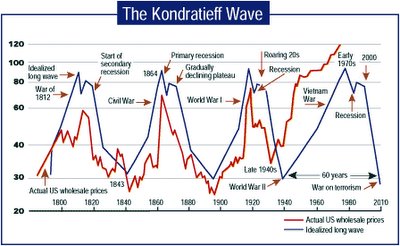

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.

If you're into investment cycles and charts, the Kondratieff Wave is one to examine. Basically the boom and bust cycle had a 60 year span. Here is a link to more detail http://www.kwaves.com/kond_overview.htm Credit the picture above from this link.The cycle this time around is a little long in the tooth. There is a reason for this and I believe as do some others, that it has to do with the increase in the length of the average persons life span.It use to be about 60 years now we are up to about 75 years.

Each generation has a group of elders that can draw from past mistakes. We are at a point right now, that the follies of the 1920's and 1930's are not part of our "group memory" any more. Most people from that era would be at least 100 years old now. Now when you quote some historical aspect a cause of the last depression, you hear the phrase,"Its different this time."

People today think that the interest only no money down mortgage is something new. Well it isn't. They were written right up to the collapse in 1929. The banks soon realized that it was like the neighbor taking out your daughter for a "test drive" before he married her. The responsibility factor was missing.

Cycles are usually displayed as circles that would follow through phases and complete back where they started. I think that this is not a true analogy of what is happening here. If you start with a spiral going out from the center, this more correctly displays "history repeating itself." It s not quite the same, things have changed somewhat.

People are consuming more and more, and with that, comes the creation of more debt. It is this debt that will be marked to market. Mr. Kondratieff's theory suggests that all of this debt will disappear and the money supply will contract accordingly (drastically in this case).

I don't think that people fully realize how money disappears. Take Lucent Technologies a few years back. It sold for $80 per share and went down to $2. Somebody owned it the whole way down.

What really scares me today, is the people with savings and retirement funds, they have been funding this whole thing. The market will always go up (believe that and I'll tell you another). The trouble is, a majority of the owners of wealth, are going to want to get out of the market pretty soon and they are at the head of the line-- the baby boomer's.The baby boomer's think that this will be a relaxing walk into retirement. More likely its going to be one hell of a panic. If Mr Kondratieff is right, there will be a drastic contraction of the money supply because of the debt marked to market, and because of this, commodities should fall in price.

My question is this. If the world population has increased 4 times in the last 60 years and most of these governments have been printing money at a very vigorous rate, can gold and silver still be considered commodities? I think that they reside outside the realm of consumables.

As an addition to the original post, here is a little bit of video from You-Tube that everyone is carrying.