 28, 2014

Wednesday, September 17, 2014

The Dumbing Down of America

The average US citizen is a vegetable that reclines on a couch. Overweight, hates his or her job and wants to make more money to buy more toys. Nobody saves for retirement until they approach 55. Then they put their retirement fund in a 401k or IRA and the salesman shows them a pyramid diagram and asks them where they want to invest their funds—down at the bottom where it’s safe or up at the top in the winner’s circle?

Did you know that solar panels are a “no-brainer?” Just ask Ed Asner. That means you don’t have to think to make money. Then there are the hybrid cars that you need to own 10 years to break even on, the only trouble is most people get a new car every 4 years because the one they’ve got, is falling apart. Plus after 10 years the car is worthless unless you replace the battery.

Obama’s wife started a healthy school lunch program to keep kids from getting fat. All it has done is reduce the number of American kids eating the lunches. Fat kids know what tastes good, they enjoy deep fried food and pizza. If you’re from Central America, any lunch is better than no lunch. The neat thing about the new kids in the school is that the school district gets $8,000 for each one, to educate them. And this is government money, it’s not like it is taxes that we paid. I’m not quite sure where that sort of logic leads to, but I wouldn’t wait for the music to stop, to sit in a chair—their playing with half a deck.

Then we tell our kids they have to go to college to get a better job. It’s true for some professions, but how many rocket scientists and brain surgeons do we need? As long as we have rich people, we will never have enough lawyers, go figure. As the student loan approaches 200k it becomes a form of slavery, from which there is no relief. Lincoln freed the slaves and by God Obama will get them back. This time it won’t be an issue of skin color, but rather one of naively trusting a government program to do what it promised. Name me one government program that has—I go ballistic with the mention of the ethanol gas program.

The new minimum wage will give everyone a boost in wages. So everyone up the ladder gets a pay raise. It’s a little like putting a magnifying glass in front of the carrot on a stick. You’ll never enlighten these workers about inflation and its causes; they’re more into cars, women, football and basketball. Notice as you earn more, you have to pay more in taxes, and 50 percent of the population pays no Federal income tax now so that should drop a tad, to say 48 percent with the pay raise.

When people discuss presidential administrations in relation to their successes and failures, they often forget to realize that it takes about 4 years before there is a cause related effect. The president on watch gets credit or blame for what was set in motion 4 to 10 years earlier. Clinton is cited for balanced budgets, guess what? Congress was Republican, both houses then. The president may be the head honcho, but he is not the one issuing the laws and writing the checks. This argument would glaze over the eyes of most minimum wage earners; the knowledge puts no money in their pocket.

Our government’s 17 trillion dollar debt is so large that it escapes comprehension. This method of accounting will work until it doesn’t. The warm and fuzzy feeling is gone, financial security is what we desire. But look at it from the government’s point of view, everyone is setting there watching and hoping that nothing overturns the apple-cart (notice how we have progressed from the analogy of the straw on a camel’s back). We are good for now, but now, is not forever.

Many cite this country as being the greatest in the world. It was at one time. You used to have to be a citizen to vote, now nobody cares, anyone can vote if they look old enough, and they can vote more than once if they feel like it. Our government hands out free money to anyone who can make it here (of course those aren’t my tax dollars that I paid to the Federal government). It still is the greatest country in the world, but it depends on whether you’re in, looking out; or out, looking in.

We need to understand that whatever our beliefs on the issues, it will not influence the final outcome. But one thing is very obvious. Things are promoted or sold to make money. SOMEONE ends up paying all of the bills. If government was smaller or had a smaller budget, we would have less of the stuff we really don't need. I guess that is just too simple of an idea to work. (Mr. SOMEONE lives down the street from me SOMEWHERE, God bless him for all the taxes he pays)

Did you know that solar panels are a “no-brainer?” Just ask Ed Asner. That means you don’t have to think to make money. Then there are the hybrid cars that you need to own 10 years to break even on, the only trouble is most people get a new car every 4 years because the one they’ve got, is falling apart. Plus after 10 years the car is worthless unless you replace the battery.

Obama’s wife started a healthy school lunch program to keep kids from getting fat. All it has done is reduce the number of American kids eating the lunches. Fat kids know what tastes good, they enjoy deep fried food and pizza. If you’re from Central America, any lunch is better than no lunch. The neat thing about the new kids in the school is that the school district gets $8,000 for each one, to educate them. And this is government money, it’s not like it is taxes that we paid. I’m not quite sure where that sort of logic leads to, but I wouldn’t wait for the music to stop, to sit in a chair—their playing with half a deck.

Then we tell our kids they have to go to college to get a better job. It’s true for some professions, but how many rocket scientists and brain surgeons do we need? As long as we have rich people, we will never have enough lawyers, go figure. As the student loan approaches 200k it becomes a form of slavery, from which there is no relief. Lincoln freed the slaves and by God Obama will get them back. This time it won’t be an issue of skin color, but rather one of naively trusting a government program to do what it promised. Name me one government program that has—I go ballistic with the mention of the ethanol gas program.

The new minimum wage will give everyone a boost in wages. So everyone up the ladder gets a pay raise. It’s a little like putting a magnifying glass in front of the carrot on a stick. You’ll never enlighten these workers about inflation and its causes; they’re more into cars, women, football and basketball. Notice as you earn more, you have to pay more in taxes, and 50 percent of the population pays no Federal income tax now so that should drop a tad, to say 48 percent with the pay raise.

When people discuss presidential administrations in relation to their successes and failures, they often forget to realize that it takes about 4 years before there is a cause related effect. The president on watch gets credit or blame for what was set in motion 4 to 10 years earlier. Clinton is cited for balanced budgets, guess what? Congress was Republican, both houses then. The president may be the head honcho, but he is not the one issuing the laws and writing the checks. This argument would glaze over the eyes of most minimum wage earners; the knowledge puts no money in their pocket.

Our government’s 17 trillion dollar debt is so large that it escapes comprehension. This method of accounting will work until it doesn’t. The warm and fuzzy feeling is gone, financial security is what we desire. But look at it from the government’s point of view, everyone is setting there watching and hoping that nothing overturns the apple-cart (notice how we have progressed from the analogy of the straw on a camel’s back). We are good for now, but now, is not forever.

Many cite this country as being the greatest in the world. It was at one time. You used to have to be a citizen to vote, now nobody cares, anyone can vote if they look old enough, and they can vote more than once if they feel like it. Our government hands out free money to anyone who can make it here (of course those aren’t my tax dollars that I paid to the Federal government). It still is the greatest country in the world, but it depends on whether you’re in, looking out; or out, looking in.

We need to understand that whatever our beliefs on the issues, it will not influence the final outcome. But one thing is very obvious. Things are promoted or sold to make money. SOMEONE ends up paying all of the bills. If government was smaller or had a smaller budget, we would have less of the stuff we really don't need. I guess that is just too simple of an idea to work. (Mr. SOMEONE lives down the street from me SOMEWHERE, God bless him for all the taxes he pays)

Tuesday, September 09, 2014

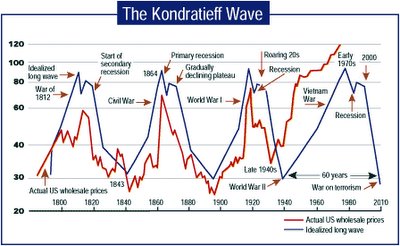

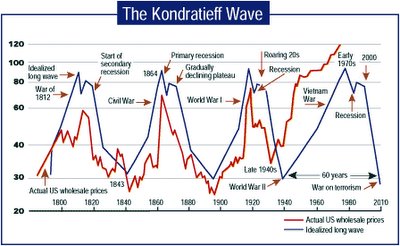

Surfing the Kondratieff Wave Reprinted from2006

Here is a reprint of my second post as a blogger way back in May of 2006. Click on the link in this article, you won't be disappointed. Little bit of writers block lately coupled with a heavy work load at my regular job. Hope to get back in form next week with something new.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

As an addition to the original post, here is a little bit of video from You-Tube that everyone is carrying.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

As an addition to the original post, here is a little bit of video from You-Tube that everyone is carrying.

Subscribe to:

Posts (Atom)